As expected, Karnataka-based VRL Logistics ([stock_quote symbol=”VRLLOG” show=”” zero=”#000000″ minus=”#FF0000″ plus=”#448800″ nolink=”1″]) listed on the stock exchanges with smart gains on the last day of April. Shares ended the day 42% above the issue price of INR205 per share and even though there was no retail discount, small investors had no reason to be unhappy.

In retrospect, the logistics firm’s IPO came at a time when the markets are heading to new highs. As such, it is no coincidence that investors’ risk appetite is quite high, if not the highest in recent years. However, it would be wrong to attribute the issue’s success purely to bullishness in the market. After all, it does not happen every day for IPOs to get such market reception – 74 times to be precise. Not to forget, the market has seen a couple of poor listings after VRL Logistics’ listing. These included MEP Infra and UFO Moviez which quickly joined the race to the bottom while PNC Infratech also couldn’t sustain the initial gains.

Coming back to VRL Logistics, it is not difficult to see the factors leading to the massive subscription. The IPO clearly benefitted from the paucity of quality fresh issues at reasonable rates. In retrospect, it appears there was almost nothing to dislike about the issue. A healthy and growing business, experienced and stable management in place and sensible approach by lead managers to leave a small change on table – almost everything went in favour of the company. While there are several factors not in the control of company management and even lead managers, the last bit is a fairly important point to be discussed at a greater length.

IPOs of several companies fail to gain the traction they deserve due to the management fixation of “everything” optimization. In this attempt to extract the last penny out of market, promoters often leave even anchor investors high and dry. Anchor investors are mostly domestic mutual funds and have a lock-in period of 30-days which is good enough for the market to discover the true price of an enterprise. This short-termism can prove detrimental for the company in case it needs to revisit the markets. VRL Logistics fared very well on this front with pricing the issue at a discount to its listed peers like Gati and Transport Corporation of India. VRL Logistics’ price band of INR195-205 per share came at the P/E range of 17-18 times, compared to P/E multiples in excess of 20 for its competitors.

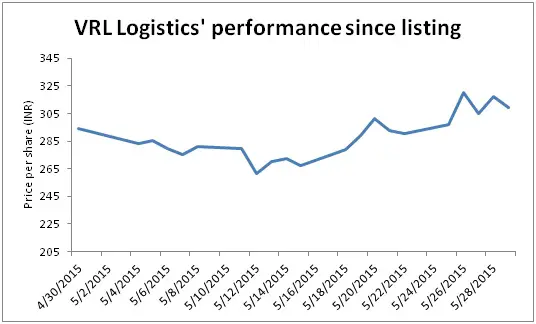

At IPO Central, we are not big fans of the immediate returns/losses a new listing makes on the listing day. We also take a dim view of a weekly performance as prices are often depressed in the first week of listing on account of selling pressure by retail investors. In our view, the market starts offering true valuation to a stock between 15 to 30 days of listing.

On these parameters, VRL Logistics has performed well with 5.2% gains between 30 April and 29 May 2015. In total, investors still holding the allotted shares in the IPO are sitting on a 50.9% gain. This is impressive no matter how it is seen. With the selling by small investors largely through, the stock is moving up with smart gains.