Godrej Agrovet will be the 27th company to tap the mainboard IPO this year in India. Priced in the range of INR450 – 460 per share, the Godrej Group company aims to mobilize total INR1,157.3 crore through a mix of fresh shares and a sale by existing investors. Being a group entity of the famed Parsi industrial conglomerate, Godrej Agrovet will be quite high on investors’ radars. This will also be an important avenue for investors looking for reasonably-priced offers following the highly-priced IPOs of ICICI Prudential and SBI Life Insurance. Through Godrej Agrovet IPO Review, we try to find out if this primary market public offer fits the bill.

|

Godrej Agrovet IPO details |

|

| Subscription Dates | 4 – 6 October 2017 |

| Price Band | INR450 – 460 per share |

| Fresh issue | INR291.5 crore |

| Offer For Sale | INR300 crore + 12,300,000 shares (INR565.8 crore) |

| Total IPO size | INR1,157.3 crore |

| Minimum bid (lot size) | 32 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Godrej Agrovet IPO Review: Temasek, Godrej Industries to get light

As mentioned above, Godrej Agrovet IPO will involve issue of fresh shares as well as an Offer For Sales (OFS) bu existing shareholders. By issuing new shares, the company plans to raise INR291.5 crore. This is less than the INR300 crore the company mentioned in the draft prospectus. The decline is due to the pre-IPO placement last month which helped the company in raising INR848.8 crore. The funds are proposed to be used as follows:

- Repayment or prepayment of working capital facilities – INR100 crore

- Repayment of commercial papers – INR150 crore

- General corporate purposes

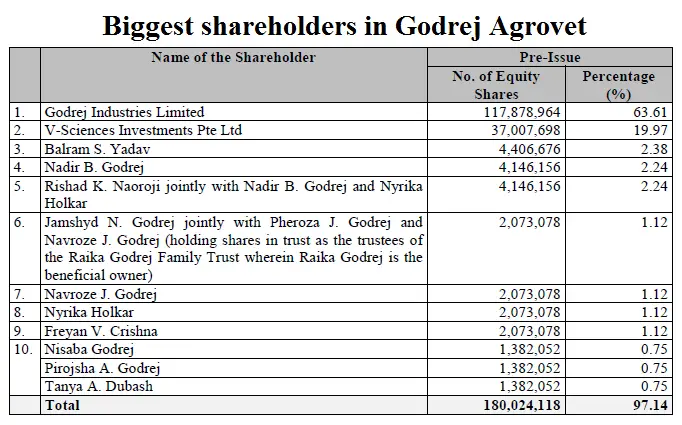

Godrej Agrovet counts private equity (PE) firm Temasek Holdings among its investors and the PE firm will be offloading nearly a third of its shares in the IPO. A total of 12,300,000 shares will be offloaded by Temasek subsidiary V-Sciences Investments which holds nearly 20% stake in the company as of now. Promoter Godrej Industries also plans to sell shares worth INR300 crore.

Godrej Agrovet IPO Review: Leadership all the way

The Mumbai-based company operates in five business verticals and is among the leading players in all of them except one. These verticals include Animal Feed (53% of FY2017 revenues), Crop Protection (15%), Oil Palm (10%), Dairy (20%) and Poultry and Processed Foods. Godrej Agrovet is the leading player in the animal feed business in India and has 50% ownership in a Bangladeshi joint venture that is among the top five players. It is also the largest producer of palm oil in India with nearly 35% market share.

Given its leadership position, it can be safely assumed that Godrej Agrovet has an extensive manufacturing and distribution network. This is indeed the case as 35 production plants for animal feed, 5 palm oil mills, 2 plants for crop protection, 2 processing plants for poultry and 9 milk processing units indicate. On the distribution side, the company has an enviable network that includes nearly 4,000 distributors for animal feed, 6,000 distributors for crop protection, 4,000 distributors for milk and 3,000 distributors for milk products.

Godrej Agrovet IPO Review: Double revenues, treble earnings

Godrej Agrovet is a robust play not just in term of market share in its business lines but also in financial performance. This is well-reflected in the way top line and bottom line have increased in recent years. In the last five years, revenues have expanded from INR2,771.6 crore in FY2013 to INR4,983.3 crore in FY2017. This is not exactly double but the net result is quite close considering that the revenues from overseas JVs are not reflected in consolidated top line. Godrej Agrovet consolidates the profits from these JVs in earnings but not revenues.

Similarly, profits have followed an increasing trajectory, except in the latest year. Earnings surged from INR93.7 crore in FY2013 to INR249 crore in FY2017. The company achieved highest margins in FY2016 at 6.9% and although it has lost some of the sheen subsequently, profitability is still quite healthy at 5%.

|

Godrej Agrovet’s financial performance (in INR crore) |

||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | Q1 FY2018 | |

| Total revenue | 2,771.6 | 3,117.4 | 3,325.5 | 3,817.7 | 4,983.3 | 1,369.4 |

| Total expenses | 2,634.1 | 2,928.9 | 3,108.3 | 3,608.5 | 4,649.4 | 1,272.3 |

| Profit after tax | 93.7 | 153.8 | 207.7 | 261.7 | 249.0 | 66.1 |

| Net margin (%) | 3.4 | 4.9 | 6.2 | 6.9 | 5.0 | 4.8 |

Source: Godrej Agrovet’s Red Herring Prospectus

Godrej Agrovet IPO Review: What’s on the table?

Regarding the business, there are no doubts that Godrej Agrovet is on a strong footing. At the same time, it is not that the company is merely sitting on its laurels. It has leadership in Research & Development (R&D) which is going to ensure the business stays ahead of its competitors. While the Animal Feed business has Nadir Godrej Center for Animal Research & Development in Maharashtra, the Crop Protection business boasts of two R&D facilities in Maharashtra. The Palm Oil business line also has an R&D facility in Andhra Pradesh. It is important to add that the acquisition of Astec Lifesciences in 2015 was also carried out to boost the existing agro chemicals business.

None of the company’s business lines is going to becoming an overnight superstar. On the contrary, these are mundane, boring businesses with a high degree of predictability around demand (and earnings). For sure, none of the businesses are highly scalable without heavy capital expenditure but on the positive side, all of them are profitable. In short, it has elements to attract the smart money.

Owing to these advantages, it wasn’t surprising that Temasek picked up a significant minority stake in the company. Its average cost of acquisition being INR154.6 per share, Temasek will be making a clean 3X return on its five year old investment in the company. And the fact that it will remain invested in Godrej Agrovet is a clear sign that the PE firm sees even better profits ahead.

The company’s Earnings Per Share (EPS) in FY2017 stood at INR10.95 and the price band of INR450 – 460 per share values the business in the Price/Earnings (P/E) ratio of 41.1 – 42. This is not comfortable valuation but not prohibitively expensive as well, considering how steeply some of the recent IPOs have been priced. Return on Net Worth (RONW) – an important parameter of profitability – stood at 22.71% as of 31 March 2017. This was helped by a strong balance sheet involving reasonable Debt/Equity ratio of 0.48. Godrej Agrovet has no listed peers with similar diversified portfolio but the recent success of Apex Frozen Foods tells that the market has a high degree of acceptability to such businesses.

Overall, Godrej Agrovet IPO Review reveals that the company has well-developed business operations, solid parentage, strong distribution network and a clear focus on R&D. At a time when IPO aspirants aren’t hesitating in asking for three digit PE ratios, Godrej Agrovet’s IPO pricing comes across as a reasonable one.