Ahmedabad-based Shalby Hospitals will launch its IPO on 5 December. The multi-specialty hospital chain will be India’s 36th mainboard IPO. Priced in the range of INR245 – 248 per share, the IPO will remain open till 7 December. Hospital IPOs have been a mixed bag for investors with Narayana Hrudayalaya registering smart gains but HealthCare Global made a tepid start. After poor shows of the recently listed IPOs of Khadim India, New India Assurance and Mahindra Logistics, investors will be looking at Shalby Hospitals IPO with a hint of skepticism. While this is not unwarranted, we aim to find out the pros and coins of the offer through Shalby Hospitals IPO Review.

Shalby Hospitals IPO details | |

| Subscription Dates | 5 – 7 December 2017 |

| Price Band | INR245 – 248 per share |

| Fresh issue | INR480 crore |

| Offer For Sale | 1,000,000 shares (INR24.5 – 24.8 crore) |

| Total IPO size | INR504.5 – 504.8 crore |

| Minimum bid (lot size) | 60 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Shalby Hospitals IPO Review: More fresh, less OFS

As mentioned in the table above, Shalby Hospitals’ public offer aims to raise INR480 crore. These funds are proposed to be used as follows:

- Repayment or prepayment in full, or in part of certain loans availed by our Company – INR300 crore

- Purchase of medical equipment for existing, recently set up and upcoming hospitals – INR58 crore

- Purchase of interiors, furniture, and allied infrastructure for upcoming hospitals – INR18 crore

- General corporate purposes

In addition, 10 lakh shares will also be sold through on Offer For Sale (OFS) route, yielding INR24.8 crore at the upper end of the price band. These shares will be sold by the company promoter Dr. Vikram Shah.

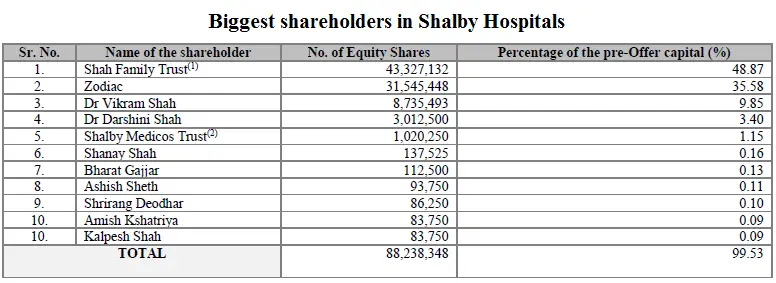

Shalby Hospitals IPO Review: First-generation, family-owned

The chain of Shalby hospitals is not very old and was started in 2004 by Dr. Shah. As a venture of a first-generation entrepreneur, the company has made solid progress in all these years as we will see later in this analysis. Typically, businesses doing well are lapped up by private equity investors. However, Shalby Hospitals continues to be a family-owned enterprise and there is no external investor. As on the date of red herring prospectus, promoters owned 97.86% in the company. Here is a list of biggest shareholders in the company.

It is worth highlighting that Zodiac Mediquip Limited is a group company with Shah Family Trust holding slightly above 91% equity stake.

Shalby Hospitals IPO Review: Focus on Western India

The Ahmedabad-based company is among the leading multi-specialty chain of hospitals but is largely known for its expertise in joint replacements and other orthopaedic surgeries. According to the latest count, the company’s network includes 11 operational hospitals with an aggregate bed capacity of 2,012 beds. However, the number of operational beds is quite less at only 841. These hospitals are spread in western and central India with a clear focus on Tier – I and Tier – II cities. While the hospitals are spread in five states, Shalby has presence in 12 states through outpatient clinics. New hospitals are being set up in Nashik and Vadodara.

Internationally, Shalby Limited has five outpatient clinics and one SACE (Shalby Arthroplasty Centre of Excellence) in Africa, and two SACE in the UAE.

Shalby Hospitals IPO Review: Financial performance

As the table below explains, Shalby has been able to grow revenues consistently over the last four years. This is not surprising since the demand for quality healthcare is constantly growing and Shalby has been expanding its network through new hospitals. Much of the growth has come in the last year with new hospitals in Jaipur, Naroda and Surat becoming operational.

What is inconsistent (and somewhat surprising) are profits which have zigzagged from INR17.1 crore to INR62.6 crore in the last five years. Nevertheless, profitability as a percentage of revenues has been volatile, although the latest annual result puts net margin at a healthy level of 18.8%.

Shalby Limited’s financial performance (in INR crore) | ||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | Q1 FY2018 | |

| Total revenue | 229.8 | 261.7 | 277.6 | 292.6 | 332.9 | 90.6 |

| Total expenses | 211.1 | 209.5 | 234.6 | 256.6 | 279.6 | 72.0 |

| Profit after tax | 17.1 | 39.0 | 25.7 | 37.6 | 62.6 | 14.4 |

| Net margin (%) | 7.4 | 14.9 | 9.3 | 12.9 | 18.8 | 15.9 |

Shalby Hospitals IPO Review: Should you invest?

As analyzed so far, Shalby comes across as a decently managed business and considering the state of healthcare in our country, it looks nicely positioned to benefit from the growth in future demand. The company’s strategy of staying clear from metropolitan markets and focusing on Tier – I and Tier – II cities has its advantages in terms of finding quality manpower – a major cost for hospitals. A major limitation we notice is with regard to a high concentration in western India with Ahmedabad accounting for a vast majority of bed capacity. This has been addressed to a great extent through new hospitals opened this year. Since these newly-opened hospitals will take time to mature and contribute meaningfully to the company’s overall EBITDA, Shalby needs to be effectively treated as work in progress.

Although owned by the family, the company is professionally managed and that’s a big positive. We also don’t see the instances of promoters paying themselves too much – a practice which is not uncommon among first-generation entrepreneurs.

Despite the positives, hospitals are not the kind of businesses which grow and expand at exponential rates. While the growth rates are decent here, there is simply a limitation in terms of how many people need joint replacement and thus, investors having a fetish for high growth plays should look elsewhere. As a hospital, Shalby is going to be a cash rich business for a long time and is unlikely to face headwinds from evolution of technology. As we mentioned earlier, Shalby is still an evolving story with tailwinds from newly opened hospitals expected to come in the next 3-5 years.

Eventually, every business needs to be supported by valuations. The IPO’s price band of INR245 – 248 per share and the Earnings Per Share (EPS) of INR7.16 mean that the company is asking for Price/Earnings (P/E) ratio in the range of 34.22 – 34.63. This compares with just 14.9 for Fortis Healthcare; however, Devi Shetty’s Narayana Hrudayalaya trades at a higher level of 72. HealthCare Global – another hospital chain that brought IPO in recent years – is available at a P/E multiple of 111. Looking at these figures, Shalby’s valuation with regard to its earnings is in line with the competition.

Another important factor is EBITDA and Shalby doesn’t disappoint here with a margin of 19% compared with 21% for Apollo Hospitals and 12% for Narayana Hrudayalaya. It also has a much better performance in terms of Return on Net Worth (RONW) which stands at 23.5%. This outperforms the single-digit values of almost all listed players.

Overall, Shalby Hospitals IPO review tells us that Shalby’s recipe has almost all ingredients in the required quantity. It may not be a high growth play makes up for it with high margins and attractive valuations. As we mentioned in our analysis of Narayana Hrudayala, there is tremendous gap of quality in this space in real life as well as in the stock market. It only helps to know that the IPO is actively traded in the grey market at a premium. Head to the discussion page to remain updated with what fellow investors have to say about the upcoming IPO.

don’t invest

remember recent ipos have listed below ipo price.

this is family run organization

strong possibility of listing below ipo price

Do you mind explaining pls?

@sam

Your post is generic and its not applicable to all IPO

it would be good if you compare or explain with some peer company or states

I agree with @sam

now a days ipo s are more dependent on market sentiments