ICICIdirect and Upstox are two of India’s most prominent stock brokers, offering unique advantages for investors and traders. In 2025, choosing between these platforms depends on individual priorities—whether seeking comprehensive investment services or prioritizing affordable trading with cutting-edge technology. ICICIdirect vs Upstox is compared in this article. Upstox’s market share is 5.25%, and ICICIdirect has 4.15% market share.

The Indian brokerage market has evolved markedly over the past decade, with full-service brokers like ICICIdirect holding legacy trust and discount brokers like Upstox empowering a new digital-first generation. Both brokers serve millions of clients and boast robust platforms, yet their approaches, pricing, and value propositions differ dramatically.

Table of Contents

ICICIdirect Vs Upstox – Company Background and Core Philosophy

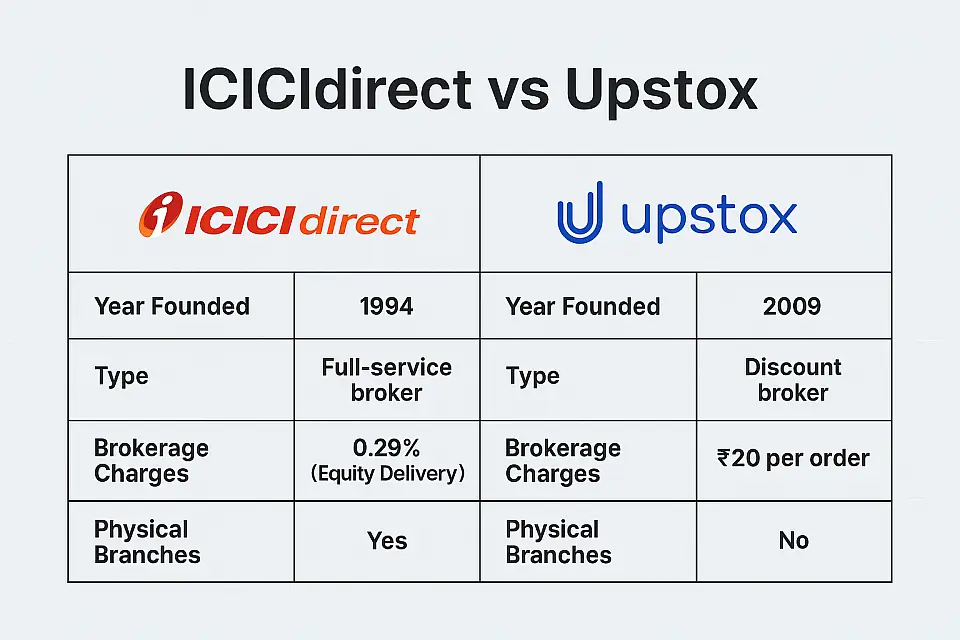

ICICIdirect is a subsidiary of ICICI Securities, founded in 1994, known for its full-service offerings, extensive research, and physical branch presence. It caters to investors who prefer in-depth guidance, personalized support, and a wide range of financial products.

Upstox, started in 2009, represents the new-age, technology-driven discount broking model. With over 13 million clients, it focuses on low-cost trading, seamless digital experience, and empowerment through advanced tools and analytics.

ICICIdirect is a legacy full-service broker integrated with ICICI Bank, offering end-to-end investment and banking solutions. Upstox is a digitally native discount broker emphasizing low-cost, technologically advanced trading.

Product Range and Investment Options

ICICIdirect provides a vast range of investment products—equity, derivatives, mutual funds, IPOs, insurance, fixed income, portfolio management, and even government bonds. Its full-service model appeals to clients seeking a single window for all investment needs, including research and physical advisory support.

Upstox offers all basic asset classes such as equities, derivatives, commodities, currencies, and mutual funds, but its real USP lies in affordable, app-centric trading, margin trading, and zero brokerage for mutual funds and IPO investments.

ICICIdirect Vs Upstox Charges

- ICICIdirect Vs Upstox Account Opening Charges & AMC

| Account Opening and Demat Charges | ICICIdirect | Upstox |

| Equity Trading Account Opening Charges | Zero | Zero |

| Trading Account AMC Charges | Zero | Zero |

| Demat Account Opening Charges | Zero | Zero |

| Demat Account AMC Charges | INR 300 Per Year (Free for the First Year) | INR 300 Per Year (Free for the First Year) |

- ICICIdirect Vs Upstox Brokerage Charges Plan 1

| Particulars | ICICIdirect Moneysaver Plan | Upstox |

| Equity Delivery | 0.29% | INR 20 per executed order |

| Equity Intraday | 0.029% | INR 20 per order or 0.1%, whichever is lower |

| Equity Futures | 0.029% | INR 20 per order or 0.05%, whichever is lower |

| Equity Options | INR 49 per lot | Flat INR 20 per executed order |

| Currency Futures | INR 20 per order | INR 20 per order or 0.05%, whichever is lower |

| Currency Options | INR 20 per order | INR 20 per executed order |

| Commodity Futures | INR 20 per order | INR 20 per order or 0.05%, whichever is lower |

| Commodity Options | INR 20 per order | INR 20 per executed order |

| Call & Trade Charge | INR 50 per executed order | INR 75 per executed order |

| Minimum Brokerage | No Minimum brokerage (Moneysaver Plan) | INR 20 or 0.05% in Equity Intraday |

| P&L/CMR Charges | INR 99 + GST | INR 10 per page |

- ICICIdirect Vs Upstox Brokerage Charges Plan 2

| Particulars | ICICIdirect Prime Plan – 299 | Upstox |

| Equity Delivery | 0.25% | INR 20 per executed order |

| Equity Intraday | 0.025% | INR 20 per order or 0.1%, whichever is lower |

| Equity Futures | 0.025% | INR 20 per order or 0.05%, whichever is lower |

| Equity Options | INR 49 per lot | Flat INR 20 per executed order |

| Currency Futures | INR 20 per order | INR 20 per order or 0.05%, whichever is lower |

| Currency Options | INR 20 per order | INR 20 per executed order |

| Commodity Futures | INR 20 per lot | INR 20 per order or 0.05%, whichever is lower |

| Commodity Options | INR 20 per lot | INR 20 per executed order |

- ICICIdirect Vs Upstox Brokerage Charges Plan 3

| Particulars | ICICIdirect Prime Plan – 9999 | Upstox |

| Equity Delivery | 0.07% | INR 20 per executed order |

| Equity Intraday | 0.007% | INR 20 per order or 0.1%, whichever is lower |

| Equity Futures | 0.007% | INR 20 per order or 0.05%, whichever is lower |

| Equity Options | INR 9 per lot | Flat INR 20 per executed order |

| Currency Futures | INR 20 per order | INR 20 per order or 0.05%, whichever is lower |

| Currency Options | INR 20 per order | INR 20 per executed order |

| Commodity Futures | INR 20 per lot | INR 20 per order or 0.05%, whichever is lower |

| Commodity Options | INR 20 per lot | INR 20 per executed order |

Read Also: Zerodha AMC Charges: A Comprehensive Breakdown

- Upstox vs ICICIdirect Other Statutory Charges

| Statutory Charges | ICICIdirect | Upstox |

| STT/CTT Equity Delivery | 0.1% (Both Buy & Sell) | 0.1% (Both Buy & Sell) |

| STT/CTT Equity Intraday | 0.025% on the sell side | 0.025% on the sell side |

| STT/CTT Equity Futures | 0.02% on the buy side | 0.02% on Sell-side |

| STT/CTT Equity Options | 0.01% on the sell side (on premium), 0.125% of the intrinsic value on bought and exercised options | 0.1% on the Sell side (on premium) |

| STT/CTT Currency Futures & Options | No STT | No STT |

| STT/CTT Commodity Futures | MCX: 0.01% on Sell side | MCX: 0.01% on the Sell side |

| STT/CTT Commodity Options | 0.05% on Sell trade | 0.05% on Sell side |

| SEBI Turnover Charges | INR 10/crore | INR 10/crore |

| GST | 18% | 18% |

| Stamp Equity Delivery | 0.015% or INR 1500/crore on buy-side | 0.015% or INR 1500/crore on buy-side |

| Stamp Equity Intraday | 0.003% or INR 300/crore on buy-side | 0.003% or INR 300/crore on buy-side |

| Stamp Equity Futures | 0.002% or INR 200/crore on buy-side | 0.002% or INR 200/crore on buy-side |

| Stamp Equity Options | 0.003% or INR 300/crore on buy-side | 0.003% or INR 300/crore on buy-side |

| Stamp Currency Futures | Nil | 0.0001% or INR 10/crore on buy-side |

| Stamp Currency Options | Nil | 0.0001% or INR 10/crore on buy-side |

| Stamp Commodity Futures | 0.002% or INR 200/crore on buy-side | 0.002% or INR 200/crore on buy-side |

| Stamp Commodity Options | 0.003% or INR 300/crore on buy-side | 0.003% or INR 300/crore on buy-side |

| DP (Depository participant) Charges | INR 20 per scrip | INR 20 per scrip |

| Pledging Charges | INR 29 per scrip (Shares as Margin) | INR 20 per scrip |

| Auto Square off Charges | INR 50 per executed order | INR 75 per executed order |

| API Subscription Charges | Zero | Zero |

Also Read: Top Stock Brokers in India 2024

ICICIdirect Vs Upstox: Exposure/Leverage (Margin)

ICICIdirect margin for intraday trading is up to 20% of the trade value (5x leverage) based on the stock, whereas the Upstox margin for intraday cash is also up to 20% of the trade value (5x leverage) based on the stock.

| Segment | ICICIdirect | Upstox |

| Equity Delivery | 100% of trade value (1x leverage) | 100% of trade value (1x leverage) |

| Equity Intraday | Upto 20% of trade value (5x leverage) | Upto 20% of trade value (5x leverage) |

| F&O (Equity, Currency & Commodity) | 100% of NRML margin (Span + Exposure) (1x leverage) | 100% of NRML margin (Span + Exposure) (1x leverage) |

Features of ICICIdirect Vs Upstox Platforms

| Feature | ICICIdirect | Upstox |

| 3 in 1 Account | Yes | Yes |

| Algo Trading | Yes | Yes |

| Charting | Yes | Yes |

| Trading Platform | ICICI Direct.com (website), ICICI Direct Mobile App | Upstox Pro Web, Dartstock, NEST Trader, Fox Trader, and mobile apps for iOS and Android |

| SMS Alerts | Yes | Yes |

| Online Demo | Yes | Yes |

| Online Portfolio | Yes | Yes |

| Margin Trading Funding Available | Yes | Yes |

| Margin Against Shares (Equity Cash) | Yes | Yes |

| Margin Against Shares (Equity F&O) | Yes | Yes |

| Intraday Square-off Time | 15:15 | 15:15 |

| NRI Trading | Yes | No |

| Other Features | Direct Mutual Funds, APIs for Algo Trading | Option strategy builder |

| Referral Program | Yes | Yes |

Also Read: Fyers Brokerage Calculator

ICICIdirect Vs Upstox – Pros and Cons

| ICICIdirect | Upstox | |

| Pros | 1. Offers a 3-in-1 account for seamless, instant transfers between bank and trading accounts 2. A single platform offering diverse investment opportunities 3. Offers watchlist curation and a 4.8-rated mobile app (App Store) 4. The Good Till Cancellation (GTC) and off-market hours order placement features are highly valuable | 1. Zero brokerage for Mutual Fund investments (Direct Plans) 2. Excellent online trading platform (Website and Mobile App) 3. Single app for equity, currency, and commodity trading 4. Good-till-triggered (GTT) orders available 5. Bracket and Cover Orders available |

| Cons | 1. Higher brokerage fees, especially costly for small trades 2. Call & Trade charges are relatively high 3. Currency trading is not offered 4. Auto Square-Off charged INR 50 per order 5. Limited commodity trading options 6. A complex brokerage structure is difficult for beginners | 1. Charges an additional INR 50 per executed order for automatic settlement 2. Doesn’t offer NRI Trading and Demat account 3. No physical branches or neighborhood offices – fully online 4. Doesn’t offer true GTC (Good Till Cancelled) orders 5. Additional INR 75 charged for Call & Trade orders 6. Additional INR 75 charged for auto square-off of intraday positions |

ICICIdirect Vs Upstox FAQs

Which is better, ICICIdirect Vs Upstox?

Upstox is generally more affordable with a flat INR 20 brokerage per order across segments. ICICIdirect, being a full-service broker, charges a percentage-based fee on delivery (0.29%) and INR 49 per options lot, which can be costlier for small or frequent traders. However, ICICIdirect offers wider investment options, in-depth research, and physical branch support.

Which broker has lower brokerage charges?

Upstox has lower brokerage charges. It follows a flat-fee model (INR 20/order), whereas ICICIdirect’s default Moneysaver Plan charges 0.29% for delivery and INR 49 per options lot.

What is the ICICIdirect AMC charge?

ICICIdirect AMC charges stand at INR 300 Per Year (Free for the First Year) + GST (18%).

What is the ICICIdirect market share?

ICICIdirect has a market share of 4.15%