The Nifty FMCG Index is specifically designed to represent the performance and behavior of Fast-Moving Consumer Goods (FMCG) manufacturers, which are characterized as non-durable products that consumers frequently purchase. This index consists of 15 stocks from the FMCG sector that are listed on the National Stock Exchange (NSE). It serves as a benchmark for evaluating the health and trends within this industry segment.

In this article, we have compiled a Nifty FMCG stocks list with weightage which is periodically updated. Nifty FMCG companies index can be used to benchmark fund portfolios and launch index funds by mutual funds, ETFs, and structured products.

What is the Nifty FMCG index?

Fast-moving consumer goods are nondurable items that are sold rapidly at relatively low prices. Due to their low pricing, these products typically have narrow profit margins but achieve high sales volumes. Examples of FMCGs include everyday items such as milk, fruits, vegetables, cooking oil, soap, toothpaste, facial creams, and over-the-counter medications.

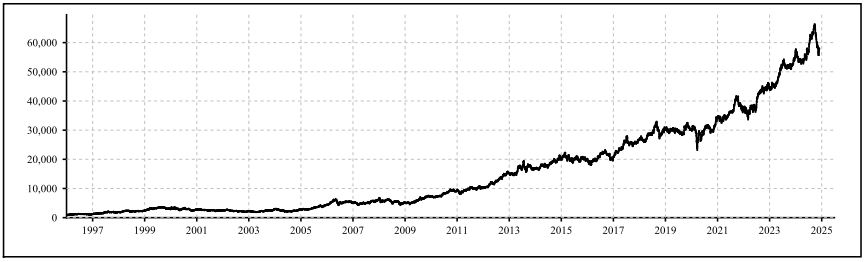

The Nifty FMCG Index is calculated using the free float market capitalization method. This means that the index level represents the total free float market value of all the stocks included in the index, relative to a specific base market capitalization value. The index has a base date of 1 January 1996, with a base value set at 1000, although it was officially launched in September 1999.

The Nifty FMCG Index serves multiple purposes, including benchmarking fund portfolios and facilitating the launch of index funds, ETFs, and structured products.

Read Also: NSE IFSC Trading In US Stocks: All You Need To Know

Nifty FMCG Companies Re-Balancing

The index is rebalanced on a semi-annual basis, with cut-off dates set for 31 January and 31 July each year. For the semi-annual review of indices, the average data for the six months leading up to the cut-off date is taken into account.

A prior notice of at least four weeks is given to the market from the date of the change. As a result, changes made on 31 January will be effective from 31 March.

Index Governance

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE Indices Limited, the Index Advisory Committee (Equity), and the Index Maintenance Sub-Committee.

Nifty FMCG Index: Key Drivers

- The FMCG industry in India is notable for its lack of cyclicality, attributed to the vast market size, a well-diversified product range, and the inelastic nature of consumer demand. Consequently, major players such as ITC, Hindustan Unilever, Nestle India, and Britannia Industries have consistently demonstrated robust performance in both revenue and profit margins over the years.

- Stable raw material prices are a notable feature of this industry, as most ingredients are locally sourced and readily available. This stability provides investors with greater earnings visibility.

Read Also: Nifty PSE Stocks List With Weightage in 2024

Nifty FMCG Weightage

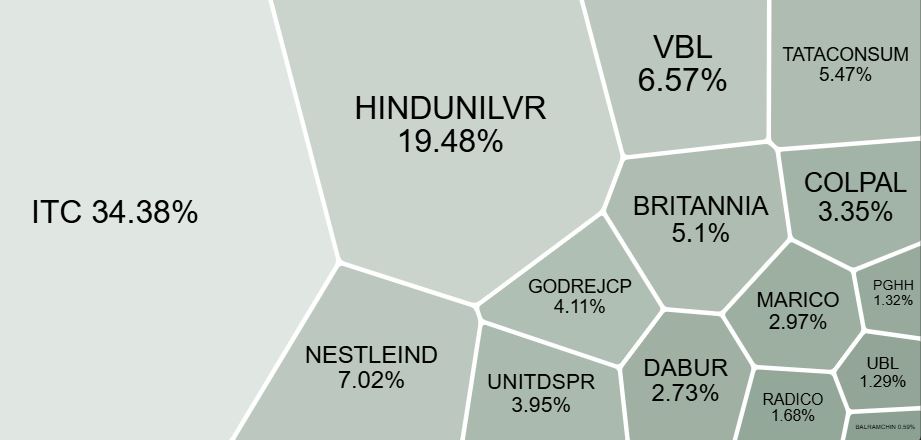

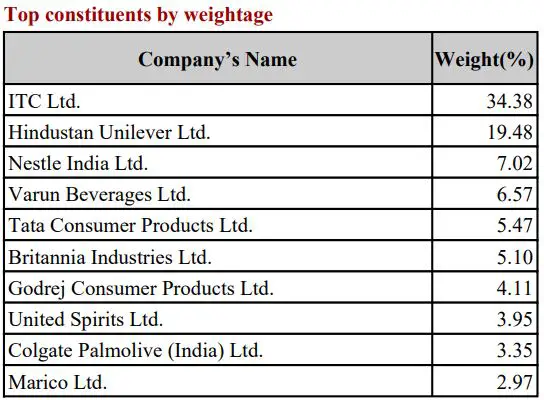

In terms of weightage, the top companies in the Nifty FMCG Stocks list are ITC (34.38%), Hindustan Unilever (19.48%), Nestle India (7.02%), Varun Beverages (6.57%), and Tata Consumer Products (5.47%).

Nifty FMCG Stocks List With Weightage

| Company Name | Industry | Price (INR) | Weightage(%) |

| ITC Ltd. | Cigarettes/Tobacco | 467.10 | 34.38 |

| Hindustan Unilever Ltd. | Household & Personal Products | 2,464.50 | 19.48 |

| Nestle India Ltd. | Consumer Food | 2,257.80 | 7.02 |

| Varun Beverages Ltd. | Consumer Food | 618.90 | 6.57 |

| Tata Consumer Products Ltd. | Tea/Coffee | 961.20 | 5.47 |

| Britannia Industries Ltd. | Consumer Food | 4,851.55 | 5.10 |

| Godrej Consumer Products Ltd. | Household & Personal Products | 1,228.50 | 4.11 |

| United Spirits Ltd. | Breweries & Distilleries | 1,526.05 | 3.95 |

| Colgate Palmolive (India) Ltd. | Household & Personal Products | 2,915.75 | 3.35 |

| Marico Ltd. | Consumer Food | 631.60 | 2.97 |

| Dabur India Ltd. | Household & Personal Products | 522.80 | 2.73 |

| Radico Khaitan Ltd | Breweries & Distilleries | 2,346.00 | 1.68 |

| Procter & Gamble Hygiene & Health Care Ltd. | Household & Personal Products | 15,820.65 | 1.32 |

| United Breweries Ltd. | Breweries & Distilleries | 1,953.10 | 1.29 |

| Balrampur Chini Mills Ltd | Consumer Food | 591.20 | 0.59 |

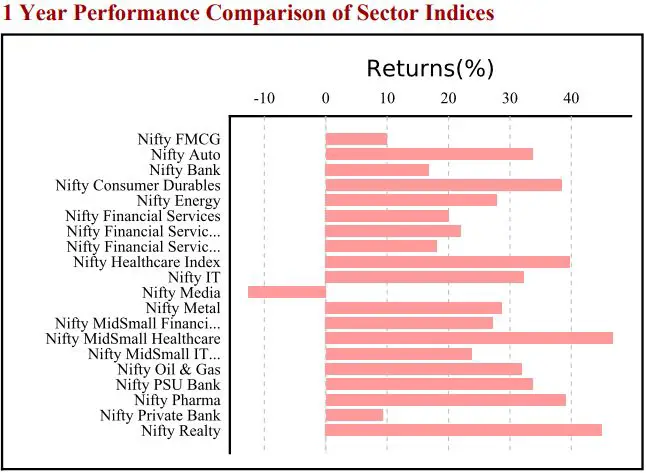

Nifty FMCG Index Vs Other Sectoral Indices

Read Also: Biggest Automobile Companies in India

Nifty FMCG Stocks List: Eligibility Criteria

- Nifty 500 Inclusion: Companies must be part of the Nifty 500 at the time of review. If fewer than 10 eligible stocks from the FMCG sector are present in the Nifty 500, additional stocks will be selected from the top 800 based on average daily turnover and full market capitalization over the previous six months.

- Sector Classification: The companies must belong to the FMCG sector.

- Trading Frequency: Companies should have a trading frequency of at least 90% over the last six months.

- Listing History: A minimum listing history of one month is required as of the cutoff date.

- Final Selection: The final selection will consist of 15 companies, determined by their free-float market capitalization. Preference is given to companies that are available for trading in the NSE’s Futures & Options segment at the time of selection.

- Weightage Calculation: The weightage of each stock in the Nifty FMCG Index is based on its free-float market capitalization. No single stock can exceed a weightage of 33%, and the cumulative weightage of the top three stocks cannot surpass 62% during rebalancing.

Read Also: Upcoming IPO Grey Market Premiums

Nifty FMCG Stocks List: Eligible Basic Industries

Companies from the following industries are eligible to be considered for inclusion in the Nifty FMCG Index List:

- Animal Feed

- Breweries & Distilleries

- Cigarettes & Tobacco Products

- Dairy Products

- Diversified FMCG

- Edible Oil

- Household Products

- Meat Products including Poultry

- Other Agricultural Products

- Other Beverages

- Other Food Products

- Packaged Foods

- Personal Care

- Seafood

- Stationary

- Sugar

- Tea & Coffee

Conclusion

The industry addresses the fundamental needs of consumers, making it a significant contributor to the Indian economy, accounting for approximately 8.00% of the Nifty 50 Index. While this sector enjoys strong and inelastic demand, along with the benefit of minor corrections, it is not immune to common challenges in equity investments, such as overvaluation and potential demand downturns.

Nifty FMCG Index Weightage FAQs

-

How many stocks are there in the Nifty FMCG Index?

Nifty FMCG Index has 15 stocks like ITC, Hindustan Unilever, and Nestle India.

-

How frequently is the Nifty FMCG Index rebalanced?

The Nifty FMCG Index is rebalanced every 6 months with the cut-off dates being 31 January and 31 July of each year.

-

Which company tops in Nifty FMCG Stocks Weightage?

On 29 November 2024, ITC Ltd had the maximum weightage of 34.38%, followed by Hindustan Unilever Ltd. at 19.48%.

-

What is Nifty FMCG’s performance in the last 12 months?

As of 29 November 2024, the index had returned 11.36% over the last 1 year including dividends.

-

Can we trade directly in the Nifty FMCG index?

Unfortunately, there are no instruments to trade intraday in the index. However, various mutual funds and ETFs are tracking the FMCG index. One such example is ICICI Prudential Nifty FMCG ETF. Investors can also pick sectoral mutual fund schemes like Nippon India ETF Nifty India Consumption which has a good overlap with Nifty FMCG Index.