Ace investor Sunil Singhania Portfolio, founder of Abakkus Asset Manager, has once again captured Dalal Street’s spotlight. Despite a nearly 12% decline in his portfolio’s net worth in FY26 so far, a set of eight high-conviction midcap and niche bets has delivered strong double-digit gains, with returns soaring as high as 50%.

According to June 2025 shareholding disclosures, Abakkus holds over 1% stakes in around 21 companies, with a combined value of INR 2,597 crore. Although weaknesses in textiles and capital goods dragged down overall performance, strong gains in consumer durables, infrastructure, auto ancillaries, and pharma helped balance the portfolio.

Sunil Singhania Portfolio: The Big Gainers

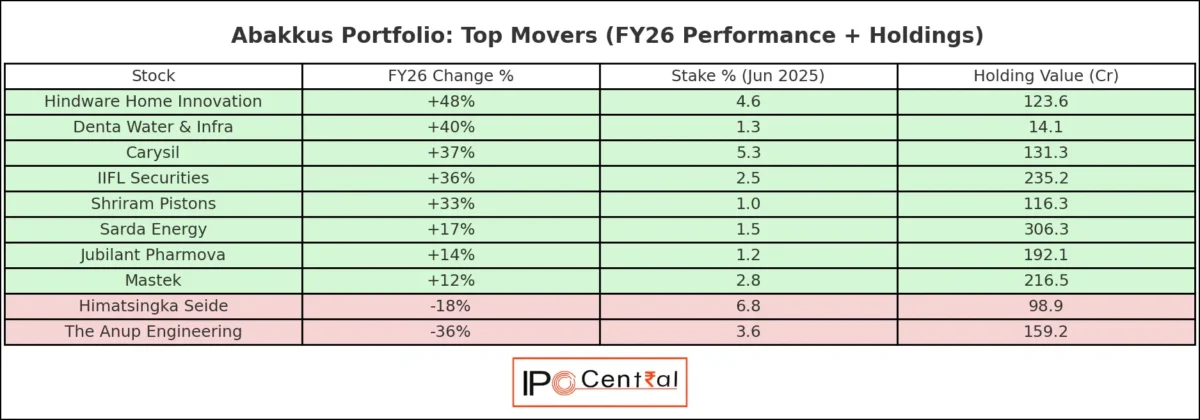

A clutch of Abakkus holdings staged strong rallies in FY26, with consumer, infra, and specialty plays driving returns:

- Hindware Home Innovation (+48%) – From INR 210 to INR 311; Abakkus stake at 4.6%. Riding on housing and premium bathroom solutions.

- Denta Water & Infra (+40%) – Infrastructure tailwinds lifted the stock from INR 285 to INR 400; stake at 1.3%.

- Carysil (+37%) – Premium kitchen appliances and global demand boosted momentum; stake at 5.3%.

- IIFL Securities (+36%) – Capital market participation surged, taking the stock from INR 218 to INR 297; stake at 2.5%.

- Shriram Pistons & Rings (+33%) – Robust auto demand kept ancillary players buzzing; stake at 1%.

- Sarda Energy & Minerals (+17%) – Commodity play; stake at 1.5%.

- Jubilant Pharmova (+14%) – Pharma recovery theme; stake at 1.2%.

- Mastek (+12%) – Midcap IT resilience; stake at 2.8%.

These winners underscore Abakkus’ strategy of riding niche consumption, infra-linked themes, and selective midcaps.

Sunil Singhania Portfolio: The Laggards

However, not all bets paid off.

- The Anup Engineering (-36%) – Stock fell from INR 3,477 to INR 2,212; stake at 3.6%. Concerns over order inflows hurt sentiment.

- Himatsingka Seide (-18%) – Textile sector slowdown dragged shares from INR 141 to INR 116; stake at 6.8%.

With sizable exposure to both, the underperformance weighed on the overall portfolio.

Recent Portfolio Moves

Abakkus has been actively rebalancing:

- Increased stake: Mastek Ltd. (+0.06%)

- Trimmed exposure: Stylam Industries (-0.41%), ADF Foods & Ethos (both fell below 1% threshold)

Such tactical moves reflect Singhania’s “dynamic allocation” approach, cutting laggards while reinforcing conviction bets.

Sunil Singhania Portfolio: Analyst View

Market watchers say the performance of Abakkus portfolio reflects a barbell strategy—combining high-growth midcaps with defensive plays.

“Sunil Singhania has consistently backed niche, under-researched sectors. His focus on consumer durables, infra, and auto ancillaries has delivered outsized gains even in a volatile FY26,” said a senior fund manager at a leading brokerage.

That said, risks remain. Concentration in select cyclical sectors (engineering, textiles) makes the portfolio vulnerable to downturns.

Investor Takeaways

- Even seasoned investors face divergence between winners and laggards.

- Selective bets can deliver 30–50% gains, but concentration risks must be managed.

- For retail investors, the key lesson is diversification and sector rotation.

Disclaimer: This article is for informational purposes only and not investment advice. Past performance is not indicative of future returns.

For more details related to IPO GMP, SEBI IPO Approval, and Live Subscription, stay tuned to IPO Central.