Last Updated on January 23, 2025 by Rajat Bhati

ArisInfra Solutions, a key player in the infrastructure sector, has just made a significant move by securing a pre-IPO placement deal worth INR 80 crore. ArisInfra Pre-IPO funding underscores the company’s ambition to expand and solidify its market presence ahead of its public offering. The ArisInfra IPO, with a size of INR 600 crore is entirely a fresh issue.

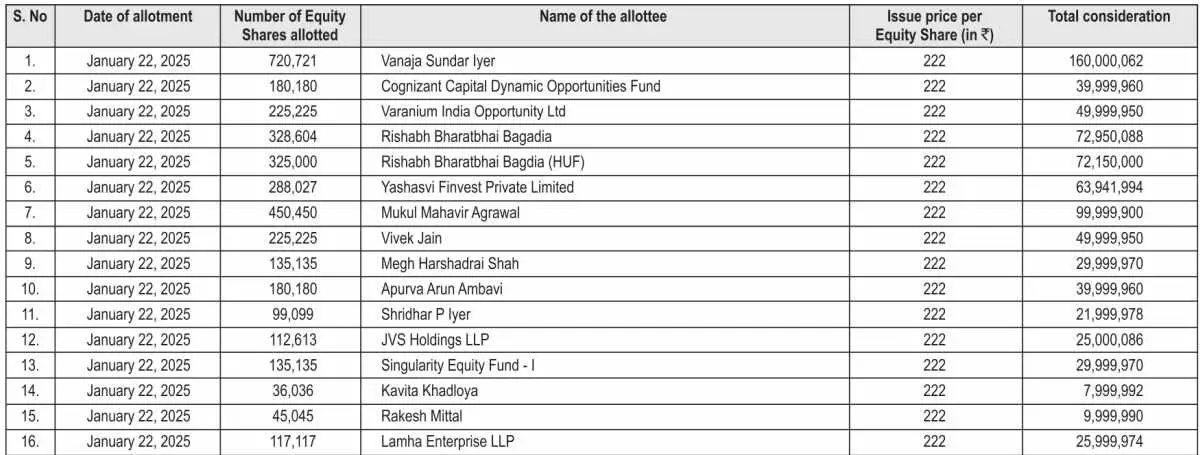

ArisInfra Pre-IPO Placement – Details

On 17 January 2025, the Board of Directors and shareholders of ArisInfra gave the green light to this pre-IPO placement. Working closely with Book Running Lead Managers, the company has managed to raise INR 80 crore by selling 36,03,792 equity shares. Each share was priced at INR 222, with a premium of INR 220, which speaks volumes about their valuation strategy and future vision.

Objectives of Pre-IPO Placement

The funds raised through ArisInfra Pre-IPO Placement is expected to serve multiple strategic purposes, including:

- Strengthening the Financial Base: The infusion of INR 80 crore provides ArisInfra with a robust financial base to support its operational and growth-related initiatives.

- Project Expansion: This cash influx will speed up current and future infrastructure projects, allowing ArisInfra to tackle bigger, more ambitious projects.

- Market Credibility: By securing this amount at such a premium, ArisInfra is boosting its image as a credible, attractive investment in the eyes of potential IPO investors.

Timing of this placement just before going public is a clever strategy. It sets a valuation benchmark and, more importantly, builds investor confidence. When investors see a company securing funds at a high price, it’s a vote of confidence in ArisInfra Solutions’ stability and growth potential.

Market Reaction

The market seems to agree. There’s been a notable buzz around this placement, with investors showing keen interest. The premium pricing of INR 222 per share, while significant, reflects the optimism surrounding ArisInfra’s business model and what they’re poised to achieve in the infrastructure sector.

Looking Ahead

ArisInfra pre-IPO placement fortifies its financial standing and sets a positive tone for its upcoming IPO. As the company gear up for the public offering, this placement underscores its strategic foresight and market credibility, promising a bright future for both the company and its investors.

As of 23 January 2025, the primary market has witnessed five listings in 2025, collectively raising INR 1,857 crore. These listings have delivered an average return of 31.80% upon listing. The best-performing IPO to date is Quadrant Future Tek, which has achieved an impressive return of 53.10%. For more details related to IPO GMP, SEBI IPO Approval, and Live Subscription stay tuned to IPO Central.