Urban Company, India’s largest tech-enabled home services marketplace, is preparing for its listing on 17 September 2025. While the fundamentals—profitability, revenue growth, and market leadership—have attracted investors, it is the grey market premium (GMP) that has stolen the limelight. Retail investors are asking: will the IPO deliver double the money on listing? Let’s analyze the data and sentiment in detail.

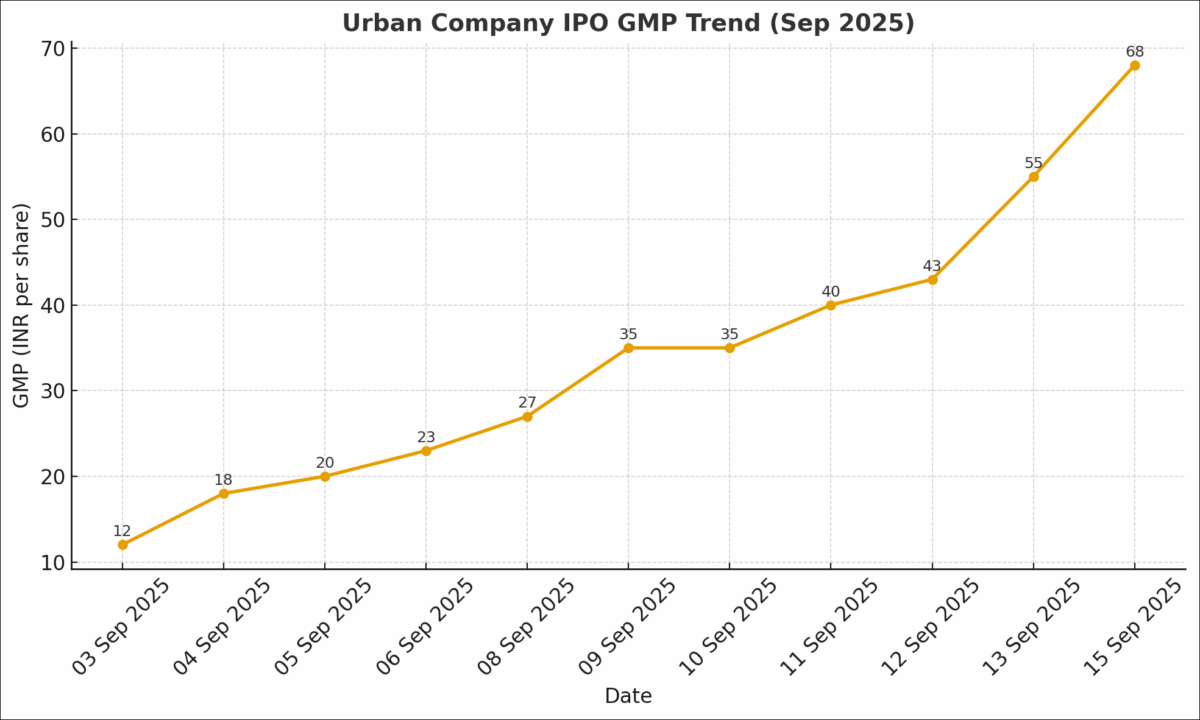

Urban Company GMP Daily Trend – From INR 12 to INR 68

Urban Company’s GMP has witnessed a dramatic rally over the past two weeks. When grey market activity began on 03 September 2025, the premium was just INR 12 per share. Since then, it has surged consistently:

- 03 September 2025: INR 12

- 04 September 2025: INR 18

- 05 September 2025: INR 20

- 06 September 2025: INR 23

- 08 September 2025: INR 27

- 09 September 2025: INR 35

- 10 September 2025: INR 35

- 11 September 2025: INR 40

- 12 September 2025: INR 43

- 13 September 2025: INR 55

- 15 September 2025: INR 68

The Subject to Sauda rate (a proxy for application-level trading sentiment) also climbed from INR 1,100 per application on 03 September 2025 to INR 7,500 by 15 September 2025. Such a surge signals rising bullishness among grey market operators and investors.

What Does the GMP Indicate?

The IPO price band is INR 98–103 per share, with a lot size of 145 shares (minimum investment of INR 14,935). At the upper end of INR 103, the GMP of INR 68 implies an unofficial listing price of INR 171.

For retail investors allotted one lot, the math looks like this:

- Investment: INR 14,935

- Expected value on listing: INR 24,795

- Profit: INR 9,860

This equals a 66% notional gain. While not a three-digit gain, it is still among the best listing prospects in recent IPOs. If sentiment continues and the stock lists near INR 200, returns could indeed approach 100%. Even if the grey premiums don’t increase further, listing at INR 171 per share will put Urban Company ahead of Aditya Infotech which delivered 60.7% on listing day. The best IPO this year has been Highway Infrastructure with debut day profits of 72.5%.

Subscription Frenzy – Record-Breaking Demand

The subscription data during the 10–12 September 2025 IPO window shows why GMP has been on fire:

- QIBs: 140.20x

- NIIs (HNI): 74.04x

- Retail: 39.25x

- Employees: 36.79x

- Overall: 103.63x

With only 10.67 crore shares offered (excluding the 8.29 crore anchor shares), demand massively outstripped supply, fueling grey market momentum further.

The Financial Backdrop – From Losses to Profitability

Urban Company’s fundamentals add strength to the optimism:

- Revenue: INR 636.60 crore (FY23) → INR 1,144.47 crore (FY25)

- Net Income: Loss of INR 312.48 crore (FY23) → Profit of INR 239.77 crore (FY25)

- Net Margin: –49.09% (FY23) → +20.95% (FY25)

- EPS (post-issue): INR 1.56

- RONW: 13.35% in FY25

This turnaround has convinced investors that the company is entering the market from a position of strength.

Brokerage Recommendations – Positive but Cautious

Brokerage houses have largely endorsed the IPO:

- Subscribe: BP Wealth, Canara Bank Securities, Ventura, Arihant Capital, Marwadi Financial

- Subscribe for Long Term: SBI Securities, Capital Market, Jainam Broking

- Subscribe for Listing Gain: Samco Securities

- Subscribe with Risk: Mehta Equities

- Avoid: GEPL Capital

The IPO is priced at a P/E of 59–66x FY25 earnings and a P/S multiple of ~12.9x post-issue. While valuations are expensive, analysts argue the company’s leadership and profitability justify the premium.

Key Risks – Beyond the Hype

Despite the bullish GMP, risks remain:

- Fragile Margins: Net margin dipped to 1.89% in Q1 FY26 (Net Profit: INR 6.94 crore).

- International Drag: Overseas operations posted an adjusted EBITDA loss of INR 368 crore in FY25.

- Valuation Stretch: At ~10x Price-to-Sales, much of future growth is already factored in.

- Market Volatility: Broader market corrections could dampen listing-day euphoria.

Investor Takeaway – Momentum vs. Reality

For those allotted shares, the Urban Company IPO offers a potential 60–70% listing gain based on current GMP. Short-term traders may benefit significantly if momentum holds. However, the sustainability of such valuations post-listing is uncertain.

For long-term investors, the company’s diversified revenue streams—consumer services, B2B professional tools, IoT appliances under the “Native” brand, and InstaHelp—present a scalable, profitable growth story in an underpenetrated market.

Bottom line: The GMP rally signals strong listing gains, possibly even a near double if market momentum peaks. But prudent investors must balance excitement with caution, using the listing event as either a tactical profit-booking opportunity or a calculated entry into India’s evolving consumer-tech ecosystem.