Last Updated on November 18, 2025 by Rajat Bhati

If you’ve tried buying or upgrading a PC lately, you’ve probably felt it — the sting of a new kind of inflation. A year ago, a solid GPU for gaming or creative work sold for INR 70,000–80,000. Today, the same card hovers around INR 1.3 lakh. Server-grade RAM and NVMe SSDs have climbed quietly but steeply. Even mid-range “AI-ready” laptops are priced like last year’s flagships.

This isn’t mere supply-chain noise or “greedy distributors.”

It’s the downstream consequence of two megatrends colliding:

- India’s explosive AI adoption, and

- A once-in-a-generation build-out of data-centre capacity.

Together, they’ve created a structural squeeze on GPUs, RAM, SSDs and power-cooling gear — a global bottleneck that India is now feeling acutely. For consumers, that means pricey hardware. For investors, it signals the start of a multi-year “AI + Data Centre” super-cycle — an industrial-scale opportunity hidden behind the pain of rising component prices.

How AI Turned Hardware into the New Oil

The Compute Hunger Beneath the Hype

AI isn’t abstract software; it’s pure computation — and computation lives in data centres.

India’s AI market, pegged at USD 20–22 billion (~INR 1.94 lakh crore) by 2027 with a 30% CAGR, is now far more than chatbots and pilot projects. Banks embed machine learning into risk and fraud detection, manufacturers automate predictive maintenance, and IT firms are retraining tens of thousands on AI workflows. Every such workload consumes compute + storage + bandwidth — each powered by silicon, metal, and electricity.

From Megawatts to Gigawatts

In 2024, India’s AI-relevant data-centre capacity stood around 950 MW. By 2026, it’s expected to exceed 2 GW — more than doubling in just two years — and industry projections stretch to 5–8 GW by 2030. That implies 45–50 million sq ft of new floor space and an additional 40–45 TWh of power demand, roughly equal to several mid-sized cities.

AI-specific data centres are even hungrier. Power density has jumped from 6–8 kW per rack in traditional facilities to 40–60 kW in GPU-heavy clusters — a seven-fold rise that transforms both engineering and economics.

GPU Deployment: The Engine of the Surge

India already hosts 34,000 + high-end GPUs — NVIDIA H100/H200, AMD MI300X, Intel Gaudi and others — running inside hyperscale or enterprise data halls.

Each AI rack drags with it a long “bill of materials”: fast RDIMM RAM, 3D NAND SSDs, high-bandwidth networking, precision cooling, and multi-megawatt power systems.

The result: a demand spike rippling through the global memory and power-equipment supply chain.

Read Also: Data Center Stocks Will Be in High-Growth Phase in Next Five Years

The Global Memory Shock

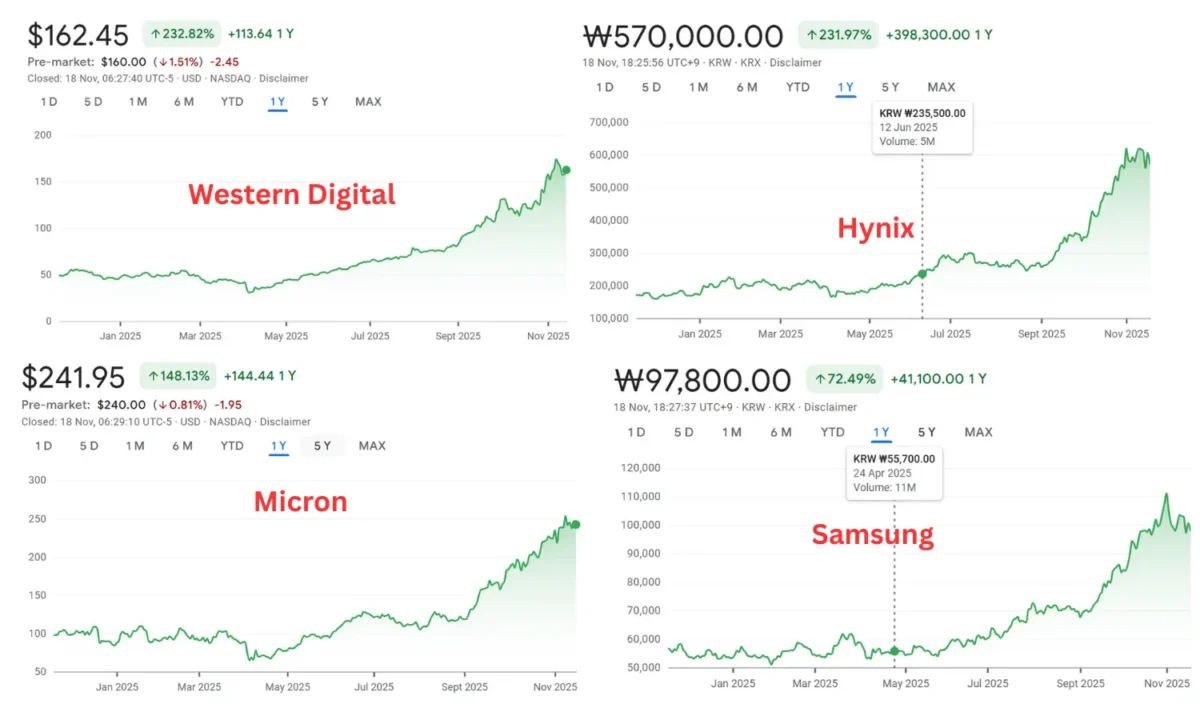

Over 2024–25, spot DRAM prices soared 200–250%, server-grade RDIMM contracts rose ~50%, and enterprise SSD prices climbed ~35%. Samsung, SK Hynix, Micron, Kioxia and Western Digital all implemented multiple price hikes as AI and cloud orders flooded in faster than new fabs could be built.

India, dependent on imports for almost all advanced hardware, feels this twice over:

global price + rupee depreciation + import duties + channel mark-ups. Hence, a 20–70% rise in end-user component prices — the same pressure that builders, gamers and small AI startups face today.

Inside AI Data Center Stocks in India

From Software Nation to Infrastructure Powerhouse

AI has turned data centres into core national infrastructure. Between 2024 and 2030, India will witness one of the world’s fastest expansions as hyperscalers and conglomerates chase AI’s compute appetite.

The New Cost Structure

AI-grade facilities cost about 15% more per MW than legacy ones due to:

- Larger generators and UPS

- Industrial-scale chillers & heat exchangers

- Liquid/immersion cooling

- Reinforced floors and fire safety

Building 1 MW now costs INR 60–90 crore — the upper band widening with GPU-dense designs.

Billions are flowing into land + power + cooling + construction + servers — the backbone of India’s AI economy.

Flagship Projects

- Reliance Industries: 1 GW AI data-centre in Gujarat with NVIDIA Blackwell GPUs.

- Adani Enterprises (AdaniConneX JV): another 1 GW green platform by 2030.

- Bharti Airtel (Nxtra): doubling capacity to 400–450 MW.

- Anant Raj Ltd: NCR & Andhra Pradesh projects targeting 100 MW IT load.

- Sify, STT, Web Werks, NTT, PDG, Equinix, RailTel: adding capacity nationwide.

India is on course to become the third-largest data-centre hub, after the US and Singapore.

AI Data Center Stocks in India: Mapping the Value Chain

1️⃣ Land & Developers – Owning the Digital Real Estate

Anant Raj, Adani Enterprises, Bharti Airtel (Nxtra), L&T, RailTel

→ Benefit from higher occupancy, annuity leases, and land re-rating as “digital infra.”

When GPU racks cost millions, clients pay premiums for reliable, well-cooled space.

2️⃣ Power & Electrical Backbone – Every Extra Kilowatt Counts

Kirloskar Oil Engines, Cummins India – diesel/gas gensets

ABB India, Hitachi Energy India – transformers, switchgear & automation

Techno Electric, Bajel Projects, Marine Electricals– EPC and cabling

Prostarm Infosystem – Power Conditioning

AI doubles power draw per rack, boosting electrical capex and vendor pipelines.

3️⃣ Cooling & Thermal Management – Turning Heat into Profit

Voltas, Blue Star – precision HVAC

KRN Heat Exchanger, Scoda Tubes – components for OEM chillers

Rack density jumping from 6 kW to 60 kW makes the cooling mission-critical.

Lower PUE and efficient heat management drive multi-year orders.

4️⃣ The PEB Edge – Steel Structures for the Digital Age

Amid the GPU and cooling headlines, the Pre-Engineered Building (PEB) industry has quietly become a core enabler. Modern data centres rely on steel-based, modular frameworks that provide strength, speed, and precision.

A single hyperscale facility can consume 30,000–40,000 tonnes of fabricated steel.

Compared with RCC buildings that take ~24 months, PEBs cut timelines by 30–40%, enabling faster deployment.

Why it matters:

- Speed & Flexibility: Supports rapid expansion and 12–15 kN/m² load.

- Integration-friendly: Simplifies routing for HVAC, power & networking.

- Sustainable: Recyclable steel fits green data-centre mandates.

Key beneficiaries:

Pennar Industries, EPACK Prefab, Everest Industries, Interarch, M&B Engineering.

India’s PEB market, INR 19,000–20,000 crore (FY25), is growing 12–15% CAGR, with data centres forming ~10% of new orders. These companies supply the literal steel skeleton of the digital economy.

5️⃣ AI Servers & Integration – Selling the Brains and Plumbing

Netweb Technologies – AI servers & HPC clusters

E2E Networks – GPU cloud as-a-service

Aurionpro Solutions, Allied Digital, Black Box, Orient Technologies, Tata Communications – cloud & hybrid integration

These firms monetise AI migration, managed services, and network design — bridging software ambition with physical compute.

6️⃣ Refurb & E-Waste – The Secondary Cycle

GNG Electronics – refurbished devices

Ecoreco (Eco Recycling) – IT asset disposition & e-waste

As new hardware grows costlier, refurbished demand and recycling volumes rise — a small but steady counter-cycle play.

Risks Behind the Euphoria

- Valuation Risk: Many mid-caps have already re-rated; future capacity is priced in. Any delay or margin squeeze can trigger sharp corrections.

- Execution Risk: Data-centre projects are capex-heavy and clearance-dependent. First-time entrants face steep learning curves.

- Power & Policy Risk: AI data centres are massive power users. Tariff changes or renewable rules can alter unit economics overnight.

- Technology Risk: Cooling, chip and server tech evolve fast; staying current demands R&D investment and diverse partnerships.

- Global Cycle Risk: Memory and GPU supply cycles remain volatile; macro slowdowns can delay hyperscaler capex.

The Investor Playbook

1️⃣ Think in Layers: Choose exposure by value-chain layer — core (power, infra), growth (PEB, cooling, AI servers), or niche (refurb, recycling) — not single-stock bets.

2️⃣ Adopt a 5–7 Year Lens: This is infrastructure investing, not momentum trading.

3️⃣ Run a Simple Checklist for AI Data Center Stocks in India:

- Is exposure real or just marketing?

- Are finances strong enough for capex?

- Does management have execution track record?

- Are valuations reasonable vs earnings visibility?

4️⃣ Build Gradually: Accumulate during quiet phases; avoid chasing hype peaks.

5️⃣ Track Leading Indicators: Monitor data-centre MW under construction, DRAM/NAND prices, power tariffs, and cloud capex guidance.

The Big Picture: From GPUs to Growth Engines

AI has turned computing into the new oil, and data centres into the refineries of the digital age.

For India, this alignment is historic — digitalisation, policy support, affordable land, and young talent converging as AI demand explodes.

The side-effect for consumers: costlier GPUs, RAM, and SSDs. But beneath that pain lies a once-in-a-decade infrastructure story — one where megawatts replace megabytes as the true currency of growth. A handful of Indian companies across real estate, power, steel, cooling and AI infrastructure stand poised to gain.

“AI may have made our PCs expensive — but it has also made India’s infrastructure priceless.”