What is Green Hydrogen?

Green hydrogen refers to hydrogen produced through the electrolysis of water, using renewable energy sources such as wind and solar power. This process generates hydrogen and oxygen without releasing greenhouse gases, making it an environmentally friendly and sustainable fuel option. Green hydrogen stands in stark contrast to grey hydrogen, which is derived from fossil fuels and significantly contributes to carbon emissions. As a cleaner alternative, green hydrogen is central to global decarbonization efforts, and India is quickly positioning itself as a leader in this growing market. In this article, we take a look at Green Hydrogen Stocks in India and the overall wind and solar power in India.

Table of Contents

Overview of Green Hydrogen Industry in India

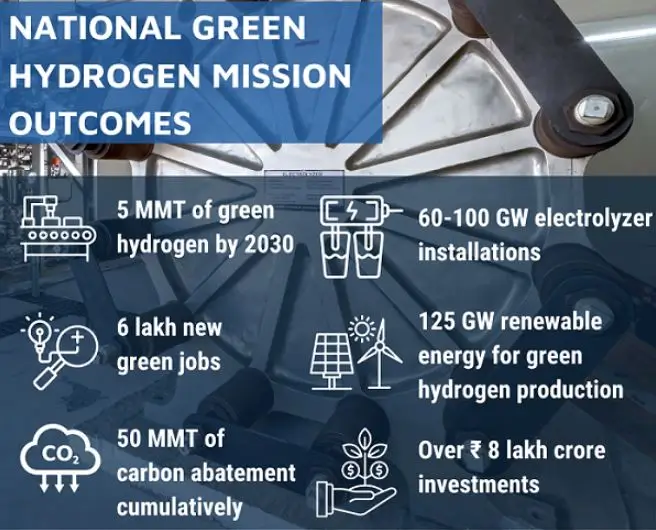

India is emerging as a key player in the global green hydrogen market, thanks to its ambitious National Green Hydrogen Mission, which was launched in January 2022. The mission aims to establish India as a green hydrogen production, consumption, and export hub. By 2030, India targets an annual production of 5 million metric tons (MMT) of green hydrogen, a milestone that will help achieve energy independence and support the nation’s commitment to reach net-zero emissions by 2070.

Market Potential

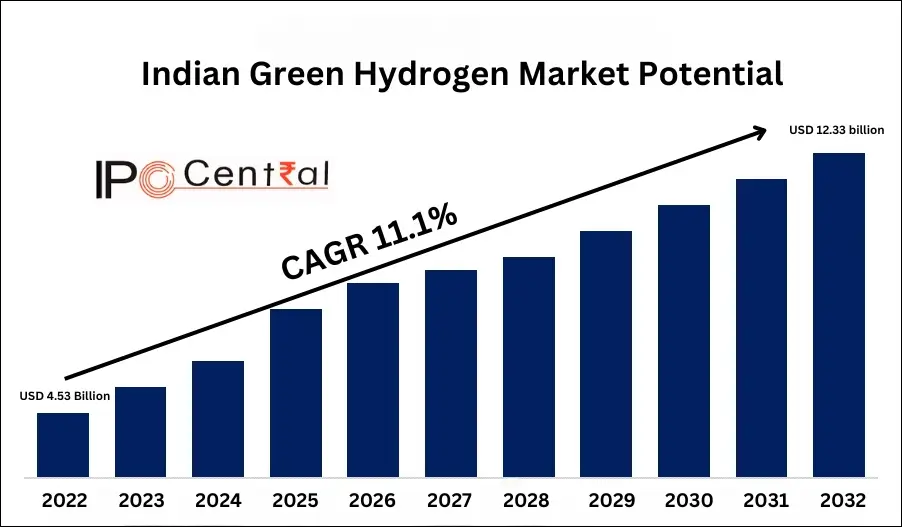

The green hydrogen market in India is projected to be valued at USD 8 billion by 2030, with an estimated growth of USD 340 billion by 2050. This growth is fueled by the National Green Hydrogen Mission, which aims to increase green hydrogen’s share to 46% of total hydrogen demand by 2030.

According to NITI Aayog, the electrolyzer market, which is essential for green hydrogen production, is forecasted to reach USD 5 billion by 2030 and expand further to USD 31 billion by 2050. These growth figures reflect a rising demand for green hydrogen in sectors such as transportation, steel production, and refineries, where the need for clean fuel is becoming more prominent.

Government Initiatives to Support Green Hydrogen

Several key government initiatives back India’s green hydrogen ambitions:

- National Green Hydrogen Mission 2023 – 2024: This flagship mission has allocated INR 19,744 crore (USD 2.4 billion) to promote green hydrogen production and reduce costs through financial incentives for electrolyzer manufacturing.

- Strategic Interventions for Green Hydrogen Transition (SIGHT): A dedicated program offering financial support for domestic manufacturing and pilot projects, aiming to scale up India’s capacity for green hydrogen production.

Top Green Hydrogen Stocks in India

The following companies are at the forefront of India’s green hydrogen revolution, each playing a pivotal role in the nation’s clean energy transition.

#1 NTPC Limited – A Leader in India’s Green Hydrogen Market

As a state-owned power giant, NTPC is spearheading a multi-GW green hydrogen project in Andhra Pradesh, with plans to produce 1,200 tonnes of green hydrogen per day. The project will be supported by an electrolyzer capacity of over 4 GW and a renewable energy capacity of at least 8 GW as of February 2024. NTPC’s strategic coastal locations also provide easy access to export facilities, aligning with India’s goal to achieve 500 GW of renewable energy capacity by 2030.

NTPC is also planning an initial public offering for its renewable energy subsidiary NTPC Green Energy to procure funds and lay out some strategy initiatives.

#2 Adani Green Energy – Among the Top Green Hydrogen Stocks in India

Adani Green Energy – a JV between India’s Adani Group and French TotalEnergies SE – is pioneering efforts in Ahmedabad to blend green hydrogen with natural gas, reducing emissions for approximately 4,000 domestic PNG consumers. The project is set for commissioning by Q1 FY24-25, with plans to increase green hydrogen in the blend to 8% or more, pending regulatory approvals. After the pilot, hydrogen-blended fuel will be rolled out to larger city areas and AGTL’s other license zones. An 8% hydrogen blend could reduce emissions by up to 4%.

The company has ambitious plans to produce 3 GW of green hydrogen by 2030, targeting a market share of 27% in the green hydrogen space. Adani’s focus on integrating wind and solar energy into green hydrogen production strengthens its position as a leader in sustainable energy solutions. The company’s revenue has grown at a rate of 41.46% over the last five years.

#3 SJVN Green Energy

SJVN Green Energy Limited (SGEL), a wholly-owned subsidiary of SJVN Limited, is making notable advancements in the green hydrogen sector. The company has set an ambitious goal of achieving 25,000 MW of installed renewable energy capacity by 2030 and 50,000 MW by 2040. SGEL is playing a key role in India’s green hydrogen landscape, particularly through its agreement to supply 4,500 MW of carbon-free energy to AM Green’s future green ammonia facilities, with the first phase delivering 1,500 MW within two years.

Additionally, SGEL launched India’s first Multi-purpose Green Hydrogen Pilot Project at its Nathpa Jhakri Hydro Power Station, producing hydrogen using a 20 Nm³/hour alkaline electrolyzer.

#4 JSW Energy

JSW Energy is a leading player in India’s power generation sector, with a diverse energy portfolio spanning thermal, hydro, wind, and solar power. As of FY 2024, the company has an installed capacity of 6,677 MW, including 3,158 MW from thermal, 1,391 MW from hydro, 1,461 MW from wind, and 667 MW from solar energy. Acknowledging the increasing significance of green hydrogen, JSW Energy is investing in a green hydrogen production facility with a planned capacity of 1 GW by 2025. This initiative supports its goal of reducing carbon emissions and promoting sustainability across its operations.

JSW Energy has created JSW Solar Limited, a subsidiary focused on renewable energy, including green hydrogen production. This move reinforces its commitment to green technologies and strengthens its position in the energy market, as the company supports India’s transition to a greener economy while ensuring a reliable energy supply.

#5 Indian Oil Corporation (IOCL)

Indian Oil Corporation (IOC) is making significant progress in the green hydrogen sector as part of its strategy for sustainable energy. The company plans to establish 1 GW of green hydrogen production capacity across its refineries, aiming for net-zero carbon emissions by 2046. IOC seeks to increase the share of green hydrogen in its hydrogen portfolio to 50% within the next 5-10 years and ultimately reach 100% by 2040. This transition will involve integrating green hydrogen into its refining processes, replacing carbon-emitting fuels used to convert crude oil into value-added products like petrol and diesel.

IOC’s plans involve developing a 7 kilotonnes per annum green hydrogen capacity at its Panipat refinery and launching a pilot project for hydrogen dispensing at its Gujarat facility. The company has also formed strategic partnerships with ReNew Power and Larsen & Toubro to enhance its green hydrogen initiatives. By establishing a dedicated subsidiary for green energy, IOC reinforces its commitment to leading India’s green hydrogen revolution and positions itself as a key player in the rapidly evolving energy landscape.

#6 Torrent Power

Torrent Power is investing INR 7,200 crore in a green hydrogen production facility with a capacity of 100 kilotonnes per annum. The company aims to expand its renewable energy portfolio to 10 GW by 2030, positioning green hydrogen as a key revenue stream. Torrent Power’s broader hydrogen initiative is expected to create 1,000 direct jobs, supporting India’s goal of 500 GW of renewable energy by the end of the decade.

#7 KPI Green Energy

KPI Green Energy is set to commission a 1 MW green hydrogen plant by April 2025, marking its entry into the green hydrogen and ammonia market. The company generates INR 14 – 15 crore in monthly revenue, with 17% of this derived from independent power production. As KPI Green Energy expands, it aims to participate in significant government tenders and extend its operations across India and beyond.

#8 Waaree Energies

Leveraging its experience in solar energy, Waaree Energies is building a 1 MW green hydrogen project in Maharashtra, set to be operational within 12 months. The company has also secured 300 MW of electrolyzer manufacturing capacity under India’s production-linked incentive (PLI) scheme. As Waaree expands its renewable energy portfolio, its role in green hydrogen production is expected to grow, aligning with India’s decarbonization objectives.

Waaree Energies’ upcoming IPO aims to raise up to INR 4,321 crore through a combination of a fresh issue of shares and an offer for sale (OFS). The OFS includes up to 48 lakh equity shares. The company’s shares will be listed on 28 October 2024.

#9 Acme Solar Holdings

Acme Solar Holdings‘ investments in green hydrogen projects include a major initiative in Oman that will produce 1,00,000 tons of green ammonia annually, with plans to expand this capacity significantly. The company is also developing a 5 GW solar power plant and a 1.5 GW electrolyzer facility in Tamil Nadu. Acme Solar’s investments underscore its commitment to scaling green hydrogen production both in India and internationally.

ACME Solar Holdings is also considering a pre-IPO placement of up to 5,222,079 shares to some investors. The company is looking to raise up to INR 500 crore through pre-IPO placement and a successful placement will mean a smaller size for ACME Solar IPO.

#10 WAA Solar

Although relatively new in the green hydrogen market, WAA Solar is diversifying its renewable energy portfolio with a focus on solar-driven hydrogen production. The company is keen on contributing to the National Green Hydrogen Mission, although specific production capacity figures are not yet available.

What is a Hydrogen Electrolyzer?

A hydrogen electrolyzer is an electrochemical device that uses electrical energy to split water (H₂O) into hydrogen (H₂) and oxygen (O₂) gases through a process called electrolysis. This technology plays a crucial role in the production of green hydrogen.

Manufacturers of Hydrogen Electrolyzer

India is rapidly developing its hydrogen electrolyzer manufacturing sector, driven by ambitious green hydrogen production goals. Key players include:

- HET Hydrogen: A subsidiary of Singapore’s Horizon Fuel Cell Group, HET plans to establish a gigafactory capable of producing 100 MW of electrolyzers annually by 2026, focusing on both Proton Exchange Membrane (PEM) and Anion Exchange Membrane (AEM) technologies.

- Ohmium International: This company has launched India’s first green hydrogen electrolyzer gigafactory in Bengaluru, with an initial capacity of 0.5 GW per year and plans to expand to 2 GW. Ohmium aims to provide comprehensive solutions for green hydrogen production.

- Avaada Group: Investing around INR 13,650 crore, Avaada is setting up a manufacturing facility in Nagpur that will produce electrolyzers and solar modules, targeting sectors like automotive and steel.

- L&T Electrolysers: Part of Larsen & Toubro, this company focuses on advanced alkaline electrolyzers at its Gujarat facility. This facility has featured a rated power capacity of 1 MW (expandable to 2 MW), this electrolyser can produce 200 Nm3/Hr of hydrogen. It is equipped with two stacks and an Electrolyser Processing Unit (EPU) ML-400, which offers the best thermal stability.

- Adani New Industries, Reliance Electrolyser Manufacturing, and Bharat Heavy Electricals are also significant players, participating in government initiatives to establish a total of 3.4 GW of electrolyzer manufacturing capacity annually.

Supported by the National Green Hydrogen Mission and various public-private partnerships, these manufacturers are positioning India as a key player in the global transition to sustainable energy solutions.

Conclusion

India’s green hydrogen market is at the cusp of significant growth, driven by ambitious government targets and substantial private sector investments. Leading companies like NTPC, Adani Green Energy, and IOCL are pioneering innovative projects that will play a vital role in reducing carbon emissions and transitioning to clean energy. With the global spotlight on climate change, investors should closely monitor the developments in this sector as India becomes a key player in the green hydrogen revolution.

The future of green hydrogen in India looks promising, with expanding opportunities for companies and investors alike to contribute to a more sustainable, low-carbon economy. In addition to the above mentioned stocks, there are several green hydrogen penny stocks in India.