Elec Steel Processing Industries, a major player in transformer component manufacturing, has filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) for an IPO.

Elec Steel IPO consists of fresh equity of up to 60 lakh shares and an Offer for Sale of up to 9 lakh shares, aggregating up to 69 lakh shares. The equity shares are proposed to be listed on the NSE Emerge platform. Unistone Capital is the Book Running Lead Manager, and KFin Technologies is the Registrar of the issue.

Elec Steel IPO – Promoters Selling Shareholders

The Offer for Sale includes shares offered by promoters Harshad Narbherambhai Bagadia and Parasbhai Harshadbhai Bagadia, who are selling 4,00,000 and 5,00,000 shares, respectively.

Elec Steel IPO – Company Overview

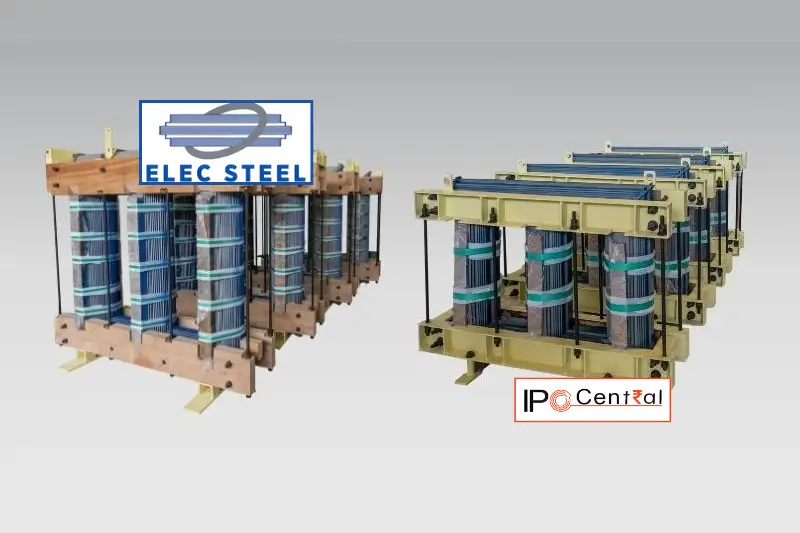

Headquartered in Por, Vadodara, Gujarat, Elec Steel Processing Industries manufactures electrical steel components like transformer laminations, toroidal cores, assembled cores and slit coils. These products, made from Cold Rolled Grain Oriented (CRGO) and Cold Rolled Non-Grain Oriented (CRNGO) steel, help in improving transformer efficiency and reducing energy losses.

The company operates on a B2B model and provides customized solutions to transformer manufacturers in domestic and international markets. The production setup includes advanced machinery like CNC cut-to-length lines, annealing furnaces, slitting machines, and quality testing equipment. As of 30 September 2024 and FY 2024, the company has utilized 77.42% and 54.30% of its installed capacity of 9,825 metric tons and 19,650 metric tons.

As of 30 September 2024, the company had 96 active clients, including 17 clients contributing revenues of INR 1 crore or more.

Elec Steel IPO – Financial Performance

Elec Steel has demonstrated a robust financial trajectory. For FY 2024, the company reported:

- Revenue from operations: INR 163.50 crore

- Profit after tax: INR 4.97 crore

- Operating EBITDA margin: 5.59%

- PAT margin: 3.04%

- ROE: 35.70%

- ROCE: 23.62%

The company has also improved its debt-to-equity ratio, which stood at 2.63 as of September 2024, compared to 3.63 in FY 2024.

Elec Steel IPO – Utilization of Net Proceeds

The net proceeds from the Fresh Issue are proposed to be used as follows:

- INR 32 crore for working capital requirements

- INR 14.13 crore for capital expenditure towards new machinery at Unit IV

- INR 14.38 crore for repayment or prepayment of borrowings

- The remaining funds will be used for general corporate purposes, subject to SEBI limits

Elec Steel IPO – Conclusion

Elec Steel Processing Industries’ DRHP filing signals its next phase of growth. With strong financials, experienced leadership, and a focus on transformer components, the company aims to expand capacity, reduce debt, and strengthen its market presence through the upcoming listing.

According to IPO Central’s data, 39 SME IPOs were listed from 1 January to 28 February 2025. Out of these 39, 13 SME IPOs landed in negative territory. The average listing returns stand at 18.60%. These SME IPOs cumulatively raised INR 1,827.94 crore from the market.

For more details related to IPO GMP, and Live Subscription stay tuned to IPO Central.