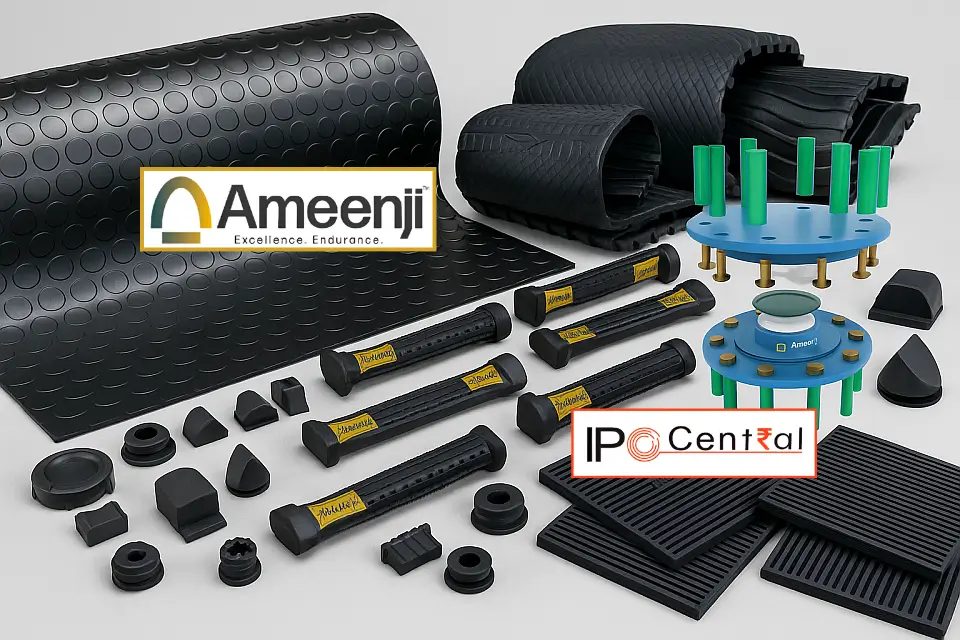

Ameenji Rubber IPO Description – Established in 2006, Ameenji Rubber is a leading Indian manufacturer, supplier, and exporter of rubber-based solutions for the railways, infrastructure, construction, and commercial sectors. Operating from a state-of-the-art facility in Hyderabad, Telangana, spanning 9,993 sq. meters, the company offers a comprehensive product portfolio that includes Elastomeric Bridge Bearings, POT-PTFE Bearings, Spherical Bearings, Expansion Joints, UIC Rubber Vestibules, Composite Grooved Rubber Sole Plates (CGRSP), rubber sheets, mats, and various commercial rubber components.

Ameenji holds critical approvals from the Ministry of Road Transport and Highways (MoRTH), the Ministry of Railways, RDSO, and the DFCC for key infrastructure products, ensuring its participation in major national projects.

Exports began in 2020, with international markets including Saudi Arabia, Tanzania, Malawi, Iraq, Nepal, and Poland. Export revenues reached INR 5.08 crore for the half-year ending 30 September 2024. With domestic sales contributing over 87% of total revenue and a growing export footprint—now supported by a U.S.-based subsidiary—Ameenji continues to strengthen its diversified and quality-driven growth strategy.

Promoters of Ameenji Rubber – Mufaddal Najmuddin Deesawala, Sakina Mufaddal Deesawala, Fatema Mufaddal Deesawala, and Zahra Mufaddal Deesawala

Table of Contents

Ameenji Rubber IPO Details

| Ameenji Rubber IPO Dates | 26 – 30 September 2025 |

| Ameenji Rubber Issue Price | INR 95 – 100 per share |

| Fresh issue | 30,00,000 shares (INR 28.50 – 30.00 crore) |

| Offer For Sale | NIL |

| Total IPO size | 30,00,000 shares (INR 28.50 – 30.00 crore) |

| Minimum bid | 2,400 shares (INR 2,40,000) |

| Lot Size | 1,200 shares (INR 1,20,000) |

| Face Value | INR 10 per share |

| Individual Allocation | 35% |

| Listing On | BSE SME |

Ameenji Rubber Financial Performance

| FY 2023* | FY 2024* | FY 2025 | |

| Revenue | 74.08 | 83.34 | 94.05 |

| Expenses | 70.05 | 77.30 | 83.69 |

| Net income | 3.50 | 4.31 | 8.03 |

* All Standalone Data

Ameenji Rubber Offer News

- Ameenji Rubber RHP

- Ameenji Rubber Draft Prospectus

- ASBA IPO Forms

- Live IPO Subscription Status

- Highest SME IPO Subscription in 2025

Ameenji Rubber Valuations & Margins

| FY 2023 | FY 2024 | FY 2025 | |

| EPS | 4.23 | 5.20 | 9.70 |

| PE ratio | – | – | 9.79 – 10.31 |

| RONW (%) | 35.57 | 30.44 | 36.22 |

| NAV | 11.89 | 17.09 | 26.79 |

| ROCE (%) | 23.50 | 22.68 | 23.43 |

| EBITDA (%) | 11.42 | 14.57 | 19.76 |

| Debt/Equity | 2.18 | 2.47 | 2.07 |

Ameenji Rubber IPO GMP Today

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| Coming soon | – | – | – |

Ameenji Rubber IPO Subscription – Live Updates

| Category | QIB | NII | Individual | Total |

|---|---|---|---|---|

| Shares Offered | 5,68,800 | 4,27,200 | 9,98,400 | 19,94,400 |

| 30 Sep 2025 | 3.79 | 3.10 | 1.08 | 2.29 |

| 29 Sep 2025 | 2.00 | 1.27 | 0.17 | 0.93 |

| 26 Sep 2025 | 1.84 | 0.93 | 0.04 | 0.74 |

The market maker reservation portion of 1,53,600 shares and the anchor investor portion of 8,52,000 shares are not included in the above calculations.

Ameenji Rubber IPO Allotment Status

Ameenji Rubber IPO allotment status is now available on Bigshare Services’ website. Click on this link to get allotment status.

Ameenji Rubber IPO Dates & Listing Performance

| IPO Opening Date | 26 September 2025 |

| IPO Closing Date | 30 September 2025 |

| Finalization of Basis of Allotment | 1 October 2025 |

| Initiation of refunds | 3 October 2025 |

| Transfer of shares to demat accounts | 3 October 2025 |

| IPO Listing Date | 6 October 2025 |

| Opening Price on BSE SME | INR 101 per share (up 1.0%) |

| Closing Price on BSE SME | INR 106.05 per share (up 6.05%) |

Ameenji Rubber Offer Lead Manager

HEM SECURITIES LIMITED

904, A Wing, Naman Midtown,

Senapati Bapat Marg, Elphinstone Road,

Lower Parel, Mumbai-400013, Maharashtra, India

Phone: +91- 22- 49060000

Email: [email protected]

Website: www.hemsecurities.com

Ameenji Rubber Offer Registrar

BIGSHARE SERVICES PRIVATE LIMITED

S6-2, 6th Pinnacle Business Park,

Mahakali Caves Road, next to Ahura Centre,

Andheri East, Mumbai- 400093, Maharashtra

Phone: +91 22 6263 8200

Email: [email protected]

Website: www.bigshareonline.com

Ameenji Rubber Contact Details

AMEENJI RUBBER LIMITED

5-5-65/1/A, F-14, S.A. Trade Centre First Floor,

Ranigunji, Secunderabad, Telangana, India, 500003

Phone: +91-040-40044006

E-mail: [email protected]

Website: www.ameenji.com

IPO FAQs

What is the Ameenji Rubber IPO size?

Ameenji Rubber offer size is INR 28.50 – 30.00 crores.

What is the Ameenji Rubber offer price band?

Ameenji Rubber public offer price is INR 95 – 100 per share.

What is the lot size of the Ameenji Rubber Offer?

Ameenji Rubber offer lot size is 1,200 shares.

What is Ameenji Rubber IPO GMP today?

Ameenji Rubber IPO GMP today is INR NA per share.

What is theAmeenji Rubber kostak rate today?

Ameenji Rubber kostak rate today is INR NA per application.

What is Ameenji Rubber IPO Subject to Sauda rate today?

Ameenji Rubber Subject to Sauda rate today is INR NA per application.