Last Updated on March 15, 2018 by Krishna Bagra

Date 14th Mar; IPO Opens 15-19th Mar at Rs. 370-375

Large Cap: Rs. 44,780 cr. Mkt cap

Industry – Commercial Bank

Valuations: P/E 40.2 times TTM, P/B 4.9 times (Post IPO)

Advice: SUBSCRIBE

Summary

Overview: Bandhan is a commercial bank focused on serving underbanked and underpenetrated markets in India. Bandhan Bank has the largest microfinance loan portfolio, with Rs. 21,380 crores as of FY17. Bandhan bank has a great brand recall, strong financial performance, good asset quality and an experienced management. It is the new MFI loans leader. Presence in underbanked East and NE regions and universal bank structure are key strengths. At a P/B of 4.93 times (post IPO), the valuation look expensive. However Bandhan has a focus and a leadership position. It also operates in niche geographies.

Risks: 1) Economically and politically sensitive sector 2) Significant exposure to unsecured loans.

Opinion: Investors can SUBSCRIBE to this IPO with a 2 year perspective.

IPO highlights

The IPO opens: 15-19th Mar 2018 with the Price band: Rs. 370-375 per share.

Shares offered to public number 11.92 cr. The FV of each is Rs. 10 and market Lot is 40.

The IPO in total will collect Rs 4,473 cr. while selling 10% of equity.

The promoter & promoter group owns 89.6% in Bandhan which will fall to 82.2% post-IPO.

The offer will be both a sale by current shareholders (OFS) and also by issuing fresh shares. The OFS proceeds would be Rs. 810 cr. at UMP and fresh issue size is Rs. 3,662 cr.

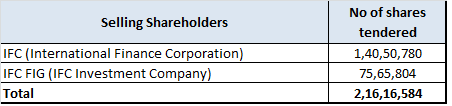

The selling shareholders are IFC and IFC Investment Co. They are partly exiting through this IPO. The IPO is being launched as Bandhan needs to comply with the RBI’s direction of listing publicly and reducing promoter holding to 40% within the first 3 years of operations.

Exhibit 1 – IPO Selling Shareholders

The IPO share quotas for QIB, NIB and retail are in ratio of 50:15:35.

The unofficial/ grey market premium for this IPO is Rs. 30-35/share. This is a positive.

For the detailed report, visit JainMatrix Investments webpage.

Disclaimer

This document has been prepared by JainMatrix Investments Bangalore (JM), and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of JM. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable. However, JM has not independently verified the accuracy or completeness of the same. JM has no stake ownership or known financial interests in Bandhan or any group company. Punit Jain intends to apply for this IPO in the Retail category. Neither JM nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend upon the recipient’s particular circumstances and, in case of doubt, advice should be sought from an Investment Advisor. Punit Jain is a registered Research Analyst under SEBI (Research Analysts) Regulations, 2014. JM has been publishing equity research reports since Nov 2012. Any questions should be directed to the director of JainMatrix Investments at [email protected].