After a four month pause, India’s IPO market is finally opening up with Rossari Biotech IPO which will open for subscription on 13 July 2020. The IPO was earlier scheduled to open on 18 March but was postponed as markets became too volatile amid the coronavirus pandemic. This is also only the second IPO this year after SBI Cards listed in March (Antony Waste Handling Cell IPO was withdrawn due to poor demand). As a result, Rossari Biotech IPO will be a litmus test for the market’s risk appetite. Through Rossari Biotech IPO review, we try to find out if is good enough to be in investors’ portfolio.

| Rossari Biotech IPO details | |

| Subscription Dates | 13 – 15 July 2020 |

| Price Band | INR423 – 425 per share |

| Fresh issue | INR50 crore |

| Offer For Sale | 10,500,000 shares (INR444.15 – 446.25 crore) |

| Total IPO size | INR494.15 – 496.25 crore |

| Minimum bid (lot size) | 35 shares |

| Face Value | INR2 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Rossari Biotech IPO Review: Offer objectives and capital structure

As one can see, the fresh component in the IPO is quite small at just INR50 crore. The company intends to use IPO proceeds for:

- Repayment/prepayment of certain indebtedness (including accrued interest)

- Funding working capital requirements

- General corporate purposes

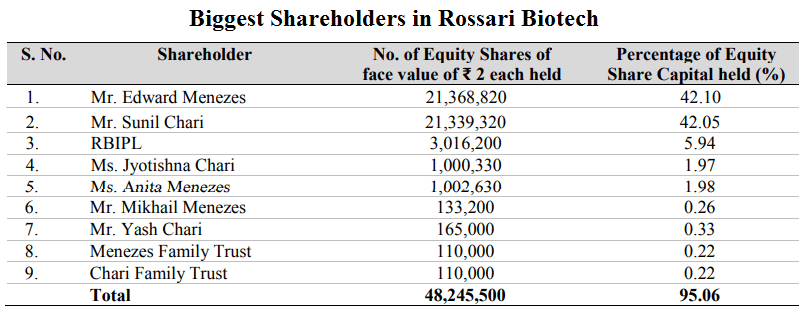

The bigger part is the Offer For Sale (OFS) and both promoters Edward Menezes and Sunil Chari plan to sell 5,250,000 shares each.

It is noteworthy that there are no external investors in the company and thus, both promoters will continue to own majority stake even after the IPO.

Read Also: Happiest Minds Technologies files prospectus for INR700 crore IPO

Rossari Biotech IPO Review: FMCG play

The company primarily manufactures specialty chemicals which are used in a variety of industries including FMCG, apparel, poultry and animal feed industries and has a range of 2,030 different products. The company claims to be the largest manufacturer of textile specialty chemicals in India.

Rossari Biotech operates in 18 countries including Vietnam, Bangladesh and Mauritius, besides India. It operates in three main product categories:

Home, personal care and performance chemicals – The company manufactures over 300 products for soaps and detergent, paints, inks and coatings, ceramics and tiles, water treatment chemicals and pulp and paper industries. The segment contributed 46.8% to its revenues in FY2020.

Textile specialty chemicals – Rossari makes specialty chemicals for the entire value-chain of the textile industry starting from fiber, yarn to fabric, wet processing and garment processing and boasts of 1,543 products in this product category. Revenue from sale of textile chemicals constituted 43.71% of its total revenue in FY2020.

Animal health and nutrition – With acquisition of Lozalo in 2019, the company diversified into animal health and nutrition and currently supplies poultry feed supplements and additives, pet grooming and pet treats including for weaning, infants and adult pets and currently manufactures over 100 products in this category. Revenues from this product line contributed 9.48% to topline in FY2020.

The company manufactures majority of its products at its manufacturing facility at Silvassa in the Union Territory of Dadra & Nagar Haveli which has installed capacity of 120,000 MTPA (Million Tonnes per Annum). The Silvassa plant has flexible manufacturing capabilities for powders, granules and liquids which means it can interchange capacities across home, personal care and performance chemicals; textile specialty chemicals; and animal health and nutrition products categories.

Read Also: EESL plans IPO, eyes INR5,000 crore valuation

Rossari Biotech IPO Analysis: Financial performance

Rossari Biotech’s financial performance (in INR crore)

| FY2017 | FY2018 | FY2019 | FY2020 | |

| Revenue | 260.6 | 300.4 | 517.1 | 603.8 |

| Expenses | 241.9 | 263.0 | 453.7 | 515.8 |

| Net income | 14.2 | 25.4 | 45.4 | 65.0 |

| Net margin (%) | 5.4 | 8.5 | 8.8 | 10.8 |

The company has done very well in the last few years with revenues doubling in the last three years. This has been fueled by stricter regulations in several markets including China. In this timeframe, the company has expanded its Home, personal care and performance chemicals business 5X and this has now become the biggest segment, overtaking the textile segment.

The rising topline has resulted in better capacity utilization which has improved from 74.2% in FY2018 to 82.5% in FY2020. Accordingly, margins have gone up too and have doubled since 2017. This is remarkable in manufacturing operations and points to operating leverage.

Read Also: Pre-IPO Shares: All you want to know

Rossari Biotech IPO Review: Subscribe or Avoid?

Rossari Biotech appears to have a well-diversified portfolio in three segments. While textile and animal health segments are somewhat mature in terms of growth, FMCG offers significant opportunities and the management has demonstrated the same as well in recent years. In short term, it stands to benefit from the expected revival in FMCG volumes as the country opens up post corona lockdown.

Meanwhile, another positive with the company is its strong balance sheet. Its debt equity ratio stood at a healthy 0.23 as of 31 March 2020. As the company embarks on capacity expansion through a new 132,500 MTPA manufacturing facility at Dahej in Gujarat, it stands to gain from increased export contribution to top line.

Despite robust growth in recent years, the management has done well by avoiding external funding or excessive debt to fund its operations. We also didn’t find instances of excessive remuneration to founder and other top executives. There appears to be no reason to not expect the management to continue along the same line post listing.

The price band of INR 423-425 per share values the company at a P/E ratio range of 31.97 – 32.12 which is not cheap by any stretch. However, its profitability is respectable and a lean balance sheet allows a relatively high Return on Net Worth (RONW) of 31.79%. These numbers are in line with its competitors like Aarti Industries, Vinati Organics, and Fine Organics Industries but expensive when compared with Atul Ltd and GalaxySurfactants.

Clearly, there isn’t much left on the table and indicate little margin of safety but the company’s shares command healthy premium in grey market, indicating strong demand for the IPO. As such, the IPO is likely to sail through. In the long run, its prospects look attractive but post listing upside may be limited as valuations are already rich. A decision to subscribe or avoid has to be taken based on one’s risk appetite.

Here is the video of Rossari Biotech IPO review: