HDB Financial Services, a wholly owned subsidiary of HDFC Bank, is a major player in India’s retail lending space. With a customer base of over 1.92 crore, an AUM of INR 1.07 lakh crore, and a strong presence across Tier II/III towns, HDB is now stepping into the public markets with an INR 12,500 crore IPO.

But what truly sets this IPO apart is a valuation anomaly that savvy investors have started noticing — one backed not by speculation, but by a USD 2 billion real-world offer from Japan’s MUFG in 2024.

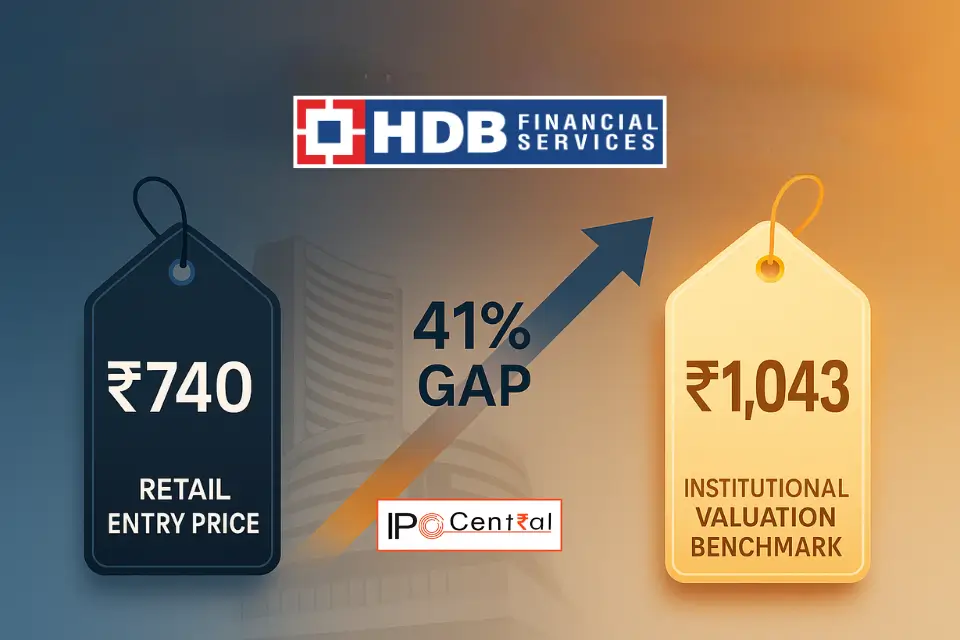

🧩 MUFG’s INR 86,000 Cr Offer vs IPO Pricing — The 41% Gap

In mid-2024, MUFG (Mitsubishi UFJ Financial Group) was in talks to acquire a 19% stake in HDB Financial. The offer, valued at USD 2 billion (INR 16,600 crore), implied a total company valuation of nearly INR 83,000 crore, or about INR 1,043 per share.

HDFC Bank declined the offer, choosing instead to comply with RBI’s October 2024 directive by going public. The outcome?

At MUFG’s implied valuation of INR 1,043 per share, HDB was worth INR 83,000 crore.

The IPO was priced at INR 740 per share, or an INR 61,300 crore valuation, creating an upside window of 41%.

For investors, this opens a rare opportunity: a chance to enter at a level that global institutions were willing to pay a premium for.

Read Also: HDB Financial Unlisted Share Buyers Get Rude Shock: Trapped and Down 40%

📌 HDB Financial IPO Snapshot

- IPO Price Band: INR 700 – 740

- Issue Size: INR 12,500 crore (INR 10,000 Cr OFS + INR 2,500 Cr fresh issue)

- Lot Size: 20 shares (INR 14,800 minimum investment)

- Retail Allocation: 35%

- IPO Dates: 25 – 27 June 2025

- Listing Date: 2 July 2025 (NSE & BSE)

📈 Strong Fundamentals Support the Narrative

HDB Financial has reported a CAGR of 23.7% in AUM over the last two years, with a diversified loan book:

- Enterprise Lending (39.3%)

- Asset Finance (38%)

- Consumer Finance (22.6%)

Over 71% of its loans are secured, and it maintains a GNPA of 2.26%. The company’s FY25 net profit stands at INR 2,176 crore, with RoE of 14.7% and RoA of 2.2% — solid for an NBFC in today’s environment.

Its AAA-stable credit rating, 1,771 branches, and fully digital collections infrastructure (95%+ digital) further reinforce its operational strength.

Read Also: HDB Financial Business Model Analysis: Potential to Double in 4 Years!

💬 What Top Brokerages Are Saying

Brokerage coverage has been largely positive, with a clear consensus to subscribe, especially for long-term investors. Here’s a breakdown:

SBI Securities has called the IPO a “Subscribe,” citing HDB’s granular loan book, stable return ratios, and strong parentage. They highlight the company’s rural reach and reasonable pricing as key positives that align well with retail credit growth trends in India.

Canara Bank Securities also gives a “Subscribe” rating, pointing to HDB’s secured loan dominance and prudent loan mix. They believe the IPO pricing offers a comfortable entry compared to listed NBFCs like L&T Finance, especially given the MUFG benchmark.

BP Wealth is bullish, highlighting that the IPO gives public investors access to a company that global institutions valued far higher just months ago. Their “Subscribe” recommendation rests on valuation comfort and solid long-term growth potential.

Capital Market adopts a “Subscribe for long-term” stance. They caution against expecting flashy listing gains but underline HDB’s operational strength, digital infrastructure, and regulatory clarity as long-term drivers.

Aditya Birla Money sees the IPO as a well-priced offer, especially given the company’s business resilience. Their “Subscribe” call is based on the rural expansion story and HDB’s balanced exposure to consumer and business credit.

Jainam Broking gives a “Subscribe for long-term” rating, focusing on the company’s presence in underbanked markets and digital collections network. They believe the capital raised will improve future profitability and compliance metrics.

Mehta Equities finds the offer attractive relative to its fundamentals and peer group. With a RoE of 14.7% and a disciplined lending model, their “Subscribe for long-term” call reflects confidence in HDB’s ability to scale sustainably.

Nirmal Bang joins the chorus, recommending “Subscribe for long-term.” They argue that the valuation already factors in short-term headwinds and that any post-listing rerating could bring the stock closer to MUFG’s valuation zone.

Anchor Book Backing: Adds Credibility to HDB Financial IPO

HDB Financial Services raised INR 3,369 crore through its anchor book, attracting participation from 141 institutional investors. LIC emerged as the largest anchor with an investment of INR 220 crore, accounting for 6.53% of the anchor allocation—a rare move for a private sector IPO. Other key participants included BlackRock, Goldman Sachs, Government Pension Fund Global, Baillie Gifford, and Abu Dhabi Investment Authority. Notably, 22 domestic mutual funds invested via 65 schemes, receiving 1.93 crore shares or 42% of the anchor allocation. The strong institutional response reinforces market confidence ahead of the public issue.

Final Word

In a market crowded with richly valued IPOs, HDB Financial stands out not just for its strategic logic and reasonable pricing, but also for the rare institutional stamp of approval it has received, with INR 3,369 crore raised from marquee anchor investors.

LIC’s INR 220 crore commitment, alongside global giants like BlackRock and ADIA, signals deep confidence in HDB’s fundamentals.

The MUFG offer set the valuation benchmark. The IPO delivers a meaningful discount. And now, with robust anchor interest, the market gets a rare window backed by conviction capital, not just sentiment.

For more details related to IPO GMP, SEBI IPO Approval, and Live Subscription stay tuned to IPO Central.