Last Updated on January 6, 2025 by Krishna Bagra

Auto components manufacturer Endurance Technologies has submitted its draft red herring prospectus (DRHP) with market regulator SEBI. As we indicated earlier, Endurance Technologies IPO will facilitate an exit to private equity (PE) investor Actis Advisers. The IPO of the Aurangabad-based will involve sale of 24,613,024 shares through an offer for sale (OFS).

Out of the total, 19,295,968 shares will be offered by Actis while the remaining shares will be sold by company promoter Anurang Jain. Since Endurance Technologies IPO will be entirely an OFS, Endurance will not get any proceeds from the public offer.

Out of the total, 19,295,968 shares will be offered by Actis while the remaining shares will be sold by company promoter Anurang Jain. Since Endurance Technologies IPO will be entirely an OFS, Endurance will not get any proceeds from the public offer.

Anurag Jain directly holds 42.1% equity stake in the company while promoter group owns another 44.1%. Actis holds 19,295,968 shares or 13.7% equity stake in the company. Actis bought out Standard Chartered PE in Endurance Technologies in December 2011 in a deal worth USD71 million (INR372.5 crore).

Read Also: Actis plans partial exit through Endurance Technologies IPO

Endurance Technologies IPO follows Precision Camshafts

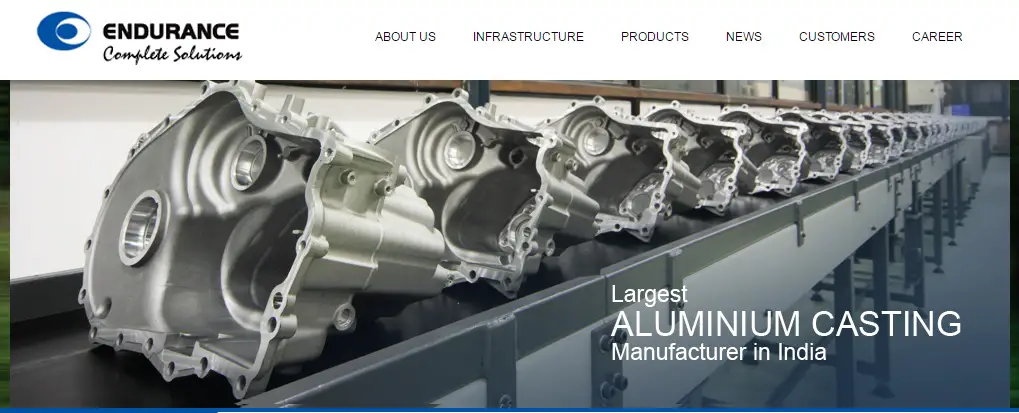

Established in 1985, Endurance operates 24 manufacturing facilities across the globe to make aluminium die castings, suspensions, transmissions and brakes. Its prominent suppliers include OEMs like Bajaj Auto, Mahindra & Mahindra (M&M), Eicher, Royal Enfield, Harley Davidson and Tata Motors.

Read Also: Hits and misses in India’s IPO market in H1 2016

According to the prospectus, the company earned a profit of INR2.89 billion (INR289.8 crore) in financial year 2016, marking third straight year of growth. Endurance Technologies’ top line also grew for the third year in FY 2016 to INR52.4 billion (INR5,240 crore).

| Endurance Technologies’ consolidated financial performance (in INR crore) | |||||

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | |

| Total revenue | 3,831.7 | 3,822.4 | 4,211.9 | 4,916.9 | 5,240.5 |

| Total expenses | 3,599.1 | 3,610.0 | 3,959.8 | 4,589.9 | 4,860.8 |

| Profit after tax | 182.3 | 169.2 | 204.4 | 252.4 | 289.8 |

Despite its highly diversified client base, the company has a high dependence on the domestic market. For FY2016, Endurance Technologies generated 70.1% of its total revenues from India while Europe accounted for the remaining 29.9%. The company claims to be the largest two-wheeler and three-wheeler automotive component manufacturer in India in terms of aggregate revenue.

Endurance Technologies IPO will be following industry peer Precision Camshafts which was the first public offer this year. Maini Precision Products and Sandhar Technologies are other IPO candidates from this space.