Last Updated on August 14, 2022 by Team IPOCentral

Balaji Speciality Chemicals – a subsidiary of Balaji Amines – has submitted its Draft Red Herring Prospectus (DRHP) with the markets regulator, Securities and Exchange Board of India (SEBI), to raise funds through an initial public offering (IPO). The upcoming Balaji Speciality Chemicals IPO consists of a fresh issue of INR250 crore and an Offer For Sale (OFS) of up to 26,000,000 shares by the Promoter and selling shareholders.

Balaji Speciality Chemicals IPO – Use of Funds

The company’s utilization of funds raised via fresh issue would be used to repay INR68 crore of its certain outstanding borrowings and use INR119.5 crore to fund its working capital requirements besides general corporate purposes. The company may consider a pre- ipo placement aggregating to INR50 crore.

Balaji Speciality Chemicals IPO – Focus on Niche Chemicals

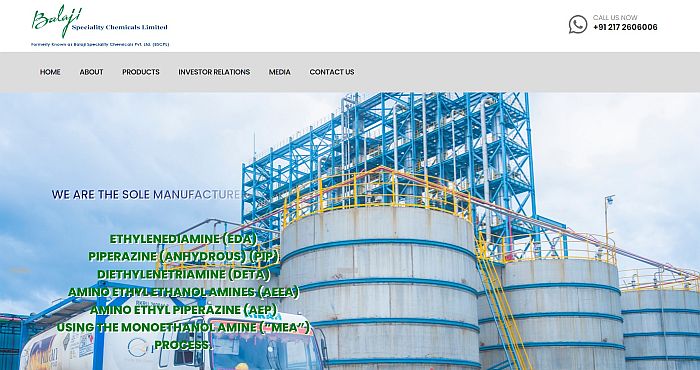

Like its parent Balaji Amines which operates in an oligopolistic market, Balaji Speciality Chemicals is all about niche chemicals. It is the sole manufacturer of niche chemicals such as Ethylene Diamine (EDA), Piperazine Anhydrous (PIP), Diethylenetriamine (DETA), Aminoethyl ethanolamine (AEEA) and Aminoethyl Piperazine (AEP), using the Monoethanol Amine (MEA) process. These chemicals are an import substitute and are used in various end-use industries such as speciality chemicals, agrochemicals, and pharmaceuticals.

Despite this long list of products, EDA and PIP account for 85.17% of its revenues. Both are expected to grow at a CAGR of 8.3% and 8.6% respectively in the Indian markets. In FY2022, India imported 31.8 KT of Ethylenediamine, 1.1 KT of Piperazine, 4.4 KT of Diethylenetriamine, 0.2 KT of Amino Ethyl Ethanol Amines and 0.3 KT of Amino Ethyl Piperazine.

EDA is primarily produced by two major routes – the Ethylene DiChloride (EDC) process and the MEA process. The MEA process has an inherent advantage by absence of hazardous waste chloride byproducts.

Impressive and Increasing customer base

Balaji Speciality Chemicals counts Aarti Drugs Limited, Dr. Reddy’s Laboratories Limited, Nanjing Union Chemical Company Limited, Korea India Limited, and UPL Limited among its key customers. From FY2020 to FY2022, its customer base grew from 45 to 182 customers. This list can be expected to increase further as Balaji Specialty expands its product basket and introduces new products such as Ethylene Diamine Tetra Acetic Acid (EDTA).

The company initiated commercial production in June 2019 from its manufacturing plant in Solapur, Maharashtra, and has since scaled up operations. It has increased its production volume from 4,428.39 MT in FY2020 to 16,851.72 MT in FY2022. As of 31 March 2022, the company had a total installed production capacity of 30,000 MTPA.

Balaji Speciality Chemicals IPO – Fastest-growing Speciality Chemicals Companies

One reason why Balaji Speciality Chemicals IPO should be on your radar is the strong delivery on key performance metrices. Its revenue from operations increased at a CAGR of 208.95% from INR 53.9 crore in FY2020 to INR514.3 crore in FY 2022. This was primarily due to the increase in sale of EDA. In terms of bottom-line too, it swung from a loss of INR15.9 crore in FY2020 to INR108.9 crore in FY2022.

Balaji Speciality Chemicals Financial Performance

| FY2020 | FY2021 | FY2022 | |

| Revenue | 53.9 | 174.4 | 514.3 |

| Expenses | 76.5 | 160.6 | 362.0 |

| Net income | (15.9) | 10.4 | 108.9 |

| Margin (%) | (29.5) | 6.0 | 21.2 |

It is evident that the company has posted robust performance in recent years and this is not limited to financial performance. Exports is another area where the company has delivered exceptional growth and the share of export sales jumped from just 2.15% in FY2020 to 24.16% in FY2022.

A major tailwind behind this performance has been stringent environmental norms in China and the resulting China+1 strategy. As a result, India’s specialty chemical industry is expected to post a 10% to 12% CAGR between 2021 and 2026.

Balaji Amines has delivered great returns to its investors and thus it is natural that investors have high hopes from Balaji Speciality Chemicals IPO. It also helps that specialty chemicals player IPOs like Laxmi Organics and Neogen Chemicals have delivered strong gains.

Being a subsidiary of Balaji Amines, there is a shareholder quota in Balaji Speciality Chemicals IPO. As a reminder, purchasing just one share of Balaji Amines before the record date will increase the investors’ IPO allotment chances.