| Airfloa Rail Technology IPO Review | Airfloa Rail Technology vs Peers |

| Airfloa Rail Technology IPO Risk Factors You Need to Consider | Airfloa Rail Technology IPO Allotment |

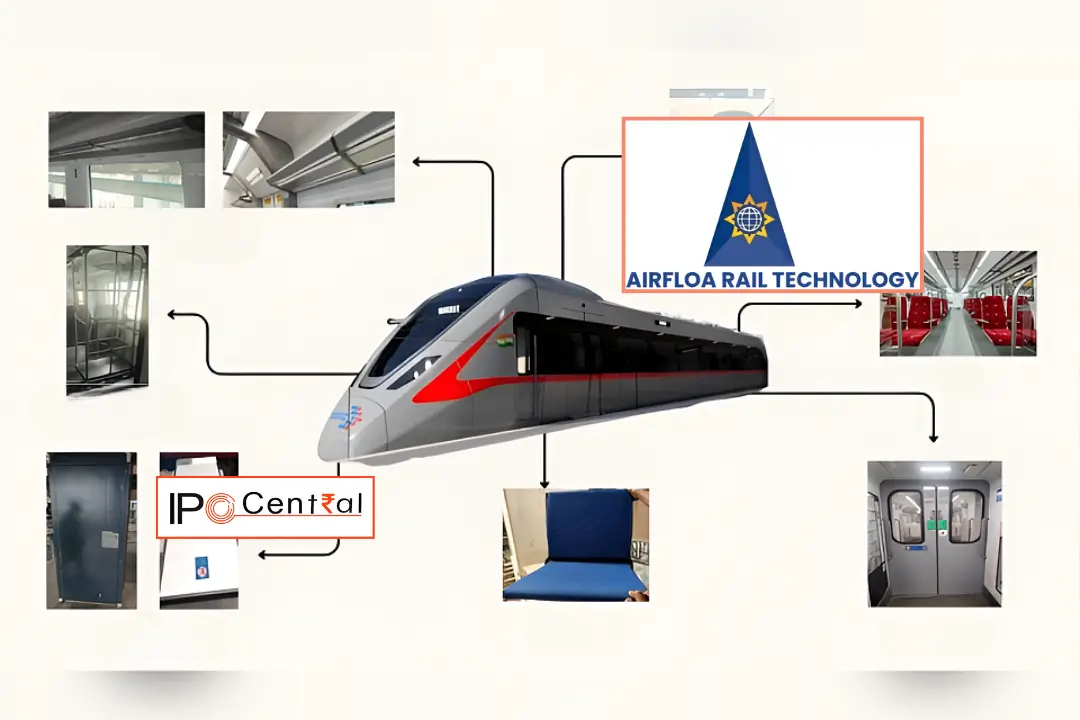

Airfloa Rail Technology IPO Description – Airfloa Rail Technology is a Chennai-based manufacturer specializing in high-precision forged and machined components for the rolling stock, aerospace, and defence sectors. With over 20 years of operational experience, the company serves Indian Railways—through Integral Coach Factory (ICF) and other coach factories—as well as global rolling stock OEMs. Its portfolio includes turnkey interior furnishing projects for notable models such as Sri Lankan DEMU and Mainline Export Coaches, Agra-Kanpur Metro Coach, RRTS Coach, Vistadome Coach, and the Train-18 Vande Bharat Express.

The company operates two advanced manufacturing facilities in Chennai, supported by a 281-employee workforce. As of 28 August 2025, Airfloa Rail Technology holds a work order backlog worth INR 375.89 crore, ensuring strong revenue visibility. Its long-standing client relationships, repeated contracts, and diversified product range across railways, aerospace, and defence underscore its position as a strategic and reliable partner with a stable, long-term growth outlook.

Promoters of Airfloa Rail Technology – Mr. Venkatesan Dakshinamoorthy, Mr. Manikandan Dakshna Moorthy, Ms. Nandhini Manikandan, and Mr. Satishkumar Venkatesan

Table of Contents

Airfloa Rail Technology IPO Details

| Airfloa Rail Technology IPO Dates | 11 – 15 September 2025 |

| Airfloa Rail Technology Issue Price | INR 133 – 140 per share |

| Fresh Issue | 65,07,000 shares (INR 86.54 – 91.10 crore) |

| Offer For Sale | Nil |

| Total IPO Size | 65,07,000 shares (INR 86.54 – 91.10 crore) |

| Minimum Bid | 2,000 shares (INR 2,80,000) |

| Lot Size | 1,000 shares (INR 1,40,000) |

| Face Value | INR 10 per share |

| Individual Allocation | 35% |

| Listing On | BSE SME |

Airfloa Rail Technology Financial Performance

| FY 2023* | FY 2024* | FY 2025 | |

| Revenue | 95.17 | 119.30 | 192.39 |

| Expenses | 92.98 | 102.27 | 157.70 |

| Net income | 1.49 | 14.23 | 25.55 |

* All Standalone Data

Airfloa Rail Technology Offer News

- Airfloa Rail Technology RHP

- Airfloa Rail Technology Draft Prospectus

- ASBA IPO Forms

- Live IPO Subscription Status

- Highest SME IPO Subscription in 2025

Airfloa Rail Technology Valuations & Margins

| FY 2023 | FY 2024 | FY 2025 | |

| EPS | 1.00 | 9.50 | 15.63 |

| PE ratio | – | – | 8.51 – 8.96 |

| RONW (%) | 3.58 | 25.42 | 23.06 |

| NAV | 27.86 | 37.36 | 63.81 |

| ROCE (%) | 11.31 | 26.42 | 26.28 |

| EBITDA (%) | 15.40 | 28.14 | 24.61 |

| Debt/Equity | 1.44 | 1.14 | 0.54 |

Airfloa Rail Technology IPO GMP Today

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| 17 September 2025 | 175 | – | 1,35,000 |

| 16 September 2025 | 175 | – | 1,35,000 |

| 15 September 2025 | 166 | – | 1,25,500 |

| 13 September 2025 | 166 | – | 1,25,500 |

| 12 September 2025 | 166 | – | 1,25,500 |

| 11 September 2025 | 166 | – | 1,25,500 |

| 10 September 2025 | 166 | – | 1,25,500 |

| 9 September 2025 | 160 | – | 1,20,000 |

| 8 September 2025 | 155 | – | 1,15,000 |

| 6 September 2025 | 155 | – | 1,15,000 |

| 5 September 2025 | 150 | – | 1,12,000 |

Airfloa Rail Technology IPO Subscription – Live Updates

| Category | QIB | NII | Individual | Total |

|---|---|---|---|---|

| Shares Offered | 12,35,000 | 9,30,000 | 21,64,000 | 43,29,000 |

| 15 Sep 2025 | 214.65 | 350.35 | 331.48 | 302.21 |

| 12 Sep 2025 | 0.72 | 77.03 | 99.78 | 66.63 |

| 11 Sep 2025 | 0.00 | 24.06 | 34.17 | 22.25 |

The market maker reservation portion of 3,26,000 shares and the anchor investor portion of 18,52,000 shares are not included in the above calculations.

Airfloa Rail Technology IPO Dates & Listing Performance

| IPO Opening Date | 11 September 2025 |

| IPO Closing Date | 15 September 2025 |

| Finalization of Basis of Allotment | 16 September 2025 |

| Initiation of refunds | 17 September 2025 |

| Transfer of shares to demat accounts | 17 September 2025 |

| IPO Listing Date | 18 September 2025 |

| Opening Price on BSE SME | INR 266 per share (up 90%) |

| Closing Price on BSE SME | INR 279.30 per share (up 99.50%) |

Airfloa Rail Technology Offer Lead Manager

GYR CAPITAL ADVISORS PRIVATE LIMITED

428, Gala Empire, Near JB Tower,

Drive in Road, Thaltej

Ahmedabad-380 054, Gujarat, India

Phone:+91 8777564648

Email: [email protected]

Website: www.gyrcapitaladvisors.com

Airfloa Rail Technology Offer Registrar

KFIN TECHNOLOGIES LIMITED

Selenium Tower – B, Plot 31 & 32, Gachibowli,

Financial District, Nanakramguda, Serilingampally,

Hyderabad – 500 032, Telangana

Tel: +91 40 6716 2222

E-mail: [email protected]

Website: www.kfintech.com

Airfloa Rail Technology Contact Details

AIRFLOA RAIL TECHNOLOGY LIMITED

No 9 Chelliamman Koilstreet Keelkttalai

Chennai-117, Tamil Nadu 600117, India

Phone: +91 9600621490

E-mail: [email protected]

Website: www.airflow.co.in

IPO FAQs

What is the Airfloa Rail Technology offer size?

Airfloa Rail Technology’s offer size is INR 86.54 – 91.10 crores.

What is the Airfloa Rail Technology offer price band?

Airfloa Rail Technology public offer price is INR 133 – 140 per share.

What is the lot size of the Airfloa Rail Technology IPO?

Airfloa Rail Technology offer lot size is 1,000 shares.

What is the Airfloa Rail Technology IPO GMP today?

Airfloa Rail Technology IPO GMP today is INR 175 per share.

What is the Airfloa Rail Technology kostak rate today?

Airfloa Rail Technology kostak rate today is INR NA per application.

What is the Airfloa Rail Technology IPO Subject to Sauda rate today?

Airfloa Rail Technology Subject to Sauda rate today is INR 1,35,000 per application.