The upcoming ICICI Pru Life IPO has set expectations very high among investors as the first IPO from the insurance sector. The IPO opens on Monday, 19 September with shares priced in the range of INR300 – 334 per share. At the upper end of the price band, the sale of 181,341,058 shares will result in an income of INR6,056.7 crore (INR60.56 billion) to ICICI Bank which is the only seller in the IPO. In this IPO review, we are going to look at this celebrated company’s financial performance, valuations and other important factors to understand if it makes sense to invest in ICICI Prudential Life IPO.

ICICI Prudential Life IPO Details

ICICI Prudential Life IPO Details

| Subscription Dates | 19 – 21 September 2016 |

| Price Band | INR300 – 334 per share |

| Offer For Sale | 181,341,058 shares (INR6,056.7 crore at upper end) |

| Total IPO size | 181,341,058 shares (INR6,056.7 crore at upper end) |

| Minimum bid (lot size) | 44 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | BSE, NSE |

OFS IPO and capital structure

All the shares in ICICI Pru Life IPO are offered by its parent ICICI Bank which holds 67% equity stake. As a result, the company will not get any funds from the IPO. After the IPO, ICICI Bank’s shareholding in the life insurance company will decline to nearly 55%.

ICICI Pru Life is joint venture between ICICI Bank and UK’s Prudential Corporation Holdings and started operations in 2001. The largest private sector life insurer in India also counts Wipro-chief Azim Premji and Temasek among its investors.

While Prudential owns 26% equity stake in ICICI Pru Life, PremjiInvest and Temasek own 4% and 2% stake, respectively. PremjiInvest and Temasek are among the newest investors with their money coming only in December 2015 and March 2016 respectively. The cost of acquisition for the two companies is INR226.34 per share which means their investment has grown by 47.5% in less than a year.

|

Biggest shareholders in ICICI Prudential Life |

||

| Name of shareholder | Equity Shares | Percentage (%) |

| ICICI Bank | 969,157,662 | 67.62 |

| PCHL | 370,784,884 | 25.87 |

| M/s Hasham Traders | 57,435,497 | 4.01 |

| Compassvale Investments Pte. Ltd | 28,717,748 | 2.00 |

| Binayak Dutta | 328,750 | 0.02 |

| Puneet K Nanda | 247,500 | 0.02 |

| Kalpana Bharat Sampat | 235,000 | 0.02 |

| Binay Kumar Agarwala | 185,000 | 0.01 |

| Shuba Rao Mayya | 175,000 | 0.01 |

| Pankaj Jain | 167,250 | 0.01 |

| Total | 1,427,434,291 | 100.00 |

ICICI Pru Life business summary

ICICI Pru Life is simply the largest private sector player in India’s insurance market. According to its red herring prospectus (RHP), the company had a market share of 11.3% among all insurance companies in India (public and private sector) in FY2016. Among the 23 private sector life insurance companies in India, the company had a market share of 21.9% on a retail weighted received premium (RWRP) basis in FY2016.

In a typical fashion for a life insurance company, ICICI Prudential has a number of agents on its rolls. It had 121,016 individual agents as on 31 March 2016, to be precise. Nevertheless, as much as 58.6% of its retail annualised premium equivalent in FY2016 came from Bancassurance – selling insurance policies through a network of bank branches including but not limited to ICICI Bank. As of July 12, 2016, ICICI Prudential Life had banking partnership with over 4,500 branches. In addition, it had a network of 521 offices in 456 locations with 10,663 employees as of 31 March 2016.

Read Also: HPL Electric IPO to open on 22 September; price band at INR175-202 per share

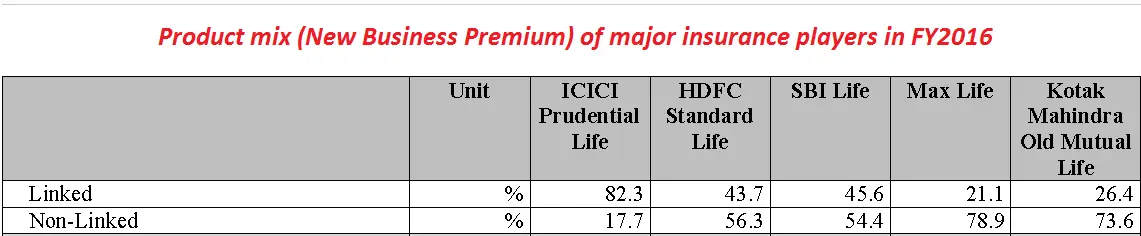

Another interesting factoid from the company’s RHP was that the much-tainted ULIPs stood for 82% of its new business premium in FY2016. ULIPs – Unit Linked Insurance Plans – are notorious for their high charges and inefficient capital allocation and by now, many of our readers are well aware of the mediocre returns they have got from such plans. Quite surprisingly, we find in the RHP that ICICI Pru Life has an unusually high reliance on such products which its competitors have stopped pushing. This high figure puts a question mark on the quality of its earnings.

Financial performance

Financial performance

Apart from being the leading private sector life insurer, ICICI Pru Life is also the foremost in making money. For the financial year ended 31 March 2016, ICICI Prudential Life posted revenues of INR18,998.7 crore (INR189.9 billion), marking a growth of 25.3% from the previous year. Its net profit during the latest year grew slightly to INR1,652.7 crore (INR16.5 billion).

|

ICICI Prudential’s consolidated financial performance (in INR crore) |

|||||

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | |

| Premium earned | 13,927.8 | 13,417.2 | 12,282.6 | 15,160.4 | 18,998.7 |

| Profit after tax | 1,385.6 | 1,515.4 | 1,561.3 | 1,640.3 | 1,652.7 |

| Net profit margin (%) | 9.9 | 11.3 | 12.7 | 10.8 | 8.7 |

Should you invest in ICICI Pru Life IPO?

As the first insurance offer in India, ICICI Pru Life IPO has its charm and mentions that it has no listed peer in this domain. However, there are comparisons available after the merger plan of HDFC Life and Max Life. The merger will create an entity bigger than ICICI Pru Life. The deal, putting the valuation of the merged entity at INR66,500 crore, was done at an EV (Enterprise Value) multiple of nearly 3.5 times. In comparison, ICICI Pru Life IPO is priced at 2.9-3.2 times. At the upper end of the price band, the IPO values ICICI Pru Life at nearly INR47,900 crore. In terms of earnings, the IPO pricing (upper end of the price range) values the company at a PE ratio of 28.9 times based in FY2016 EPS of INR11.53.

These are decent numbers and given the under-penetration of insurance in India, there is immense scope for future growth. However, the fact that a few million shares of the company changed hands six months ago at lower valuations leaves a pretty bad taste in mouth of investors. When ICICI Bank sold these shares to Temasek, ICICI Pru Life was valued at INR32,500 crore and just six months down the line, the company’s worth has increased by 47.5%. Clearly, either Temasek and PremjiInvest got a good deal or IPO investors are being offered a raw one. Now it is true that such transactions usually take place at a discount but 47.5% discount is simply too much to digest.

Its high dependence on products like ULIPs means that the company is weak in pure insurance business known as protection business. The company has also identified this gap and intends to expand this business line. “We are focusing on expanding our protection business as these products typically have higher margins,” reads a line in the RHP. For the moment, we have the IPO from an insurance company which is light on term plans. Another area where it has struggled in the past has been claim settlement ratio (read this eye opener from Deepak Shenoy here), although it has covered some ground in the recent years.

“We are focusing on expanding our protection business as these products typically have higher margins.,” says the company’s IPO prospectus

Thankfully, the company pays dividends consistently. In FY2016, ICICI Pru Life paid dividend of INR8.4 per share amounting to INR12.03 billion. This amount is nearly 72% of the profits the company earned in the FY. Going forward, we can hope to see the same dividend policy as ICICI Bank and Prudential will still be prominent shareholders, although the yield for IPO investors will only be around 2.5%.

In all likelihood, ICICI Pru Life IPO will sail through easily given the scarcity of insurance companies in the listed domain although it comes with its own set of weaknesses and shortcomings. It has a good parentage, private investors on board and a strong brand name. We have seen IPOs with good retail connect faring well after listing. If you want to see what retail investors think of the offer, head to this page on ICICI Pru Life IPO and offer your valuable suggestions.

I feel the pricing is higher compared to MFSL where in you get 7 for three. Ar current valuation of 580-600, you get 7 shares for 1800 which is much below the ICICI pru share. HDFC has better brand name than Icici. I will buy for definite conversion of MFSL than apply for this issue. Highly priced

if u feel so plz apply and when u get allotmnt sell to me at 2000 profit

8863805714

i will like to sell if i got alloted today

Financial Performance table shows Net Profit Margin as % of Premium earned. Shouldn’t it be % of Revenues? coz settled Claims need to be deducted from Premium earned.