Milky Mist is rapidly emerging as one of India’s most dynamic private dairy brands — and now, it’s gearing up for its Initial Public Offering (IPO) after receiving approval from SEBI. Headquartered in Erode, Tamil Nadu, the company has built a fully integrated dairy ecosystem driven by technology and precision. With 100% of its revenue coming from value-added products like paneer, curd, cheese, and ghee, Milky Mist represents the new-age model of India’s dairy success story — ready to challenge legacy giants like Amul.

Building an Empire Around One Product: A Focus That Defies Convention

Milky Mist stands out as one of India’s few dairy companies that has completely moved away from the traditional “sell milk” model to focus entirely on value-added dairy products. According to the DRHP, 100% of its revenue comes from value-added products — unlike most dairies, which generate only 20–30% of their revenue from processed items such as cheese, paneer, and curd.

The Hero Product — Paneer

Paneer – also known as Cotton Cheese – is not just one of Milky Mist’s products; it is the core identity of the brand. While most Indian dairy players treat paneer as a side category, Milky Mist invested in a dedicated automated production line with an installed capacity of 192 MT per day, making it one of the largest private, organized paneer manufacturing facilities in India.

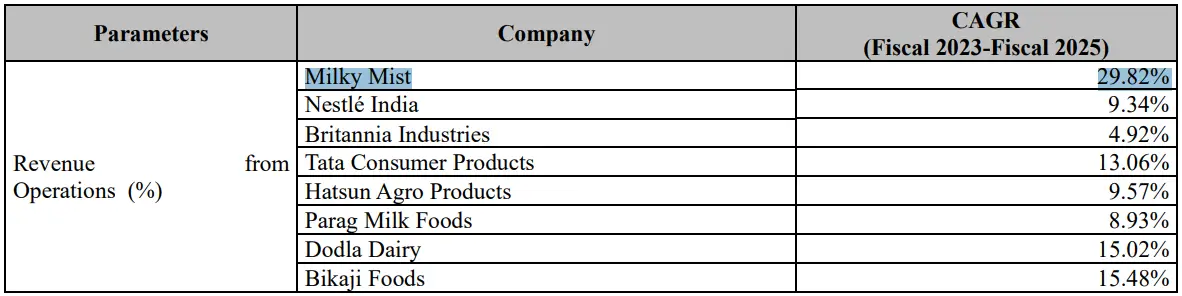

- Between FY23 and FY25, Milky Mist achieved a revenue CAGR of 29.82%, one of the fastest among Indian packaged food brands, with revenues exceeding INR 1,500 crore.

- This performance signals not just market success but operational precision — the company has effectively turned “Paneer” into a scalable FMCG product.

Turning Freshness Into Technology — The Perundurai Model

Milky Mist’s Perundurai (Erode, Tamil Nadu) manufacturing hub is one of India’s most advanced dairy facilities. The plant runs on end-to-end automation, robotics, and real-time process monitoring — from milk collection to final packaging — with minimal human intervention.

Key operational features include:

- Full traceability: Every litre of milk is digitally tracked from farm to package.

- Sustainability focus: The plant can recycle 2.15 million litres of water daily, progressing toward “water neutrality”.

- Renewable energy: Nearly 70–80% of total power is generated from solar and wind sources.

- Green logistics: The company uses EV delivery vehicles and methane-to-energy systems to minimize its carbon footprint.

This industrial ecosystem enables Milky Mist to maintain consistent product quality, hygiene, and shelf-life, positioning it as a technologically advanced food manufacturer rather than just another dairy processor.

Supply Chain Science — Engineering Freshness at Scale

Milky Mist’s most formidable advantage lies in its in-house cold chain ecosystem, designed to keep freshness intact from factory to shelf. It is among the first Indian dairy brands to deploy Visi-Coolers across retail outlets, ensuring that every product remains stored between 2°C–6°C even at the last mile.

Operational data highlights:

- A 400 km sourcing radius ensures a consistent raw milk supply and reliability.

- A network of 67,615 farmers, including 31,961 women, is directly linked to Milky Mist’s procurement system — making it one of the most inclusive agri-supply chains in India.

- Industry-leading cost control: Transportation cost-to-sales ratio dropped from 5.1% in FY23 to 4.3% in FY25, thanks to route optimization and return-load systems.

This self-sustained model — from milk collection to product delivery — makes Milky Mist one of the few vertically integrated private dairies in India. Unlike most competitors dependent on third-party distributors, Milky Mist owns and controls its entire cold logistics network, giving it unmatched consistency and supply stability.

Cold Chain Mastery — Owning the “Freshness Infrastructure”

Milky Mist’s biggest operational edge lies in its in-house cold chain ecosystem, a rarity in India’s dairy industry. Unlike most organized dairies that rely on distributors for logistics, Milky Mist owns and manages end-to-end cold chain logistics — from milk procurement to retail delivery. This strategic decision ensures temperature consistency between 2°C and 6°C across the entire supply chain, significantly reducing spoilage and ensuring uniform product quality across geographies.

The company’s cold chain footprint includes:

- A dedicated fleet of temperature-controlled trucks with optimized routes ensuring minimal turnaround time.

- Branded visi-coolers are deployed at retail outlets across South India, pioneering the concept of refrigeration-led retail expansion for dairy brands.

- Transportation cost-to-revenue ratio of only 4.3% in FY25, among the lowest in the industry, achieved through return-load optimization, where vehicles are used both ways.

This infrastructure has transformed Milky Mist from a regional dairy into a logistics-driven FMCG company, ensuring product freshness comparable to international dairy benchmarks.

Product Strategy — From a Single Product to a Nutritional Portfolio

While paneer remains the hero product, Milky Mist has expanded strategically into high-margin value-added dairy products (VADP) like cheese, yogurt, ghee, butter, milkshakes, and ready-to-cook (RTC) products. As per the DRHP, 100% of Milky Mist’s revenue in FY25 came from value-added dairy products — a figure unmatched by any peer, with competitors averaging only 25–40%.

Key highlights from FY25:

- Paneer installed capacity: 192 metric tonnes/day — one of the largest in India.

- New product launches: INR 511.64 crore in FY25 revenue contribution, the highest among Indian dairy peers.

- 80% of total sales fall under daily consumption categories such as paneer, curd, yogurt, ghee, and butter — ensuring repeat purchases and predictable demand.

- Focus on functional health products — high-protein paneer (50g protein/pack) and Skyr yogurt (12g protein/serving), catering to India’s growing protein deficiency market.

By building a portfolio of nutritionally differentiated products, Milky Mist is aligning itself with India’s emerging “protein-conscious” consumer base — an area where legacy players like Amul and Nandini have limited offerings.

Procurement and Farmer Network — The Silent Strength

Milky Mist’s direct procurement model connects the brand to over 67,615 farmers, including 31,961 women, across a 400 km radius around its Erode (Tamil Nadu) facility. This model allows the company to procure one of the highest shares of milk directly from farmers among private dairy players in India.

Operational impact:

- Raw material stability: Direct farmer linkages reduce price volatility and ensure consistent milk quality.

- Empowerment-based ecosystem: The inclusion of women farmers ensures financial inclusion and sustainability.

- High yield realization: Milky Mist achieved an average realization of INR 74 per litre of milk processed in FY25 — the highest among Indian peers, due to its premium pricing and efficiency in conversion.

The direct-sourcing model not only stabilizes supply but also strengthens brand authenticity — allowing Milky Mist to maintain a farm-to-fork traceability that few in the industry can match.

Brand Building — Transforming from Farm Fresh to Smart Dairy

Milky Mist’s brand strategy focuses on premium freshness through precision manufacturing. The company’s advertising and marketing spend grew from INR 20.56 crore in FY24 to INR 71.13 crore in FY25, accounting for 3.03% of revenue, significantly higher than Hatsun (2.1%) or Dodla (1.5%).

Milky Mist’s brand narrative has evolved from “Farm Fresh Dairy” to “Smart Dairy for Smart India.”

Key brand-building pillars include:

- Digital-first campaigns: Milky Mist’s online revenue reached INR 224.7 crore in FY25, marking a 134% jump from FY23.

- Workforce transformation: Out of 1,520 employees, 549 are in sales and marketing, underlining a strong brand-forward organization.

- Influencer and recipe marketing: Focused on lifestyle and home cooking segments, especially through integration with Swiggy Instamart, Zepto, and Blinkit.

Unlike Amul, which depends heavily on cooperative advertising, Milky Mist’s campaigns are consumer-behavior-led and data-driven, ensuring deep penetration in digital-first markets.

Growth Outlook — A Blueprint for National Expansion

Between FY23 and FY25, Milky Mist’s Revenue from Operations grew from INR 1,394.18 crore to INR 2,349.50 crore (CAGR 29.82%), outpacing every major FMCG dairy peer in India. EBITDA margin improved to 13.21%, and Return on Equity (ROE) surged to 15.11% in FY25, up from 7.14% the previous year.

Expansion drivers:

- Perundurai Plant Capacity Expansion: Paneer capacity to increase from 192 MT/day to 250 MT/day by FY26.

- New Cheese Line: Added 72 MT/day in FY25.

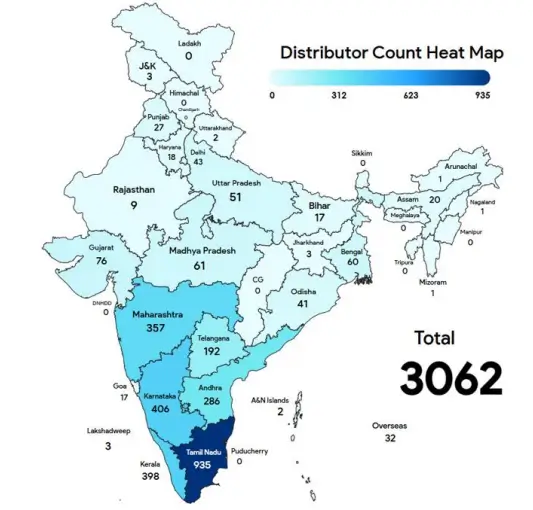

- Distribution Footprint: Presence expanded to 22 states and 5 union territories, supported by 3,062 distributors (up from 2,033 in FY23).

This growth has positioned Milky Mist as one of the few Indian private dairies achieving national relevance without a cooperative structure, combining operational control with scalability — a model that differentiates it from Amul’s mass-driven cooperative approach.

The “Amul Challenger” — A New Definition of Competition

Amul, governed by GCMMF, represents India’s largest cooperative, while Milky Mist stands as a privately-owned, vertically integrated, automation-led competitor. Here’s how Milky Mist’s model challenges the traditional dairy hierarchy:

| Metric | Amul | Milky Mist (FY25) |

|---|---|---|

| Business Model | Cooperative | Private, vertically integrated |

| Value-added product share | ~20% | 100% |

| EBITDA Margin | ~8–9% | 13.21% |

| Automation Level | Semi-automated | Fully automated |

| Distribution | Multi-layer cooperative | Direct cold chain & Visi-coolers |

| Brand Positioning | Mass market | Premium freshness & innovation |

| Procurement Network | 36 lakh farmers | 67,615 farmers (47% women) |

Milky Mist’s advantage lies not in size, but in efficiency, specialization, and data-driven operations. While Amul dominates volume, Milky Mist dominates value per litre, achieving the highest realization of INR 74 per litre, compared to peers’ average of INR 58 – INR 63.

This operational sharpness positions Milky Mist as India’s first premium dairy brand capable of challenging Amul’s everyday dominance — not through price, but through quality and consistency.

Conclusion — From “India’s Paneer Factory” to “Next-Gen Dairy Giant”

Milky Mist has transformed India’s dairy industry — shifting from the traditional cooperative “volume model” to a tech-driven precision approach. Built on focus, freshness, and full integration, it turned paneer into a modern FMCG category through automation and data-led efficiency. If Amul led the White Revolution, Milky Mist is driving a new “Smart Freshness Revolution,” blending innovation, automation, and nutrition to redefine Indian dairy.