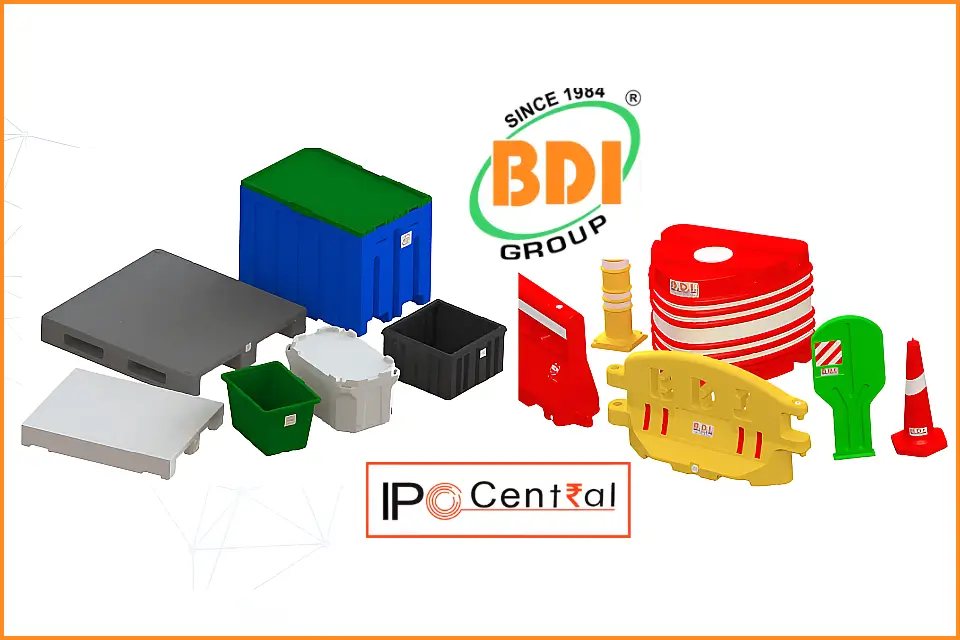

BD Industries IPO Description – BD Industries (Pune), established in 1984, began with the repair and manufacturing of traction batteries and soon diversified into rotomoulded plastic container boxes. The acquisition of Toyo Containers in 2010 marked a strategic expansion into high-quality rotomoulded battery boxes and water tanks. Over the years, the company has evolved into a leading manufacturer and trader of plastic products for diverse sectors, including automotive, industrial, and infrastructure.

As of 31 March 2025, BD Industries reported consolidated revenue from operations of INR 82.38 crore, with manufactured goods contributing INR 79.03 crore. Key automotive offerings include plastic fuel tanks for off-road vehicles, urea tanks, fenders, hydraulic tanks, and cabin roofs. Non-automotive segments span road safety, water management, marine, and healthcare applications.

The company operates three fully functional manufacturing facilities in Pune (Maharashtra), Dewas (Madhya Pradesh), and Hoshiarpur (Punjab), with a fourth facility under construction in Zaheerabad (Telangana). Of these, the Pune plant is owned directly by BD Industries (Pune) Limited, while the others are managed by its wholly owned subsidiary, B.D. Industries (India) Private Limited.

Promoters of BD Industries – Dalbirpal Saini, Arti Saini, Akshay Saini, and Rahul Saini

Table of Contents

BD Industries Offer Details

| BD Industries IPO Dates | 30 July – 1 August 2025 |

| BD Industries Issue Price | INR 102 – 108 per share |

| Fresh issue | 42,00,000 shares (INR 42.84 – 45.36 crore) |

| Offer For Sale | NIL |

| Total IPO size | 42,00,000 shares (INR 42.84 – 45.36 crore) |

| Minimum bid | 2,400 shares (INR 2,59,200) |

| Lot Size | 1,200 shares (INR 1,29,600) |

| Face Value | INR 10 per share |

| Individual Allocation | 35% |

| Listing On | BSE SME |

BD Industries Financial Performance

| FY 2023* | FY 2024* | FY 2025 | |

| Revenue | 54.61 | 54.25 | 82.38 |

| Expenses | 53.08 | 50.92 | 72.96 |

| Net income | 1.49 | 3.18 | 8.15 |

* All Standalone Data

BD Industries Offer News

- BD Industries RHP

- BD Industries Draft Prospectus

- ASBA IPO Forms

- Live IPO Subscription Status

- Highest SME IPO Subscription in 2025

BD Industries Valuations & Margins

| FY 2023 | FY 2024 | FY 2025 | |

| EPS | 1.49 | 3.18 | 7.60 |

| PE ratio | – | – | 13.42 – 14.21 |

| RONW (%) | 14.41 | 23.49 | 35.97 |

| NAV | 10.35 | 13.52 | 21.12 |

| ROCE (%) | 24.52 | 35.13 | 43.50 |

| EBITDA (%) | 5.89 | 10.67 | 18.92 |

| Debt/Equity | 0.21 | 0.37 | 1.05 |

BD Industries IPO GMP Today

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| Coming soon | – | – | – |

BD Industries IPO Subscription – Live Updates

| Category | QIB | NII | Individual | Total |

|---|---|---|---|---|

| Shares Offered | 7,96,800 | 5,97,600 | 13,94,400 | 27,88,800 |

| 1 Aug 2025 | 1.27 | 4.02 | 1.32 | 1.89 |

| 31 Jul 2025 | 1.01 | 3.06 | 0.64 | 1.26 |

| 30 Jul 2025 | 1.01 | 2.98 | 0.32 | 1.09 |

The market maker reservation portion of 2,16,000 shares and the anchor investors portion of 11,95,200 shares are not included in the above calculations.

BD Industries IPO Allotment Status

BD Industries IPO allotment status is now available on Cameo Corporate Services’ website. Click on the Cameo Corporate Services weblink to get allotment status.

BD Industries IPO Dates & Listing Performance

| IPO Opening Date | 30 July 2025 |

| IPO Closing Date | 1 August 2025 |

| Finalization of Basis of Allotment | 4 August 2025 |

| Initiation of refunds | 5 August 2025 |

| Transfer of shares to demat accounts | 5 August 2025 |

| IPO Listing Date | 6 August 2025 |

| Opening Price on BSE SME | INR 108.9 per share (up 0.83%) |

| Closing Price on BSE SME | INR 108.2 per share (up 0.19%) |

BD Industries Offer Lead Manager

ARYAMAN FINANCIAL SERVICES LIMITED

60, Khatau Building, Ground Floor,

Alkesh Dinesh Modi Marg, Fort, Mumbai – 400 001

Phone: +91 22 – 6216 6999

Email: [email protected]

Website: www.afsl.co.in

BD Industries Offer Registrar

CAMEO CORPORATE SERVICES LIMITED

“Subramanian Building”, No. 01, Club House Road,

Mount Road, Chennai – 600 002, Tamil Nadu

Phone: +91-44-40020700/ 2846 0390

Email: [email protected]

Website: www.cameoindia.com

BD Industries Contact Details

B. D. INDUSTRIES (PUNE) LIMITED

15th Flr, 1501-B, Universal Majestic, PL Lokhande Marg,

G M Link Road, Nr R B K International School, Mumbai City,

Govandi West Mumbai, Maharashtra, India, 400043

Phone: 022-6249-0801

E-mail: [email protected]

Website: www.bdi-group.org

IPO FAQs

What is the BD Industries IPO size?

BD Industries’ offer size is INR 42.84 – 45.36 crores.

What is the BD Industries’ offer price band?

BD Industries’ public offer price is INR 102 – 108 per share.

What is the lot size of the BD Industries IPO?

BD Industries offer lot size is 1,200 shares.

What is BD Industries IPO GMP today?

BD Industries IPO GMP today is INR NA per share.

What is the BD Industries kostak rate today?

BD Industries’ kostak rate today is INR NA per application.

What is the BD Industries IPO Subject to Sauda rate today?

BD Industries Subject to Sauda rate today is INR NA per application.