Bikaji Foods International Ltd has filed its draft red herring prospectus (DRHP) with capital market regulator SEBI seeking approval to launch its IPO. Bikaji Foods IPO draft document is a treat to read and has several interesting aspects of the business. Since the document is currently under regulatory scanner, Bikaji Foods IPO date is not known yet but the upcoming IPO will surely be an interesting development to watch. Here is more on this.

Read Also: Bikaji Foods IPO GMP, Date, Profit Estimate

#1 History and Business Background

The company is a pioneer in the Indian packaged snacks industry and has given a novel twist to classic Indian snacks with a contemporary taste. Its history and lineage traces back to Mr. Gangabishan Agarwal, founder of Haldiram brand. His grandson, Mr. Shiv Ratan Agarwal, launched the Bikaji brand in the year 1993.

Currently, it is among India’s largest FMCG brands with an international footprint, selling Indian snacks and sweets, and is among the fastest growing companies in the Indian organised snacks market. In the six months ended 30 September 2021, it sold more than 250 products under the Bikaji brand. The mainstay of the company is family pack products (packs priced at more than INR10) which accounted for 62.64% of its sale of food products in FY2021.

Read Also: Multibagger Chemical Stocks for 2022

#2 Major Player in Ethnic Snacks Category

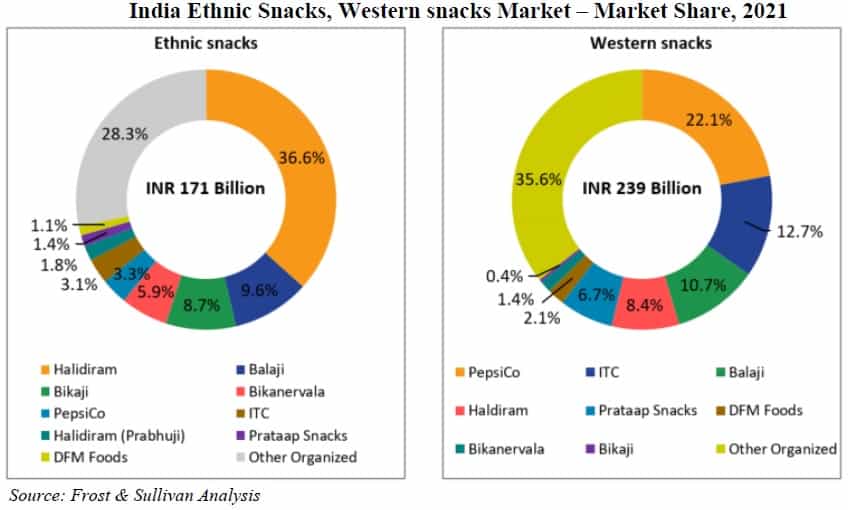

Bikaji is a major player in the Indian Ethnic Snacks market with a market share of 8.7% and is only behind Haldiram and Balaji Wafers. The Indian Ethnic Snacks market stood at INR171 billion in 2021 and is growing at a healthy pace. It is also present in the Western snacks category but with a miniscule market share.

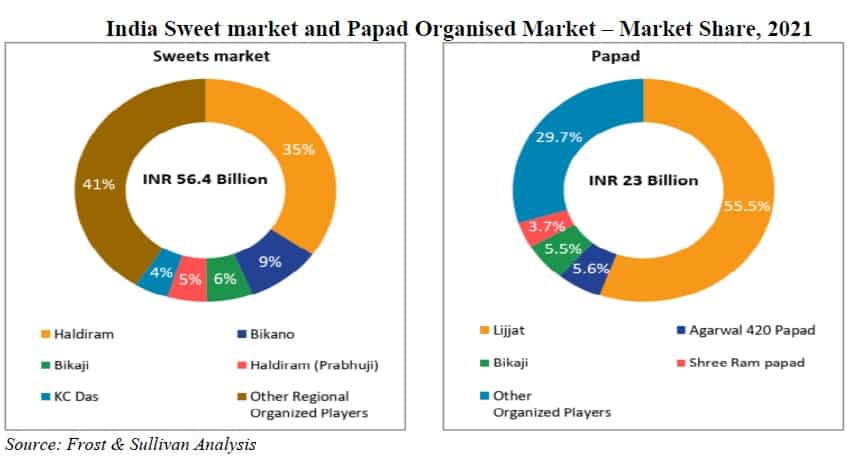

Other product categories where Bikaji operates in are Sweets and Papad where it is among top three players.

#3 Production Capacity

In FY2021, Bikaji was the largest manufacturer of Bikaneri bhujia with annual production of 26,690 tonnes, and was the second largest manufacturer of handmade papad with an annual production capacity of 9,000 tonnes in FY2021.

It has leadership in other product categories such as rasgulla, soan papdi and gulab jamun. In these three categories, its annual production capacity stood at 24,000; 23,040; and 12,000 tonnes, respectively in FY2021.

The company counts Rajasthan, Assam and Bihar among its core geographies and this is reflected in its production plants as well. Out of its six operational manufacturing facilities, four are located in Bikaner (Rajasthan) while two are in Guwahati (Assam) and Tumakuru (Karnataka). In addition, it has a non-exclusive contract manufacturing agreement in Kolkata (West Bengal) as well as a small facility in Mumbai to manage its Mumbai restaurant sales.

#4 Strong Distribution

In order to leverage its massive manufacturing capacity, the company has matching distribution network. As of 30 September 2021, it had five depots, 43 superstockists, 438 direct and 1,644 indirect distributors, located across 22 states and three union territories in India.

The company has established market leadership in the ethnic snacks market in the three core states and has gradually expanded footprint across India. In the six months ended 30 September 2021, Bikaji exported products to 35 international countries, including countries in North America, Europe, Middle East, Africa, and Asia Pacific, representing 4.6% of its sales of food products.

In the core markets of Rajasthan, Assam and Bihar, it enjoys approximately 44.5%, 58.1% and 29.2% share respectively, in the organized Indian ethnic snack category in such states during FY2021.

#5 Capital Structure – PE Investors on board

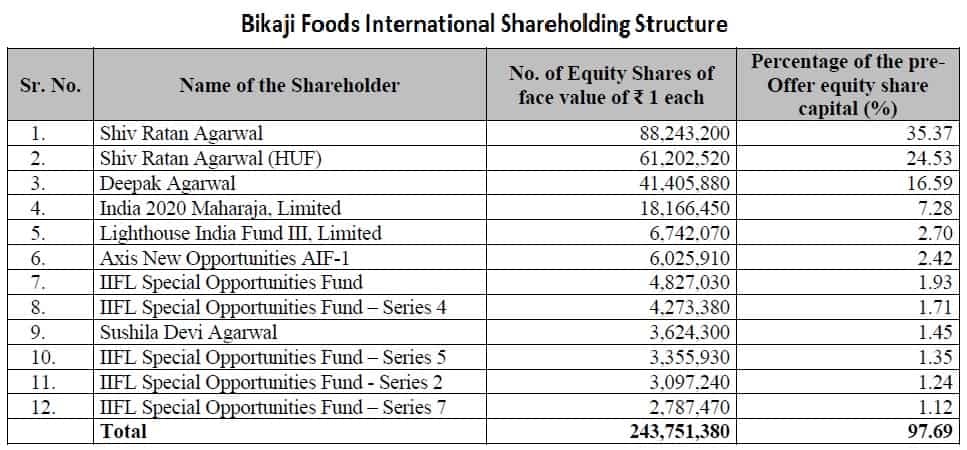

Promoter and Promoter Group entities currently own 194,543,900 shares or 77.97% equity in the company. Bikaji raised funds from private equity investors India 2020 Maharaja, IIFL, and Lighthouse India Fund in 2014, 2018 and 2021, respectively. Currently, its external investors include Avendus, Axis Asset Management, Lighthouse Funds, IIFL Asset Management, and Intensive Softshare.

#6 Bikaji Foods IPO – Financial Performance

First thing one notices in Bikaji Foods’ financial figures is that there is no impact of Covid-19 pandemic. The company continued its sales growth in the last 3 years in a consistent way. In the first 6 months of financial year 2022, it is on track to surpass the sales peak scaled in FY2021. Considering the essential nature of the company’s products, it is not surprising that it maintained the momentum during the pandemic.

Similarly, its net income has also been increasing and margins have been in the range of 5.2 to 6.8%. Aiding this performance is a lean balance sheet with minimal debt. Bikaji’s debt/ equity ratio stood at just 0.13 as of 30 September 2021. During FY2021, its ROCE also stood at a healthy 20.9%.

| FY2019 | FY2020 | FY2021 | H1 FY2022 | |

| Revenue | 910.6 | 1,082.9 | 1,322.2 | 777.1 |

| Expenses | 834.8 | 1,019.3 | 1,202.1 | 721.4 |

| Net income | 50.9 | 56.4 | 90.3 | 40.9 |

| Margin (%) | 5.6 | 5.2 | 6.8 | 5.3 |

#7 Expansion After Bikaji IPO

Going forward, the company plans to expand presence in Uttar Pradesh, Punjab, Haryana and Delhi in north India and Karnataka and Telangana in south India. With this in view, it intends to operationalise five additional manufacturing facilities, of which one facility in Rajasthan will be owned and operated by the company and will manufacture frozen snacks and sweets products. The other four facilities in Rajasthan, Bihar and Uttar Pradesh for the manufacture of namkeen and western snacks will be under contract manufacturing agreements.

As one can see, the company operates in a segment which is isolated from supply and demand shocks. This robust nature of business, coupled with a strong balance sheet, makes Bikaji Foods IPO all the more interesting. While the offer’s date isn’t finalized, Bikaji Foods IPO GMP will likely attract good traction.