Mobile marketing player Affle India is all set to launch its IPO on 29 July 2019. This will be 11th mainboard IPO in India this year, including the failed attempt by KPR Agrochem. Here are the important points you need to know about Affle India IPO:

Affle India IPO: Fresh + OFS

Like most IPOs this year, Affle’s public offering is also a mix of fresh shares to raise capital towards working capital and an offer by existing shareholders. Affle India plans to raise INR90 crore through sale of fresh shares.

In addition to the fresh shares, 4,953,020 shares amounting to as much as INR369 crore will be sold by Affle Holdings Pte Ltd.

Read More: Affle India IPO Discussion and GMP

Affle India IPO: Microsoft on board

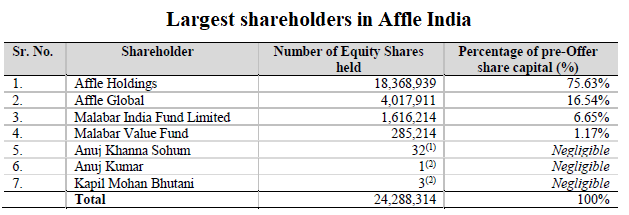

The company is promoted by Anuj Khanna Sohum and Affle Holdings Pte Ltd and the latter is the largest shareholder with 75.63% of the shares. Another Affle Holdings subsidiary Affle Global holds 16.54% stake. Sumeet Nagar’s Malabar India Fund and Malabar Value Fund directly hold a combined stake of 7.82% in Affle India.

It is important to highlight that Microsoft Global Finance holds 6.23% shareholding in Affle Holdings while Bennett, Coleman & Co Limited is also a shareholder with 5.19% holding.

Affle India IPO: Business operations

The company is a technology player with a proprietary consumer intelligence-driven mobile marketing platform. This platform is used by business to consumer (B2C) companies across industries, including e-commerce, fin-tech, telecom, media, retail and FMCG companies, both directly and indirectly through their advertising agencies.

Read Also: Here is why analysts are bullish on Affle India IPO

The platform provides: (1) new consumer conversions (acquisitions, engagements and transactions) through relevant mobile advertising; (2) retargeting existing consumers to complete transactions for e-commerce companies through relevant mobile advertising; and (3) an online to offline (O2O) platform that converts online consumer engagement into in-store walk-ins.

As of 31 March 2019, the consumer platform had approximately 2.02 billion consumer profiles, of which approximately 571 million were in India, 582 million were in Other Emerging Markets (which comprises Southeast Asia, the Middle East, Africa and others) and 867 million were in Developed Markets (which comprises North America, Europe, Japan, Korea and Australia).

Affle India IPO: Acquisitions in a fragmented market

Digital advertising technology is a growing market and there are over 100 companies around the world that offer one or more components of the digital advertising technology. However, only a few companies operate internationally, such as Affle, InMobi, Criteo, Trade Desk, Freakout, Mobvista and YouAppi.

This fragmented nature of the market allows good opportunities for consolidation to achieve global scale. Affle has capitalized on these opportunities and has made several acquisitions in the last couple of years. These include Markt, Vizury Commerce Business, Shoffr Platform Business, and the RevX Platform Business.

Affle India IPO: Serial entrepreneur’s encore

Anuj Khanna Sohum, 41, is the man behind the mobile marketing platform. Being a serial entrepreneur, Anuj is not an unknown name in startup circles. Prior to Affle, he co-founded Anitus Technologies while studying at National University of Singapore (NUS). Anitus was acquired by Malaysian conglomerate MCSB in 2001. A Singaporean by citizenship, Anuj subsequently set up an information security startup named SecLore Technology which was bought by Herald Logic in 2007.

Affle India IPO: Growing revenues and improving profitability

Understandably, the company is in growth phase and has shown a remarkable trend of revenue growth in all of the last five years but one in FY2017. Similarly, its profits have grown consistently over the years except a dip in FY2017.

As mentioned above, the company has been on an acquisition spree lately and this is reflected in its results for FY2019 which are markedly higher. The results for FY2019 consolidate the results of its Singaporean and Indonesian subsidiaries. As one can see, the profitability of the business has also gone up in these years and seems to have stabilized now in high-double digit levels.

| Affle India’s financial performance (in INR crore) | ||||||

| FY2014 | FY2015 | FY2016 | FY2017 | FY2018 | FY2019 | |

| Total revenues | 14.9 | 39.5 | 88.9 | 66.8 | 84.9 | 249.8 |

| Total expenses | 12.8 | 37.7 | 85.0 | 66.0 | 71.3 | 190.0 |

| Comprehensive income | 1.3 | 2.3 | 2.6 | 0.6 | 8.8 | 48.5 |

| Net margin (%) | 8.7 | 5.7 | 2.9 | 1.0 | 10.4 | 19.4 |