Akums Drugs – India’s largest contract-manufacturing pharmaceutical company – is gearing up for stock exchange listing as early as 2024. According to a Moneycontrol article, the company has finalized four investment banks for its public markets debut. The report cited unnamed industry people with knowledge of the matter and added that ICICI Securities, Citi, Axis Capital and Ambit have been tasked with Akums Drugs IPO.

While more details of the upcoming IPO are unknown at the moment, Akums Drugs IPO is likely to range somewhere between INR 1,500 and INR 2,000 crores.

Akums Drugs IPO: Speeding-up the Listing Plans

The latest report is indicative of a material change in the company’s strategy with regards to public market listing. Earlier this year, Akums’ Joint Managing Director Sanjeev Jain was quoted as saying that the company is targeting a listing in the next 2-3 years.

Since new public listings are a function of conditions in the secondary markets, it is hardly surprising that Akums Drugs IPO work has gained steam now. Nevertheless, the change in stance also means that investors can see lot more action in Akums Drugs IPO including filing of draft papers in the coming months.

Read Also: Biggest Unlisted Companies in India

Akums Drugs and Pharmaceuticals Limited: A Comprehensive Overview

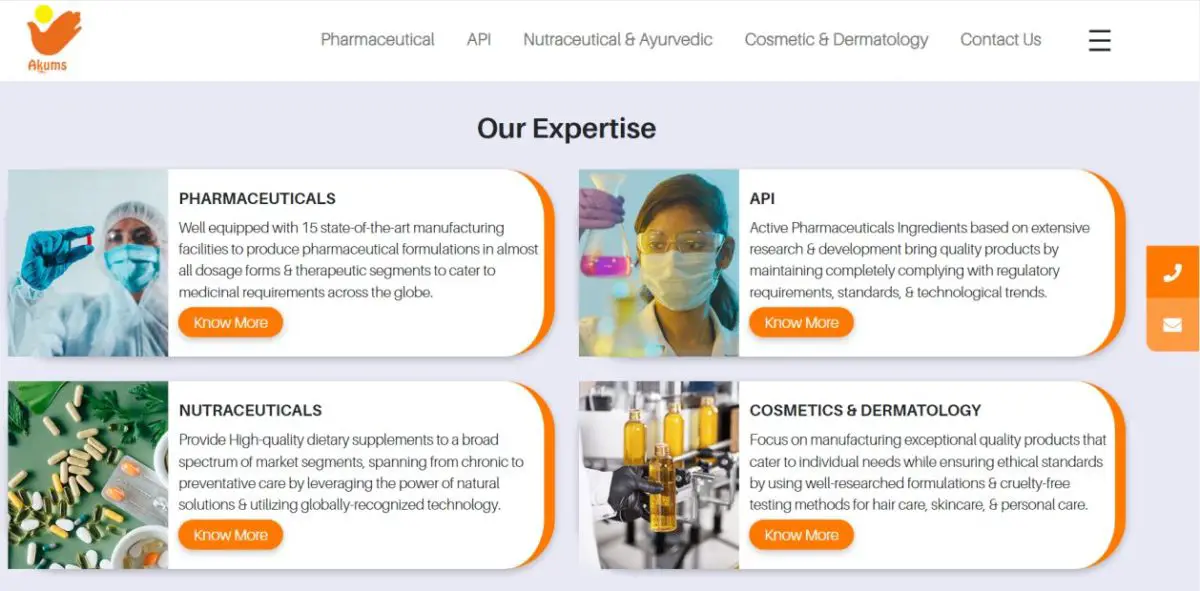

Akums Drugs is a well-known name in the Indian pharmaceutical market. The company started its operations in 2004 and today, is an internationally recognized WHO-GMP certified company. Their Offerings are primarily divided into the following categories –

- Pharmaceuticals

- API

- Nutraceutical

- Cosmetics & Derma

Akums Drugs undertakes and specializes in activities including manufacturing, Innovation, Research and Development, Regulatory, and Quality assurance. The company’s head office is situated in Delhi and has various manufacturing facilities and branches to cater to the customers.

In December 2019, Akums Drugs raised about USD 70 million in a funding round through healthcare-focused private equity firm, Quadria Capital. The PE firm recently divested its investment from the Indian biotechnology company, Concord Biotech, in its public issue.

Akums Drugs IPO: Business Segments

As mentioned above, the operations of Akums Drugs are divided into four broad segments, these are-

Pharmaceutical

Under the Pharmaceutical segment, the company has spread its operations very widely. Akums has over 10 manufacturing facilities and a Centralized Stability Centre to deliver the products on time to its customers.

Active Pharmaceutical Ingredients (API)

Akums Drugs is also engaged in manufacturing and sales of API, High Potency API, and API intermediates through its Akums Lifesciences Ltd. The manufacturing is carried through the three manufacturing units located in Haryana and Punjab. Its manufacturing capacity under various categories ranges from 750 MT/year to 1200 MT/Year.

The company is a leading API supplier. Its regulatory-approved facilities allow it to supply the products across 51 countries to its partners.

Nutraceutical & Ayurvedic

Another subsidiary company of Akums Drugs – Maxcure Nutravedics – makes Food Supplements, Nutraceuticals, Veterinary Feed Supplements, and Herbal & Ayurvedic Formulations. The company was established in the year 2010 and its facility has been approved by US-NSF. Manufacturing operations in these facilities are undertaken with the combination of traditional nutritional knowledge with modern science.

Cosmetic & Dermatology

Another broad category of products where Akums Drugs has specialized is Cosmetic & Dermatology. The company curates and manufactures products that can cater to the particular demands and requirements of every individual. .

Indian Pharmaceutical Industry

The domestic pharmaceutical industry of India was valued at an estimated sum of USD 42 billion in 2021. The industry is expected to attain the mark of USD 130 billion by 2030. Further, India stands as the world’s largest provider with a 20% share of total global pharmaceutical exports of generic medicines. The industry has evolved over time into a thriving industry growing at a CAGR of 9.43% over the past nine years.

Indian pharmaceutical industry caters to about 50% global demand for numerous vaccines, around 40% of generic demand in the US, and 25% of all medicine in the UK. India has a network of 3,000 drug companies and 10,500 manufacturing units in the domestic pharmaceutical sector.

Akums Drugs Financial Performance

The consolidated financial statements show that Akums Drugs and Pharmaceuticals clocked total sales of INR 3,677.2 crores for the Financial Year 2022 but incurred a loss of INR 250.8 crores. In the year, the total assets of the company have increased by 4.42%. Its EBITDA too has shown an impressive growth of 166.81% from the previous year.

Going forward, the company management has chalked out an aggressive growth plan that entails reaching turnover of over INR 10,000 crore by FY 2028. API business – which has somewhat remained in the shadows so far – is likely to aid this growth even as Jain is expecting the vertical to touch sales of INR 1,000 crore.

Akums Drugs IPO – Final Verdict

Akums Drugs has experience of over 20 years in the domestic pharma market and has emerged as a clear leader as far as contract manufacturing is concerned. As per reports, the company captures a manufacturing share of over 12.5% of the total drugs consumed in India.

The company has a wide operational capacity in terms of manufacturing and its reach. The products of the company are delivered within India and worldwide. It has about 13 manufacturing facilities for its formulations and API products which underline its extensive scale of operations.

Although the current financial health of the company is not in top-class, it has set aggressive targets which might aid profitability as well. Akums Drugs IPO is also likely to shape its prospects firmly and allow it to venture into newer segments and verticals.