India’s IPO market is again turning busy with Aditya Birla Sun Life AMC IPO schedule to open on 29 September for subscription. The offer, priced in the range of INR695 – 712 per share, aims to mobilize as much as INR2,768.26 crore by selling 38,880,000 shares. All the shares will be offered by existing shareholders, valuing the firm at nearly INR20,505.6 crore at the upper end of the price band. Following the successful listings of HDFC AMC and Reliance Nippon AMC, investors will be surely looking positively to this IPO as well. This is also visible in the strong grey market premium the offer is commanding. Through Aditya Birla AMC IPO review, we try to find out if the company’s valuation leaves something on the table for investors.

Aditya Birla AMC IPO details

| Subscription Dates | 29 September – 1 October 2021 |

| Price Band | INR695 – 712 per share |

| Fresh issue | Nil |

| Offer For Sale | 38,880,000 shares (INR2,702.16 – 2,768.26 crore) |

| Total IPO size | 38,880,000 shares (INR2,702.16 – 2,768.26 crore) |

| Minimum bid (lot size) | 20 shares |

| Face Value | INR5 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Aditya Birla AMC IPO Review: No new shares, all OFS

There will be no fresh shares in the IPO and all the shares will be offered by the company’s promoters – Aditya Birla Capital and Sun Life (India) AMC Investments. Aditya Birla Capital currently holds 146,879,680 shares or 51% stake in the company while Sun Life owns 141,120,000 shares or 49%. Aditya Birla Capital plans to sell 2,850,880 shares while a larger chunk of 36,029,120 shares will be offloaded by its joint venture partner. Following the IPO, Aditya Birla Capital’s stake in the AMC will drop to 50.01% while Sun Life will pare its stake to 36.49%.

Average cost of acquisition of Aditya Birla Capital and Sun Life AMC is INR2.30 and INR2.77 per share, respectively which means that both will reap multifold returns. For Aditya Birla Capital, it translates to an impressive CAGR of 23.66%!

Read Also: Upcoming IPOs: A quick look at India’s IPO pipeline

Aditya Birla AMC IPO Review: Distribution, traditional and digital

The company is India’s largest non-bank affiliated AMC by QAAUM (Quarterly Average Assets Under Management). As of 30 June 2021, it managed total AUM of INR2,936.42 billion under mutual funds, portfolio management services, offshore and real estate offerings.

Aditya Birla Sun Life AMC’s distribution presence covers 284 locations spread over 27 states and six union territories. The network included over 66,000 KYD-compliant MFDs (Mutual Fund Distributors), over 240 national distributors and over 100 banks/financial intermediaries, as of 30 June 2021.

In addition, Aditya Birla AMC has a solid digital presence. In FY2021, digital transactions contributed 85% to the overall transactions. Similarly, the number of investors that were added through digital channels increased from 63.7% in FY2020 to 81% in FY2021.

The company managed 118 schemes comprising 37 equity schemes, 68 debt schemes, two liquid schemes, five ETFs and six domestic FoFs, as of 30 June 2021. Its flagship schemes include Aditya Birla Sun Life Frontline Equity Fund and Aditya Birla Sun Life Corporate Bond Fund.

In addition, the company provides portfolio management services, offshore and real estate offerings and managed total AUM of INR115.15 billion as part of such services.

Read Also: 5 tips to increase IPO allotment chances

Aditya Birla AMC IPO Review: Financial strength

In recent years, the company has focused on improving its equity-oriented scheme mix in order to enhance profitability as equity-oriented schemes generally generate higher management fees compared to other schemes. As a result, its equity-oriented MAAUM grew at a CAGR of 24.94% from INR323.45 billion in FY2016 to INR984.80 billion in FY2021, and further to INR1,080.44 billion as of 30 June 2021. This in turn boosted its share of equity-oriented MAAUM in total MAAUM from 23.66% in FY2016 to 38.09% as of 30 June 2021.

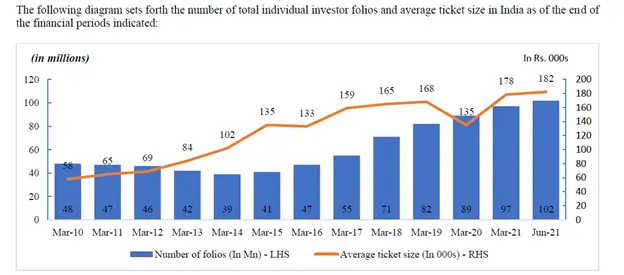

It also achieved substantial growth in individual investor MAAUM and customer base, comprising retail and HNI investors. Its individual investor MAAUM grew at a CAGR of 18.38% from INR546.13 billion in FY2016 to INR1,269.82 billion in FY2021. Similarly, the number of total investor folios (including domestic FoFs) more than doubled from 2.93 million in FY2016 to 7.07 in FY2021. This represents a CAGR of 19.3%, which is greater than the industry increase of 15.5% over the same period.

Aditya Birla AMC’s Financial Performance (in INR crore)

| FY2018 | FY2019 | FY2020 | FY2021 | Q1 FY2022 | |

| Revenue | 1,323.7 | 1,407.2 | 1,234.8 | 1,205.8 | 336.2 |

| Expenses | 802.2 | 761.5 | 574.0 | 510.0 | 130.4 |

| Net income | 349.1 | 447.9 | 494.2 | 527.7 | 156.4 |

| Margin (%) | 26.4 | 31.8 | 40.0 | 42.4 | 46.5 |

The results of increased focus on equity products are clearly visible in the company’s financial performance as well. Even though its topline has remained rangebound in the recent years, the company managed to increase its profits as a result of higher contribution from high-margin products.

Aditya Birla AMC IPO Review: Should you invest?

We have mentioned time and again (read our previous analysis here and here) that asset management industry has a superb base to expand upon and is already receiving several tailwinds. Here is one such graph from the RHP which tells how the industry has grown in recent years despite dynamic market conditions.

Let’s understand this well, these tailwinds are not ending anytime soon. This is going to be a multiyear bull run in asset management business. And given that the industry is likely to grow at a secular rate, all parties will gain immensely.

The bottom-line here is that it is foolish to think short term in such a booming industry.

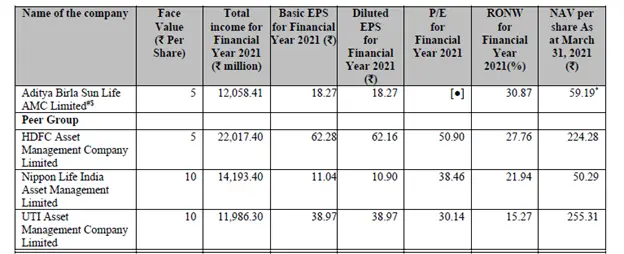

It is not to suggest that we should totally neglect fundamentals. Without a doubt, fundamental aspects remain as important as ever and thankfully, Aditya Birla AMC IPO checks most of the tick boxes. The company has kept its pricing in line with its peers. The pricing is actually at a lower point when its superior RONW profile compared to Nippon Life AMC. UTI AMC is available at a lower PE ratio but it should be noted that it has a higher debt mutual fund contribution which directly impacts RONW.

The company also pays dividend regularly but it should be the last reason to apply to the IPO. What Aditya Birla AMC IPO review tells us is the story of a well-placed player in a sunrise industry. Apart from the jockey, it is also a bet on the entire race track! Grey market price movements indicate there is strong interest in the IPO which means the issue will be likely subscribed many times.