What is Dividend Stocks?

Best dividend stocks in India are shares of companies that regularly distribute a portion of their earnings to their shareholders in the form of a dividend. These payments can be made quarterly or annually by companies across various sectors as a way to share profits with their investors.

Table of Contents

Benefits of Dividend Investing

Dividend investing has certain characteristics in terms of the stocks and businesses behind it, as well as the investors preferring this investment style. Typically, companies pay dividends when they are short of investing opportunities which can generate higher rates of return. This largely includes companies in mature industries where the business is saturated.

However, exceptions exist and in India, PSUs are a fine example of this. PSUs are good dividend payers simply because the government, generally the largest shareholder in PSUs, gets revenues this way.

Similarly, the best dividend stocks India are usually preferred by individuals who are looking for regular cash flows. These include retired individuals where the safety of capital and regular cash flows are the most important factors.

Although dividends can be reinvested to buy more shares, doing this runs contrary to the original requirement of receiving regular cash flows. Since dividends are now taxed in India, it further complicates the situation. These are the top dividend stocks with high dividend yields and reasonable valuations.

Read Also: All-time Largest IPOs in India at a Glance

List of High Dividend Stocks in India

| Company | Industry | Market Cap INR (Cr) |

| Chennai Petroleum Corporation | Refineries | 10,734 |

| Coal India | Mining | 2,34,954 |

| Bharat Petroleum Corporation | Refineries | 1,50,091 |

| Hindustan Petroleum Corporation | Refineries | 92,879 |

| Indian Oil Corporation | Refineries | 2,12,807 |

#1 Chennai Petroleum Corporation – Biggest Among Top Dividend Stocks in India

Chennai Petroleum is in the business of refining crude oil to produce and supply various petroleum products, specifically lubricating oil additives. It is a government-owned company headquartered in Chennai and thus, its name in the list of the best dividend stocks India is not surprising.

The company has a refining capacity of 10.45 MMTPA. It is entering into a Joint venture with Indian Oil for a 9 MMTPA refinery. Chennai Petroleum has a strategic partnership with Indian Oil for the marketing of LPG, Motor spirit, ATF, and diesel. The company also produces nationally important products such as Navy-grade NATO diesel, Missile fuel Vajravega, and Rocket Propellant.

Revenue – INR 59,356 crore

Net income – INR 214 crore

3-Year sales growth – 11.3%

ROCE -4.30%

PE Ratio – 50.1

Dividend Yield – 7.73%

#2 Coal India – Dividend Investing Imperative

Coal India is a Maharatna company owned by the Government of India. Coal India mainly operates in the mining and production of coal and is the country’s largest coal producer. Major consumers of the company’s products are the power, steel, cement, and fertilizer sectors.

Coal India had highest highest-ever production of 781 MT in FY 2025 from 310 working mines. The company is adopting modern techniques like blast-free selective mining for better quality and consistent-size coal. Coal India is diversifying in clean energy through its subsidiary CIL Solar PV Limited.

Revenue – INR 1,43,3694 crore

Net income – INR 35,302 crore

3-Year sales growth – 9.33%

ROCE – 48.0%

PE Ratio – 6.67

Dividend Yield – 6.67%

#3 Bharat Petroleum Corporation – Completing Oil Marketing Triad

Bharat Petroleum (BPCL) is a Government-owned company that operates in the refining of crude oil and marketing of petroleum products. The company operates 3 refineries with a total capacity of 35.30 MMTPA.

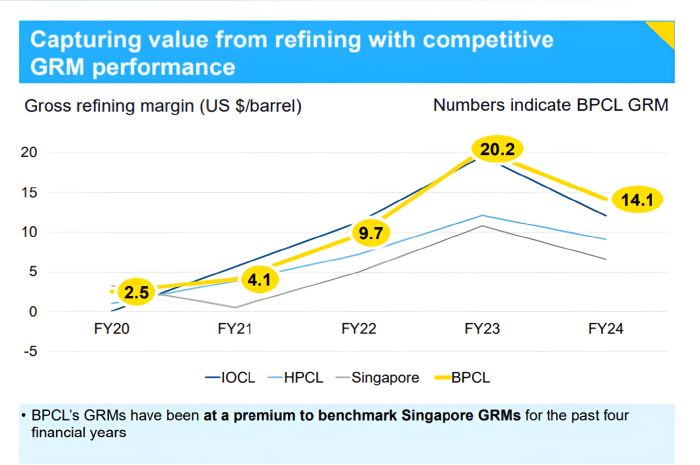

Bharat Petroleum has operational excellence with Gross refining margins (GRM) of USD 14.14 /bbl highest in the industry. The company is planning to expand its capacity to 45 MMTPA through the expansion of Mumbai and Kochi refineries, and its expansion of Bina refinery by 5 MMTPA is underway. BPCL is in a joint venture with Petronet LNG to operate LNG terminals at Kochi and Dahej.

Bharat Petroleum has 2,213 CNG outlets in India and is also enhancing its petrochemical capacity up to 3.2 MMTPA by 2029. It has been awarded as Innovator of the Year for “BharatH2Sep Technology”, and “K Model®” named new product of the year: Shaping the Future Through Innovation.

Revenue – INR 4,40,272 crore

Net income – INR 13,337 crore

3-Year sales growth – 8.28%

ROCE – 16.2%

PE ratio – 11.0

Dividend Yield – 6.06%

#4 Hindustan Petroleum Corporation – Another PSU Among Best Dividend Stocks India

Hindustan Petroleum Corporation operates in the business of refining crude oil and marketing petroleum products and is a subsidiary of Oil and Natural Gas Corporation (ONGC) which is owned by the Government of India. The company owns and operates the largest lube refinery in India with a refining capacity of 23.2 MMTPA. The company holds a 20.54% domestic market share in petroleum products in India.

Hindustan Petroleum has the second-largest retail network in India with 23,747 retail outlets. It also has the second-largest petroleum product pipeline in India, with a total pipeline network of 5,134 KM. The company has a joint venture with the Rajasthan Government for a refinery in Pachpadra, Rajasthan, with a total capacity of 9 MMTPA, and it is also enhancing its presence in LNG, with a 5 MMTPA LNG terminal at Chhara, Gujarat.

Revenue – INR 4,34,106 crore

Net income – INR 6,736 crore

3-Year sales growth – 7.45%

ROCE – 10.5%

PE Ratio – 13.8

Dividend Yield – 2.37%

#5 Indian Oil Corporation

Indian Oil Corporation – among the largest companies operating in the petroleum industry – is controlled by the Government of India. It is the largest refiner in the country, operating 11 refineries with 80.8 MMTPA refining capacity and holds a 31% share in domestic refining capacity. The company is the second-largest petrochemical player with a capacity of 4 MMTPA.

Indian Oil has a strong focus on innovation through R&D, it has filed 1,809 patents and doubled granted patents in the last 5 years. The company has also delivered impressive profit growth of 21.5% CAGR over 5 years while maintaining a healthy dividend yield and dividend payout.

Revenue – INR 7,58,106 crore

Net Income – INR 13,789 crore

3-Year sales growth – 8.76%

ROCE – 7.37%

PE Ratio – 17.6

Dividend Yield – 1.96%

As you can see, the list of high dividend stocks in India is dominated by PSUs, especially in the energy space. This is not surprising given the ownership of these companies by the government. Nevertheless, a longer list of high dividend stocks may include private companies.