Astron Paper & Board is coming up with its maiden public offer next week and it will be the 38th IPO to list on Indian mainboards this year. The IPO will open on 15 December and will remain open till 20 December. Priced in the range of INR45 – 50 per share, the IPO will be a fairly small one, raising only INR70 crore at the upper end of the price band. In fact, this will be the second smallest IPO this year after Salasar Techno Engineering which raised INR36 crore in July. Given the massive bullrun we are witnessing, it wouldn’t be surprising if the offer receives very strong demand. Neverthless, it is never a bad idea to know in detail about a company before committing your money and Astron Paper IPO review is a step in this direction.

Astron Paper & Board Mill IPO details | |

| Subscription Dates | 15 – 20 December 2017 |

| Price Band | INR45 – 50 per share |

| Fresh issue | 14,000,000 shares (INR63 – 70 crore) |

| Offer For Sale | Nil |

| Total IPO size | 14,000,000 shares (INR63 – 70 crore) |

| Minimum bid (lot size) | 280 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Astron Paper IPO Review: All fresh, no OFS

As mentioned above, Astron Paper IPO will raise as much as INR70 crore. There is no Offer For Sale (OFS) by existing shareholders so all these funds will go to the company. Astron Paper plans to use the proceeds towards:

- Setting up of additional facility for manufacturing of Kraft Paper with lower GSM (Grams per Square Meter) ranging from 80 to 180 GSM and lower BF (Burst Factor) ranging from 12 BF to 20 BF – INR23.02 crore

- Part repayment of unsecured loan availed by the company – INR8.1 crore

- Funding the working capital requirements of the company – INR23.9 crore

- General corporate purposes

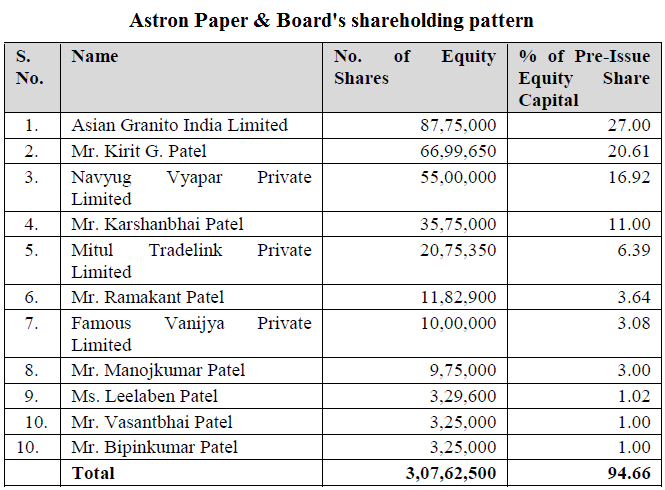

Astron Paper’s capital structure is quite simple and it has no external investor. The company is promoted by Mr Kirit G Patel, Mr Ramakant Patel, Mr Karshanbhai Patel and Asian Granito India Limited which is a listed company. Promoters and promoter group directly hold 62.64% in the company.

Astron Paper IPO Review: Paper for packaging industry

Like the name suggests, Astron Paper & Board is engaged into the production of paper and board, mostly kraft paper which is supplied to the packaging industry. Astron Paper is one of the major kraft paper manufacturers in Gujarat. It has installed capacity of 96,000 mt tonnes per annum at the manufacturing facility at Halvad. The facility is equipped with an in-house testing laboratory and produces kraft paper with GSM ranging from 140 to 350 and BF ranging from 22 to 35.

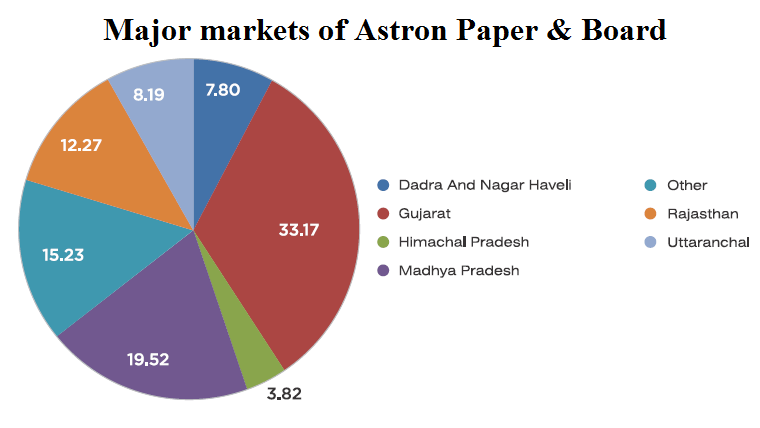

Being based in Gujarat, the state is the biggest market for the company. The other important states are Madhya Pradesh and Rajasthan. Between them, the three states account for nearly 65% of the company’s sales.

Astron Paper IPO Review: Strong growth, fueled by debt

The company has made strong growth in recent years and the table below captures this very well. Revenues grew from INR26.7 crore in FY2013 to INR184.6 crore in FY2017 and this pulled the company’s operations from a loss of INR4.1 crore to a profit of INR10 crore in the latest year. Much of this growth was fuelled by debt and not long ago, the company’s debt equity ratio was over 3 in FY2014. Nevertheless, it has come down to 2 in the latest year which has helped in improving profitability. In the latest year, the company’s net profit margin stood at 5.4%.

The situation has further improved in the latest six months of FY2018 and Astron Paper appears to be on track of growing its top and bottom-line from the last year. In fact, it has already earned profit of INR9.5 crore in the six months compared to INR10 crore for the last full year. This has boosted the profit margin to 8.6%.

Astron Paper and Board Mills’ financial performance (in INR crore) | ||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | H1 FY2018 | |

| Total revenues | 26.7 | 106.2 | 152.1 | 157.9 | 184.6 | 111.0 |

| Total expenses | 28.8 | 107.6 | 146.2 | 151.5 | 176.1 | 103.9 |

| Profit after tax | -4.1 | -3.0 | 4.1 | 6.1 | 10.0 | 9.5 |

| Net margin (%) | -15.4 | -2.8 | 2.7 | 3.9 | 5.4 | 8.6 |

Astron Paper IPO Review: Should you invest?

Per capita paper consumption in India is just above 13 kg, lagging massively behind the global average of 57 kg. At the same time, India is among the fastest growing markets for paper globally. This presents an exciting scenario with big consumption patterns likely to emerge in the coming years. According to a report prepared by FICCI, the Indian packaging industry is expected to grow from USD32 billion in FY2015 to USD73 billion by 2020. Accordingly, the demand of kraft paper is also estimated to increase to 6 million ton by 2025 from 3.5 million tonne in 2016 with a growth of 8% per annum.

It is not difficult to see this demand and the emergence of e-commerce is a great pointer. Traditionally, corrugated boxes were used in big sizes for movement of finished products from factories to warehouses and then to distributors. However, this chain has been disrupted as e-commerce players are using corrugated boxes of different sizes for almost every individual shipment. Corrugated boxes account for 85-90% of the total demand for kraft paper and this expected growth in paper demand is likely to benefit kraft paper manufacturers like Astron Paper.

Increasing consumption from a large and growing middle class is not only driving demand of kraft paper but is also fueling product innovation in the industry. Lighter weights of paper to achieve the same results and solutions that can interface with digital print technologies are all examples of such innovation. Astron Paper is already taking steps to produce low GSM and low BF paper and should benefit from this trend.

Not all is positive with Astron Paper and its overdependence on imports for waste paper is particularly noteworthy. During FY2017, imports accounted nearly 96.81% of its total waste paper consumption and this exposes the company to an array of factors such as foreign exchange, shipment delays transit damages etc.

Nevertheless, the company’s surging top line and improving profitability show that there is clearly operational leverage at play. In terms of valuations, it is not expensive as well. It earned INR3.06 per share in FY2017, which means the IPO is in the price/earnings (P/E) range of 14.70 – 16.33. This compares with 17.7 for Shree Ajit Pulp and Paper and 12.25 for South India Paper Mills. These two are the closest competitors for Astron paper while a bigger peer Genus Paper and Board trades at a P/E ratio of 20.37. However, all the three companies fare poorly on other parameters like Return on Net Worth (RONW) in single digits. In comparison, Astron Paper’s RONW is quite high at nearly 22%.

In all, Astron Paper IPO Review tells us that the company is sweetly positioned to benefit from the expected demand of packing paper and decent valuations, despite high growth and improvement in profitability, further make a strong case for the company.