Global brokerage powerhouse UBS has initiated coverage on Shaily Engineering Plastics with a firm ‘Buy’ rating and a target price of INR 4,000 per share — implying a potential 60% upside from its latest closing price of around INR 2,500. The brokerage argues that the market is undervaluing Shaily’s execution strength, technological edge, and multi-segment growth levers.

UBS’s valuation, pegged at 45x the FY27–FY28 average EPS, represents a premium over Shaily Engineering Plastics’ three-year average multiple of 28x, yet remains below its peak of 60x — indicating room for re-rating as growth visibility strengthens.

The GLP-1 Catalyst: A Billion-Dollar Opportunity

At the core of UBS’s bullish thesis lies Shaily Engineering Plastics’ strong positioning in the healthcare and drug-delivery device space, particularly with auto-injector and fixed-dose pen technologies — areas where the company holds patented capabilities.

The GLP-1 (semaglutide) patent — used in diabetes and obesity treatments — is set to expire in 2026 across major markets including India, Canada, and Brazil. UBS estimates these regions collectively represent a total addressable market of 55–60 crore units, translating into potential revenues of INR 8,000–8,500 crore by 2030.

Shaily Engineering Plastics has already partnered with 23–24 global pharmaceutical companies to supply devices for the upcoming generic GLP-1 launches. UBS projects that Shaily could capture a 50–60% market share in these markets due to high entry barriers, regulatory complexity, and customer lock-ins, as injector vendors are often written into regulatory filings, making supplier changes costly and time-consuming.

UBS forecasts an explosive 96% revenue CAGR for Shaily’s healthcare vertical between FY25 and FY28, with its contribution to total revenues expected to soar from 21% currently to 55%. Meanwhile, the segment’s EBITDA could expand at a 52–59% CAGR (base to high case) over FY25–FY30E.

Consumer and Industrial Segments: Steady Engines of Growth

While the healthcare division drives the next phase of growth, UBS notes that Shaily Engineering Plastics’ consumer and industrial segments remain critical pillars of stability. The company supplies precision-engineered plastic and metal components to IKEA, Gillette, P&G, GE Appliances, and Schaeffler, serving both domestic and export markets.

UBS expects 18–19% revenue CAGR in these verticals between FY25 and FY28, aided by better capacity utilisation, improving demand, and potential tariff benefits from an anticipated India–US trade agreement. Such trade deals could narrow the competitiveness gap between India and other emerging manufacturing destinations, further boosting Shaily’s export prospects.

Additionally, Shaily is reportedly onboarding a large global client in the consumer electronics and semiconductor space — a development UBS describes as a “hidden optionality” that could accelerate earnings beyond base assumptions.

Shaily Engineering Plastics: Financial Momentum

UBS expects Shaily Engineering Plastics’ earnings per share (EPS) to grow at a 75% CAGR between FY25 and FY28, supported by margin expansion and an improved sales mix tilted towards high-value healthcare products.

Under UBS’s base-case scenario, Shaily’s consolidated revenues could rise from INR 786.8 crore in FY25 to INR 2,258.1 crore in FY28, with EBITDA margins climbing into the low-to-mid 30% range. EPS is projected to jump from INR 20.23 in FY25 to INR 108.37 by FY28 — a fivefold surge in just three years.

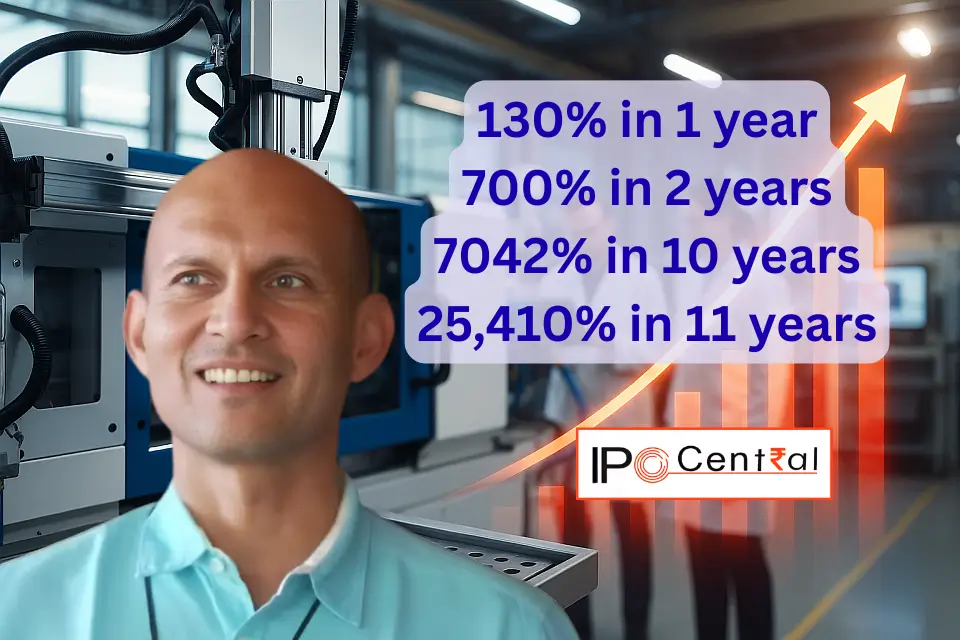

Market Performance: A Proven Multibagger

Shaily Engineering Plastics has already been a stellar wealth creator. The Ashish Kacholia-backed midcap has rallied over 130% in the past year and nearly 700% in the past two years, turning heads on Dalal Street.

Over the past decade, the stock has delivered an eye-popping 7,000%+ return, transforming from a small-cap industrial player into a global precision plastics powerhouse. As of September 2025, veteran investor Ashish Kacholia holds a 3.22% stake in the company, underlining his conviction in its long-term prospects.

Why UBS Thinks the Best Is Yet to Come

UBS believes the market is underestimating both the scale of the GLP-1 opportunity and Shaily Engineering Plastics’ operational readiness to capture it. The brokerage highlights:

- Patented technologies and stringent regulatory certifications (ISO 13485, ISO 15378, FDA 21 CFR 820 compliance) as critical entry barriers.

- A shift towards higher-margin healthcare revenue, which justifies valuation multiples above historical averages.

- Potential tariff cuts and capacity utilisation gains as catalysts for incremental upside.

- A robust order pipeline spanning healthcare, personal care, industrial, and electronics segments.

UBS also acknowledges key risks — including potential delays in generic semaglutide launches, regulatory hurdles, and execution challenges in scaling up capacity — but maintains that Shaily’s track record and client stickiness mitigate these concerns.

Bottom Line

With strong fundamentals, visible earnings momentum, and a rapidly expanding healthcare footprint, Shaily Engineering Plastics stands at the cusp of a transformative phase. UBS’s initiation reaffirms the Street’s confidence that the multibagger story is far from over — and if projections play out, the stock’s journey to INR 4,000 could be just the next milestone in a long growth runway.

For more details related to IPO GMP, SEBI IPO Approval, and Live Subscription stay tuned to IPO Central.