India’s IPO market is warming up again with a number of IPOs lined up in December. Azad Engineering is aiming to launch its IPO next week. It aims to mobilize INR 740 crores by way of a public offer that includes a fresh issue of shares and an Offer for Sale (OFS) by existing investors. Here are the top things to know in Azad Engineering IPO review.

#1 Azad Engineering IPO Review: Business Overview

Azad Engineering is a producer of high-quality product lines catering to global original equipment manufacturers (OEMs) in the energy, aerospace & defense, and oil & gas sectors. Specializing in the fabrication of intricate and precisely engineered forged and machined components, the company focuses on items vital to missions and life, resulting in some products carrying a stringent “zero parts per million” defects requirement. As of September 30, 2023, Azad Engineering boasts around 45 qualified manufacturing processes and 1,400 qualified parts and components.

#2 Azad Engineering IPO Review: Business Verticals

Energy: Airfoils/blades are among the most crucial three-dimensional (3D) rotating and stationary components within the compression section of a turbine. These components play a pivotal role in energy generation through natural gas, nuclear (clean energy), and thermal operations. To endure the elevated pressure levels, airfoils/blades are crafted from exotic/super alloys, employing a distinct manufacturing process developed by the company.

These components are sophisticated and intricately designed, posing a substantial entry barrier in both qualification and production aspects. The company has established a stage-wise process engineering approach to fabricate and create these parts. This involves an in-house process for forging and machining turbine blades, encompassing the design and manufacture of forging dies, tooling, and fixtures.

Aerospace and Defense: The company manufactures medium and highly complex precision components, along with assemblies/sub-assemblies crucial for both civil and military applications. These play a mission-critical role in various platforms, including airfoils/blades for aircraft engines and APUs, body valves, housing mounts, housing compressors, fan blisks, mixed flow impellers, housing fans, shells, housings, aerostructures, turbine wheels, nozzles, unison rings, lever arms, hydraulic systems, fuel inerting systems, flight control systems, actuating systems, and others.

These components are commonly manufactured using castings, forgings, bar stock, tubes, and plates, finding extensive applications across diverse commercial and military platforms. The sub-assemblies involve rigorous processes, including precision machining, testing, specialized procedures, and thermal spray coatings, such as high-velocity oxygen fuel coating.

The company also produces industrial aerospace standard fluid distribution components integrated into the hydraulic systems of aircraft.

Oil and Gas: The company has expanded its operations into the oil and gas sector, leveraging its specialized precision manufacturing capabilities. It holds the belief that this industry holds significant importance, given the diverse applications of oil and natural gas in transportation, electricity generation, heating, and manufacturing. The oil and gas sector encompasses activities such as exploration, extraction, refining, and the distribution of fossil fuels, primarily oil and natural gas.

Mr Vishnu Malpani, Whole-Time Director (Right)

#3 Azad Engineering IPO Analysis: Offer Details and Shareholders

The Azad Engineering IPO is scheduled for 20 to 22 December 2023, with a price range of INR 499 to 524 per share. The IPO consists of an Offer for Sale (OFS) of 9,541,957 shares, valuing the offering between INR 476.14 – 500 crores, and a Fresh Issue of 4,580,151 shares, amounting to as much as INR 240 crores. It is worth highlighting that the company will not get any funds from OFS portion. The minimum bid size is 28 shares, priced at INR 14,672, and retail investors are allotted 35% of the shares. The IPO will be listed on both BSE and NSE.

Its external investors include Piramal Group and DMI Finance. As an aside, the company counts Sachin Tendulkar, PV Sindhu, Saina Nehwal, and VVS Laxman among its minority shareholders.

#4 Azad Engineering IPO Review: Manufacturing Facilities

As of September 30, 2023, the company operates four manufacturing facilities in Hyderabad, Telangana, India, spanning approximately 20,000 square meters. These facilities boast a combined annual installed capacity of 642,310 hours per annum, with an actual annual production of 578,316 hours and a capacity utilization rate of 90% per annum. The company intends to finance its capital expenditure requirements using the net proceeds, directed towards the acquisition of plant and machinery for its existing manufacturing facilities, as well as the employment of a skilled workforce comprising 1,300 personnel.

#5 Azad Engineering IPO Review: Customers

Since its inception, the company has supplied components to countries including the USA, China, Europe, the Middle East, and Japan. Consequently, it has become a pivotal link in the global supply chain for OEMs/customers. The customer base comprises global OEMs across the energy, aerospace and defense, and oil and gas industries, including General Electric, Honeywell International Inc., Mitsubishi Heavy Industries, Ltd., Siemens Energy, Eaton Aerospace, and MAN Energy Solutions SE.

For the six months ended 30 September 2023 and FY 2023, 2022, and 2021, (a) contribution to revenue from operations from the top five customers was INR 96.34 crore, INR 158.82 crore, INR 106.61 crore, and INR 73.51 crore, respectively and (b) constituted 60.69%, 63.11%, 54.82% and 59.90%, respectively, of the total revenue from operations. In the six months ended 30 September 2023 and FY 2023, 2022, and 2021 the company has a diversified customer base with the top 10 customers accounting for 79.71% and 79.76%, 73.64%, and 81.47%, respectively of the revenue from operations.

#6 Azad Engineering IPO Analysis: Financial Performance

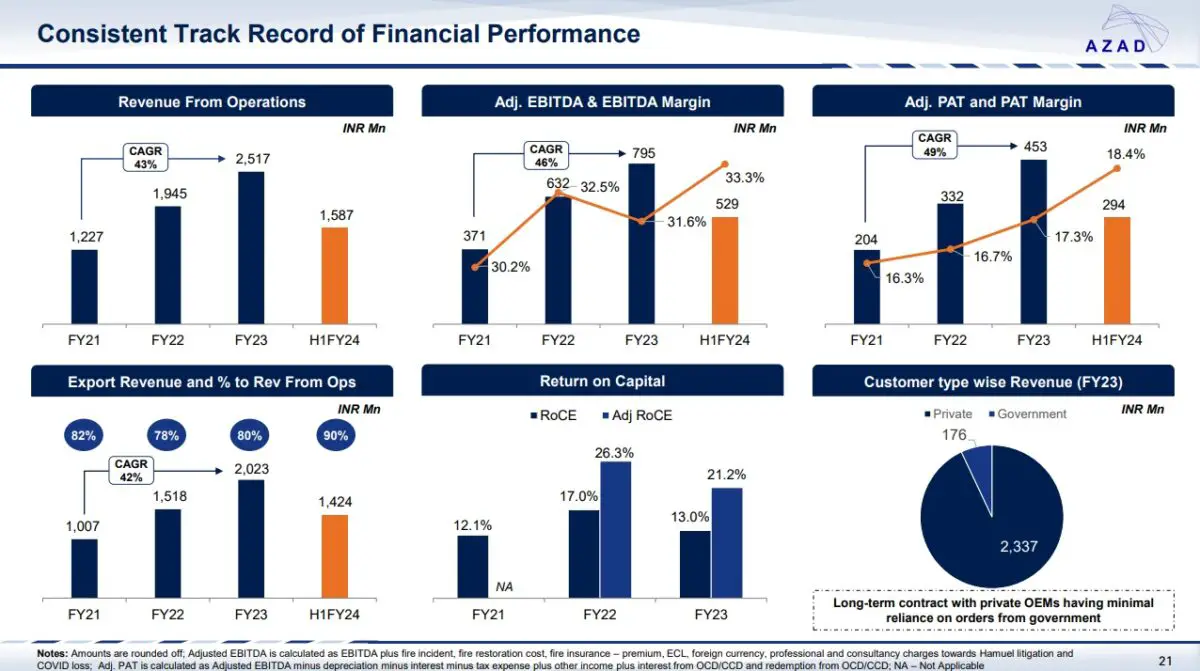

Azad Engineering increased its revenue from INR 124 crore in FY20 to INR 251.68 crore in FY23 (CAGR of 27% between FY20 – 23) with an EBITDA margin of 31.61% in FY23. The company is one of the fastest growing manufacturers in terms of revenue growth for the period between FY20 – 23 with one of the highest EBITDA margins.

| FY 2021 | FY 2022 | FY 2023 | H1 FY 2024 | |

| Revenue | 122.72 | 194.47 | 251.68 | 158.75 |

| Expenses | 108.79 | 159.13 | 248.36 | 137.92 |

| Net income | 11.50 | 29.46 | 8.47 | 26.89 |

| Margin (%) | 9.37 | 15.15 | 3.37 | 16.94 |

The strong performance has continued in the latest reported period of six months ending 30 September 2023. This is an important element in Azad Engineering IPO Analysis.

#7 Azad Engineering IPO Review: Should You Invest?

As one can see, there are certain advantages the company enjoys. For one, it operates in a competitive but rewarding industry which gets reflected in its healthy margins. Return ratios adjusted for exceptions look even better as the management explained in its commentary. Revenue growth is evidently quite strong but the real kicker comes in the form of quality of revenues. The average relationship with some of its global OEMs is over 10 years which is a great indication of the company’s competitiveness and customer retention.

The other aspect of Azad’s business is the high entry-barrier in the form of stringent qualification processes by OEMs. Since these are mission & life-critical components, onboarding a new vendor can take up to 48 months. Simply put, it is a business that can’t be replicated with just money.

So far so good! The company comes across to be nicely placed in a key industry with a high degree of export volumes.

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 2.53 | 6.49 | 1.79 |

| PE ratio | – | – | 278.77 – 292.74 |

| RONW (%) | 12.65 | 25.37 | 4.23 |

| NAV | 20.02 | 25.58 | 42.30 |

| ROCE (%) | 12.09 | 16.95 | 12.99 |

| EBITDA (%) | 22.94 | 32.02 | 28.72 |

| Debt/Equity | 0.97 | 1.64 | 1.47 |

Let’s take a look at valuations. The PE ratio may appear high but it comes down after adjusting for debt reduction following the IPO. The company plans to repay debt amounting to INR 138.2 crore from IPO proceeds. Since its current long-term borrowings stand at INR 213.7 crore, repayment will bring a significant reduction in debt and interest payments.

While the company has mentioned MTAR Technologies, Paras Defence and Space Technologies, Dynamatic Technologies, and Triveni Turbine among its competitors, it is worth highlighting that these companies may not be strictly comparable with Azad Engineering.

Overall, Azad Engineering IPO review tells us that the company has a robust business model, strong credentials and management expertise that has delivered well in the past. The informal IPO grey market has given a thumbs up to the IPO with a premium of nearly INR 400 per share.