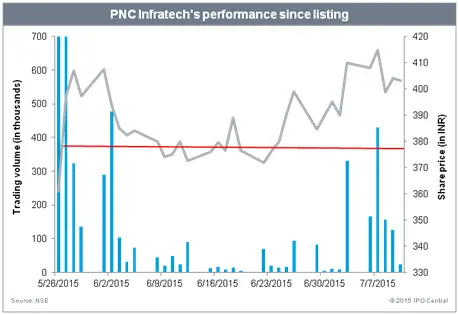

Shares of Agra-based PNC Infratech listed last month on a weak note following the initial public offering (IPO) which saw a subscription of 1.4 times. Following the tepid debut, the stock withstood the hectic trading activity in the subsequent days and even recovered above the allotment price of INR378 per share. By the end of the first week, the stock was up 4.5%, closing at INR394.85 per share. This advantage trimmed to just 0.65% by the end of fourth week as stock price tanked to INR 380.45 per share.

Read Also: PNC Infratech fails to maintain gains, slips after listing high

However, the stock has rewarded patient investors who held the shares through 45 days. We believe 45 days is a reasonable timeframe for the selling pressure to subside and for the market to discover the true value of an enterprise. Initial couple of days following the listing is usually marked with intensive selling by investors which got in with a view of listing gains. In the event of poor listing, such investors have one more reason to dump the shares. While this explains exceptionally high trading volumes in days right after listing, there are subsequent spikes in trading volumes as more investors classes seek a way out. Anchor investors including domestic mutual funds have a lock-in period of 30 days and thus, stock prices tend to be hammered by excessive supply right after this lock-in is lifted.

PNC Infratech’s shares did well towards the end of our 45-day window, although it slipped below the allotment price in the intermediate period. The IPO itself did not generate great amount of curiosity among retail investors. The company raised INR488 crore by offering 1.29 crore shares to investors through the IPO. Although the company roped in several mutual funds as anchor investors, the IPO saw a muted response from high networth individuals (HNI) and retail categories with subscription of 0.65 times and 0.28 times respectively. While the IPO received oversubscription of 1.56 times, the figure is misleading as the issue was salvaged by institutional buyers. The issue saw a subscription of just 0.28 times in the retail category while subscription in the Non Institutional Investors (aka HNI) portion was limited to just 0.65 times. This under subscription from the key categories earned the IPO a red flag from IPO Central. One of the issues keeping investors at bay was the highly leveraged balance sheet of the company.