Cafe Coffee Day’s parent company, Coffee Day Enterprises Limited is launching India’s biggest initial public offering (IPO) in the last three years. Since Cafe Coffee Day is a prominent brand with direct connection with consumers, Coffee Day IPO has generated strong expectations among small investors. The INR11.5 billion issue is scheduled to open on 14 October with an intended price band of INR316 – 328 per share. Investors can bid in multiple of 45 shares. Interestingly, the IPO consists of fresh issue of shares with no offer for sale (OFS) from its existing investors, making it the third IPO to do so this year. This is an important distinction and we like the fact that none of the existing investors (which is an impressive bunch) are in a hurry to offload their shares. More on this later.

Kotak Mahindra Capital Company, Citigroup Global Markets India, Morgan Stanley India, Axis Capital, Edelweiss Financial Services and YES Bank are managing the issue.

Issue Details

| IPO dates | 14-16 October 2015 |

| Price Band | INR316-328 per share |

| Issue Size | INR11.5 billion |

| Employee Reservation Portion | INR150 million |

| Category allocation | QIB – 50%, NII – 15%, Retail – 35% |

| Minimum lot | 45 shares |

| Minimum investment | INR14,220 – INR14,760 |

Usage of Funds

Out of the INR11.5 billion, INR2.87 billion is reserved for expansion of coffee business. This amount is segmented as follows:

| INR973.61 million | Manufacturing and assembling 8,000 vending machines |

| INR877.10 million | Setting up 216 new outlets and 105 kiosks |

| INR605.83 million | Refurbishment of existing outlets |

| INR418.56 million | New coffee roasting plant set up |

However, the biggest portion of the IPO proceeds will go towards paying back debt. This has been a common theme in almost all IPOs launched this year and CDEL is no exception here. The company plans to use INR6.33 billion towards debt repayment, split between INR5.3 billion for CDEL and INR1.26 billion for CDGL (Coffee Day Global Limited) which houses the coffee business. Debt reduction will be positive for CDEL and will be able to help profitability (which is not in great shape).

Read Also: Cafe Coffee Day IPO: What you need to know

Immense retail presence

One of the prominent reasons behind the debt mountain at CDEL’s books is the extensive retail outlet network. It has been tremendous growth for the business which started with just once outlet in 1996 in Bengaluru. As on June 2015, Cafe Coffee Day has a network of 1,538 outlets in the home market, spread across 219 cities. In addition, the company also operates 14 international outlets.

Read Also: Starbucks rival Cafe Coffee Day files DRHP for INR1,150 crore IPO

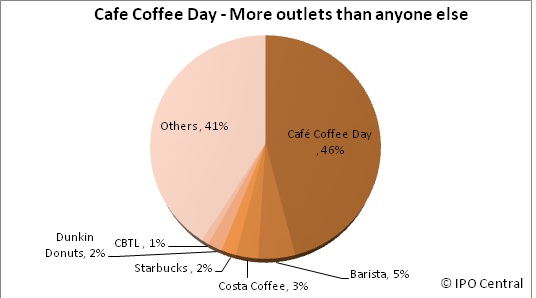

Coffee Day is a clear winner among its rivals in terms of number of outlets. Its competitors include Barista, Starbucks, Dunkin Donuts, Costa Coffee and MacDonald’s McCafe. Barista owns 169 while the global leader Starbucks operates with a mere 64 outlets in India.

KKR, Nilekani, Jhunjhunwala – they have got all!

CDEL has a rather impressive list of investors and in a sense, it need not rope in anchor investors after the pre-IPO round in March 2015 which saw fresh investments from Infosys co-founder Nandan Nilekani, Rakesh Jhunjhunwala’s Rare Enterprises, and value investor Ramesh Damani. However, these investors have small stakes in the company. Following company promoter VG Siddhartha, NLS Mauritius – an affiliate of New Silk Route – is the biggest shareholder with 13.1% holding. KKR is the third biggest shareholder with 12.7% equity stake while Standard Chartered Private Equity is also among the 10 biggest shareholders with 8.1% ownership. In comparison, Nandan Nilekani has 1.2% stake in the company.

This is surely an impressive and long list of investors but equally impressive is the non-participation by any of the investors. To be sure, it wouldn’t make sense for Nilekani and Co. to sell their shares as their average cost of acquisition turns out to be INR362.5 per share which is higher than the IPO price band. However, no such compulsion for Standard Chartered Private Equity which has an average cost of acquisition of INR171.8 per share through its investment in February 2010. Acquisition cost for KKR, which invested around the same time, is also lower than the current IPO price band. This clearly indicates the confidence existing investors have got in Cafe Coffee Day’s business model.

It is worth highlighting that out of the 15 IPOs so far in 2015, MEP Infrastructure Developers and Manpasand Beverages are the only ones without an OFS component. CDEL will be third such IPO this year.

Good for big guys – what’s in Coffee Day IPO for retail investor

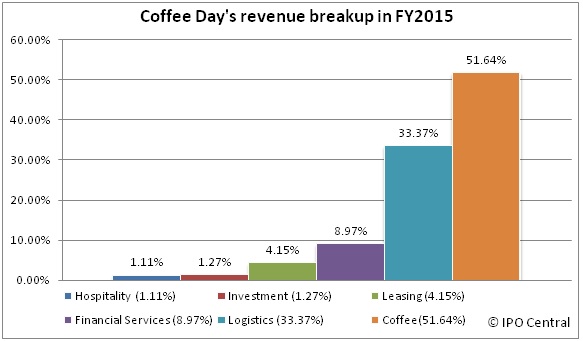

Despite the positivity around the company, it is critically important to highlight that Coffee Day Enterprises Limited is a holding company which happens to have a coffee business among others. Not to rob CDEL of its merits, the holding company derives only 51.6% of its annual revenues by selling coffee. Among its other prominent businesses are development of IT- ITES technology parks, logistics, financial services, and hospitality. With annual revenue of INR8.2 billion, logistics is no small business. In fact, it accounts for one third of CDEL’s consolidated revenue. This is on account of CDEL’s 52.8% equity stake in Sical Logistics.

Through its 85.5% stake in Way2Wealth Securities, financial services is also an important vertical for CDEL. The business accounts for nearly 9% of CDEL’s top line.

It might seem a good idea to some IPO investors that owning shares of a holding company is best of both worlds. In practice, however, holding companies with diverse businesses are valued less than the sum of their individual businesses. This so called “conglomerate discount” is on account of way too many levers in the business model. Since there is little in terms of synergies between financial services and coffee business, Coffee Day IPO is not entirely a call on India’s consumption story.

Financial performance is not impressive

As a brand, there is no denying that Coffee Day connects well with consumers but Coffee Day IPO doesn’t necessarily indicate the same relationship for IPO investors. Coffee Day’s financial performance has not been creamy and frothy in recent years, to say the least. With a burden of consolidated debt of INR27.62 billion as on 30 June 2015, the firm has been in losses in the previous three years and the worrisome part is that the losses are mounting. In the latest year, the company recorded a loss of INR872.35 million on revenues of INR25.5 billion.

Hopefully, things will turnout better for Coffee Day going forward but hope isn’t the best choice retail investors can make.

| Coffee Day’s consolidated Financial Performance (INR million) | ||||

| 31 Mar 15 | 31 Mar 14 | 31 Mar 13 | 31 Mar 12 | |

| Total Income | 25,487.15 | 23,527.71 | 21,491.44 | 16,338.71 |

| Total Expenses | 26,959.13 | 24,943.59 | 22,129.29 | 16,466.66 |

| Net Profit/Loss | (872.35) | (770.28) | (214.05) | 192.95 |

Source: Coffee Day Enterprises Limited RHP

Conclusion

With the tailwinds of a great brand, it may not be difficult for Coffee Day IPO to get high subscription levels. However, we are not convinced that retail investors should go for this avenue. Since CDEL is a loss-making company as of now, there is little to talk about a valuations-based approach.

There is lot of steam in the consumption story and the supporters would quickly cite the example of Jubilant Foodworks which has rewarded shareholders handsomely, but we can’t emphasize enough that CDEL is a bag of different businesses which are not necessarily related. There are enough examples of conglomerates destroying shareholders’ value, and while it may not be the case with Coffee Day, there is little to no reason to opt for such diversification. If investors are interested in logistics business, they have the option of buying shares of Sical Logistics which is a listed company. However, buying CDEL is not the most obvious choice to play the consumption story, especially for investors who are looking to buy and hold. Going forward, its financial performance will continue to be affected by constituent businesses. Given the overly diversified business model, there is a strong case for retail discount in Coffee Day IPO, which could have been an attraction for listing gains.

Bang on point, you guys saved me from this dud ipo. Keep up good work.