Chalet Hotels will launch its maiden public offer today as the second IPO in India during 2019. Having priced the IPO in the range of INR275 – 280 per share, the Mumbai-based company plans to raise anywhere between INR1,628.84 crore and INR1,641.18 crore The upcoming IPO will comprise of fresh shares being issues as well as an Offer For Sale (OFS) by existing shareholders. Investors can place bids for minimum 53 shares and in multiples thereafter. Through this Chalet Hotels IPO review, we try to find out if it has makings of a worthwhile investment.

|

Chalet Hotels – Upcoming IPO details |

|

| Subscription Dates | 29 – 31 January 2019 |

| Price Band | INR275 – 280 per share |

| Fresh issue | INR950 crore |

| Offer For Sale | 24,685,000 shares (INR678.84 – 691.18 crore) |

| Total IPO size | INR1,628.84 – 1,641.18 crore |

| Minimum bid (lot size) | 53 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Chalet Hotels IPO Review: Fresh + OFS

The K Raheja Group company plans to raise INR950 crore by issuing new shares and the proceeds will be used towards repayment or prepayment of debts and for general corporate purposes. This step is likely to shave INR720 crore of debt from its books. More on this later as the company has loads of interest-bearing debt.

As mentioned above, the IPO will also have an OFS component of 24,685,000 shares. The biggest chunk of shares will be offloaded by promoter K Raheja Corp (10,784,176 shares) while Ravi Raheja and Neel Raheja plan to sell 5,550,000 shares each. Another 2,00,824 shares will be sold by Ivory Properties And Hotels Private Limited while Palm Shelter Estate Development LLP plans to offload 800,000 shares. In total, the selling shareholders plan to mobilize as much as INR802.26 crore at the upper end of Chalet Hotels IPO price band.

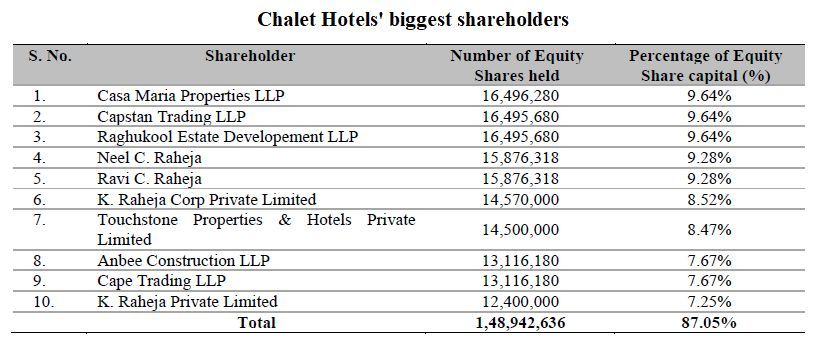

The company has no external investors and is controlled through a number of K Raheja group companies. No firm holds more than 10% equity stake in Chalet Hotels.

Chalet Hotels IPO Review: Hotels without self-branding

Incorporated in January 1986 as Kenwood Hotels, the company has a long operating history. In its prospectus, the company explained its business strategy of operating a chain of premium and upscale hotels in strategic, high density business districts of key metro cities in India. Its hotel platform comprises five operating hotels, including a hotel with a co-located serviced residence, located in the Mumbai Metropolitan Region, Hyderabad and Bengaluru, representing 2,328 keys, as of 31 March 2018. Despite operating in business districts, the company makes sure to have large land parcels in order to provide a wide range of amenities, such as fine dining and specialty restaurants, large banquet halls, ball rooms and executive lounges, swimming pools and outdoor spaces, spas and gymnasiums.

One of the most distinguishing characteristics of Chalet Hotels is that it hasn’t got its own brand but relies on global brands, such as, JW Marriott, Westin, Marriott, Marriott Executive Apartments, Renaissance and Four Points by Sheraton for its properties. As one can sense, this strategy has benefits of having to spend on advertising and branding. On the operating side, it directly manages some of its hotels while taking help of third party hotel operators for other properties. The company claims to have an active asset management model in place which helps in maintaining best financial performance of its hotel properties.

Chalet Hotels IPO Review: Rocky, not rocking

As the litmus test of any business is how much money it earns, we focus on its financial performance. The company doesn’t disappoint when it comes to top line performance as revenues have grown regularly since FY2015. Despite a dip in FY2015, its revenues grew from INR516.7 crore in FY2014 to INR929.5 crore in FY2018. As can be seen in the table below, expenses have also been largely under control but the performance on net profits front tells a different story. It has been profitable in only two of the last five years and profitability in FY2018 was a mere 3.4% before it swung again to losses in the first six months of FY2019.

That’s easy to understand since the company has not included depreciation and amortization and finance costs in its expenses. Out of these two factors, finance costs have taken a heavy toll on earnings amid heavy capital expenditure as consolidated debt/equity (D/E) ratio grew in each of the last five years. The only exception to it was in FY2018 when there was a small dip. As such, the jump in D/E ratio from 2.49 in FY2014 to 5.36 in FY2018 says a lot about the financial health of the company.

|

Chalet Hotels’ financial performance (in INR crore) |

||||||

| FY2014 | FY2015 | FY2016 | FY2017 | FY2018 | H1 FY2019 | |

| Total revenues | 516.7 | 467.1 | 597.6 | 924.5 | 929.5 | 497.0 |

| Total expenses | 362.7 | 377.3 | 441.7 | 493.7 | 579.4 | 363.1 |

| Profit after tax | -99.4 | -126.4 | -112.5 | 127.4 | 31.2 | -43.7 |

| Net margin (%) | -19.2 | -27.1 | -18.8 | 13.8 | 3.4 | -8.8 |

Chalet Hotels IPO Review: Should you subscribe?

Now that we have seen that high debt is the culprit behind the unreliable financial performance of the company, it might look like a safe assumption that use of IPO funds to pay down debt and better revenue growth in the coming years will shore up profitability. However, the real picture is quite different as it will use only INR720 crore from IPO proceeds towards debt reduction and one can gauge how much impact it will have if consolidated debt is a whopping INR2,725 crore. The move is, nevertheless, a step in the right direction.

Similarly, the expectation of better revenues in future is something investors need to take with a pinch of salt as it is not uncommon for these gains to be offset by rising costs. Indian hotel industry was marred by lower occupancy levels and lower room rates until 2016 and while we have lately seen an improvement in occupancy levels, a recovery in room rates has been missing. There are expectations of rates also going up due to slower inventory creation. However, the advent of online hotel booking platforms has effectively resulted in erosion of pricing power for hotels. Meanwhile, growing popularity of solutions like Airbnb means that the growth in demand is at least partly satisfied by inventory addition outside of the hotel industry.

In absence of stable profitability, valuations don’t mean a great deal. In FY 2018, its Earnings Per Share (EPS) stood at INR1.82 which translates into a Price/Earnings (P/E) ratio range of 151.10 to 153.85. However, it is not a reliable indicator but the pricing appears to be expensive on other parameters as well. For example, its Return on Net Worth (RONW) of 6.20% in FY2018 isn’t confidence inspiring while Net Asset Value (NAV) of INR29.36 per share means the Price/Book Value (P/B) ratio is quite high at 9.37 – 9.54.

In totality, Chalet Hotels IPO review tells that the company’s impressive top line growth doesn’t translate to attractive valuations and thus, it may be more suited for investors with higher risk appetite. The absence of grey market premium also indicates there is no fancy for this IPO. For other investors, there are well-established names such as EIH Limited and The Indian Hotels Company which have better profitability, balance sheet and at the same time, are available at better valuations.

Inter-related party transactionsChalet Hotels owns hotels. It buys land and constructs hotels on the same. K Raheja group has many business verticals like retail, residential, commercial and hotels. For each business vertical, the group requires land. I am not sure how the group can ensure that land would be available at reasonable price for the listed entity-Chalet. When asked, the management said that, in the past, as and when land was acquired from the group companies, it was acquired at cost-plus basis. This creates some kind of issues on transparency. In the recent past, we have seen that the share price takes a huge beating even when there is a small doubt on corporate governance. In that sense, I have a feeling that Chalet may not command the premium which otherwise it would have commanded had there been fewer related party transactions.Shoppers Stop-Another group company did not create that wow moment for investorsIn 2005, when Shoppers Stop came out with an IPO, it gave hope to the investors that this company would create wealth for them as the retail industry then looked promising. But that was not to be. It made an IPO at Rs 238 (face value Rs 10) against which the price is at Rs 517 (FV Rs 5). It gave CAGR of 11 per cent since listing. I would say that this is an average return as the company had the first mover advantage, but it failed to capitalise on the same. Sensex during the same period gave much better returns of 13 per cent CAGR. Its present market cap is Rs 4,500 crore. In the last five years, Shoppers Stop underperformed the broader market as the share price has gone up by 36 per cent, while Sensex during the same period is up by 72 per cent. This despite retail being the flavour of the season. Players like Avenue Supermarts (D-Mart) did extremely well in the retail business and enjoys market cap of Rs 85,000 crore. K Raheja group had Hypercity in its portfolio (where Shoppers Stop also had a stake), a business that can be compared with D-Mart, but it could not scale up and ultimately sold out to the Future group. Just for comparison, Future Retail has a market cap of Rs 22,000 crore. That gives me a feeling that the group is not able to scale up business and that is a risk Chalet Hotels may also carry.Its Vashi hotel is under litigationThe company operates Four Points by Sheraton Hotel at Vashi. This was purchased from promoter K Raheja in December 2005. Due to two PILs, the Mumbai High Court during FY14-15 directed K Raheja to demolish the hotel and give it back to CIDCO. The company filed special leave petition against the order in the Supreme Court and the apex court has ordered maintaining the status quo till the court announces final verdict. In case the ruling goes against the company, it can adversely impact the sentiments as well as the financials of the company.Hotel industry did not create wealth for the investorsThe stocks of hotel companies have struggled to create wealth for the investors. This shows that they are not the darling of the investors. In the last one year almost, the stocks of all hotel companies have underperformed the broader market. There is a reason for the same. The industry saw excess supply of room inventories and, due to that, the occupancy rates as well as ADR (average daily rate) took a beating. In the recent past, there has been uptick in the room rates and occupancy rates, but it is a little early to call it a trend. Also, this industry is facing challenges from new start-ups like Airbnb and OYO. Despite OYO being in the budget segment (Chalet is in the premium segment), it does impact demand. I am not sure whether the hotel industry is on the cusp of rerating. Many hotel properties today are available below their replacement cost, thereby reflecting poor sentiment for the sector.Volatile FinancialsThe company’s financials are not of much comfort to the investors. For FY2016, the company’s loss at PBT level (before exceptional items) was Rs 166 crore. The same figure improved in FY2017, where the company reported profit of Rs 79.12 crore. But again, it took a dip in FY2018, when the profit declined to Rs 21.19 crore. In the first six months of the current year, the PBT (before exceptional items) showed a loss of Rs 62.84 crore. In all probability, the company will report losses in the current financial year. The past financial performance does not inspire much confidence.ValuationsDespite the volatile financials, the company wants rich premium from investors. Based on the price band, the company will command market cap of Rs 5,655 crore. Indian Hotels (Taj group of hotels) commands market cap of Rs 16,000 crore, while EIH Ltd (Oberoi group of hotels) commands market cap of Rs 10,000 crore. Based on March 2018 numbers, the company would command EV/EBDIT of 24 times, which is equivalent to what Indian Hotels is commanding. For the first six months, the company’s financials have deteriorated and hence EV/EBDIT has further moved into expensive territory. This does not leave scope for capital appreciation.In all probability, Chalet Hotels will not live up to the investors’ expectations. I would not be subscribing to the IPO.