PNB MetLife India Insurance Company has filed prospectus with market regulator SEBI for its maiden public share sale. PNB MetLife IPO will mobilize as much as INR2,500 crore (INR25 billion) as existing shareholders will offload their shares. This will be the fourth public offer from life insurance sector in India, following listing of ICICI Prudential Life Insurance, HDFC Life Insurance and SBI Life Insurance in the last few years. Here is a quick overview of PNB MetLife IPO:

PNB MetLife IPO: PNB, MetLife, Pallonji Group, Elpro, Jammu and Kashmir Bank and others

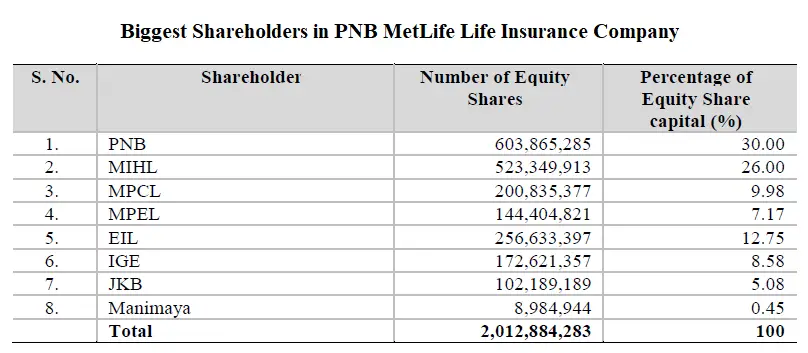

PNB MetLife, incorporated as MetLife India Insurance Company in 2001, has an impressive list of backers. These include the well-known promoters Punjab National Bank (PNB) and MetLife while other shareholders are Pallonji Group (through MPCL and MPEL), electrical equipment manufacturer Elpro International Limited (EIL), IGE India, Jammu And Kashmir Bank (JKB), and Manimaya Holdings. In total there are only eight shareholders. Here is the list of biggest shareholders in PNB MetLife:

PNB MetLife IPO: No fresh shares, all OFS

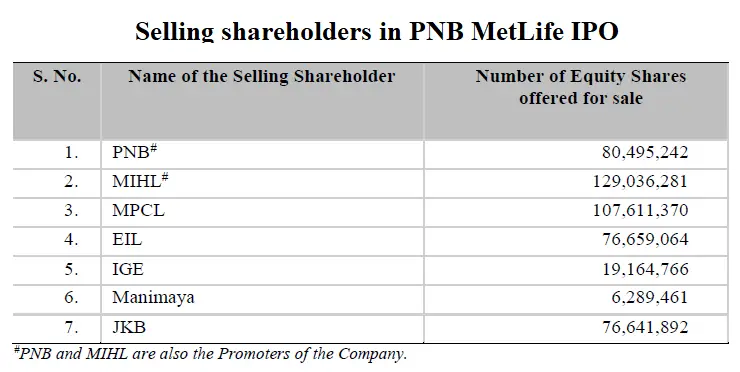

The company – a joint venture between PNB, MetLife, Elpro International, M Pallonji & Company, and Jammu and Kashmir Bank – will not get any funds from the IPO as all the shares will be sold by existing shareholders. As many as 495,898,076 shares or 24.64% of the company’s share capital will be sold under the Offer For Sale (OFS). This will value the company at nearly INR10,000 crore. The IPO is likely to be launched by mid-September.

Out of the eight shareholders, seven will participate in PNB MetLife IPO. The biggest chunk of shares will be sold by Metlife International Holdings (MIHL) (129,036,281 shares) while M. Pallonji & Company Private Limited (MPCL) will sell 107,611,370 shares. PNB – which is struggling with bad loans – also plans to sell 80,495,242 shares while electrical equipment manufacturer Elpro International Limited (EIL) will offer 76,659,064 shares. Other sellers include IGE India, Jammu and Kashmir Bank, and Manimaya Holdings.

PNB MetLife Network: Less branches, more partnerships

Selling life insurance and settling the subsequent claims and other paper work requires an easily accessible network. As of 31 March 2018, PNB MetLife had 110 branches across the nation. It is worth noting that this figure is down from 161 five years ago as the company is on a cost control drive (more on this later). Nevertheless, it has other channels to compensate for this reduced reach on the ground. The company counts three major channels to sell its products:

Bancassurance: PNB is the largest bancassurance partner of PNB MetLife and has been exclusively distributing the latter’s life insurance products since October 2011. In addition to PNB, the life insurance player counts Jammu and Kashmir Bank and Karnataka Bank among bancassurance partnerships. In total, these bank partnerships allowed PNB MetLife access to 11,239 branches as of 31 December 2017.

Read Also: Upcoming IPOs in 2018: A quick look at India’s IPO pipeline

Direct sales: As of 31 March 2018, its direct sales channel included 4,048 insurance managers in 92 cities. In addition, the company had 225 loyalty managers who focus on servicing existing policies and cross selling products to existing customers.

Agency: Life insurance business cannot be imagined without individual agents and PNB MetLife is no exception. It had 6,452 exclusive agents as of 31 March 2018 under agency sales channel.

PNB MetLife IPO: Cost reduction efforts

As mentioned above, the company has been focusing on lowering its cost structure in recent years. As part of these efforts, it has reduced the number of branches and has also brought down the number of administrative and management employees from 77 as of 31 March 2015 to 50 as of 31 March 2018. Similarly, the number of its sales managers has been brought down from 1,868 as of 31 March 2015 to 836 in the latest year.

These efforts, coupled with growth in business, have resulted in an improvement in operating expense ratio from 24.53% in FY2015 to 20.61% in FY2018. In the same time frame, its new business premium grew at a compounded annual rate of 19.85% while expenses increased by only 10.52%. As a result, its operating return on embedded value increased from 14% for the 12 month period ended 30 September 2017 to 16.1% for FY2018.

PNB MetLife IPO: Financial performance

Like its listed peers, PNB MetLife has also posted strong sales growth in recent years, primarily due to the underpenetrated market and the resulting huge upside. In 2016, India’s life insurance penetration was 2.7% which was not just less than the global life insurance industry’s penetration of 3.5% but also less than life insurance penetration in markets like Thailand, Singapore and South Korea.

As such, most private sector life insurance players are focusing on business growth and have been decently successful. PNB MetLife is no different and has managed to increase income from premium and other investments, while also plugging the leaks in its finances to bring down expenses.

|

PNB MetLife’s financial performance (in INR crore) |

||||||

| FY2014 | FY2015 | FY2016 | FY2017 | FY2018 | ||

| Premium and other income | 3,377.8 | 4,383.9 | 3,049.1 | 4,745.9 | 5,278.6 | |

| Profit after tax | 175.0 | 62.5 | 67.7 | 103.4 | 141.7 | |

| EPS (INR) | 0.87 | 0.31 | 0.34 | 0.51 | 0.70 | |

HDFC IPO statistics now