Billwin Industries Rights Issue is scheduled on 13 May – 10 Jun 2024

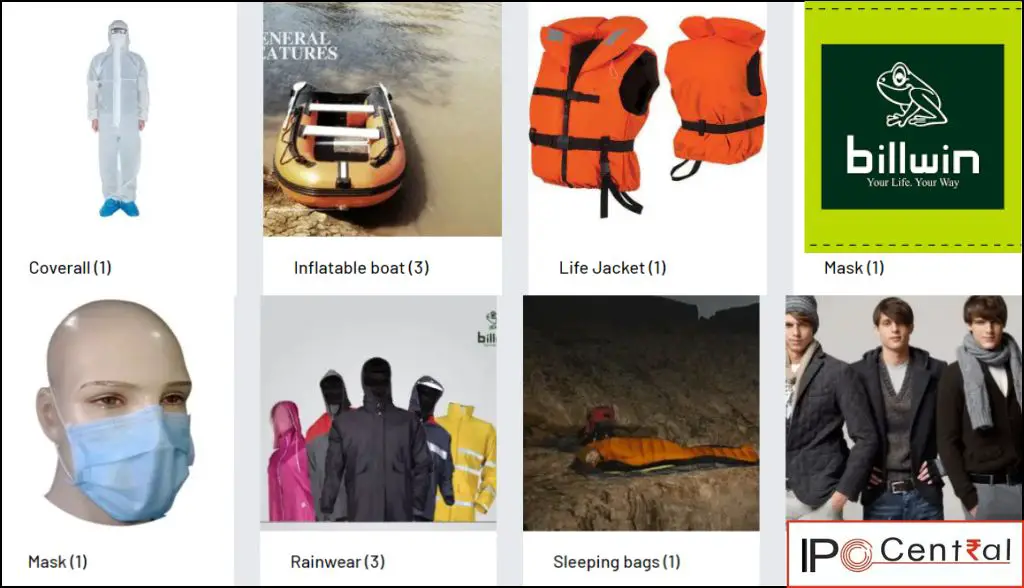

Founded in 2014, Billwin Industries is in the business of manufacturing protective gear, including rainwear, life jackets, and inflatable boats, which are used for safety in seas and other water bodies. The raw material used for manufacturing these protective gears is known as coated fabric. The company also trades in the protective gear it produces.

Billwin Industries’ product range includes raincoats, rain jackets, pulsar jackets, winter jackets, river raft boats, inflatable dinghies, sleeping bags, school bags, life jackets, rucksacks, and face masks, among other items. The company also sells its products through e-commerce platforms such as Amazon, Flipkart, Shopclues, Xerve, and BuyHatke.

The company’s manufacturing unit is situated in West Mumbai, Maharashtra. It sells its products through a variety of channels, including tenders, distributors, and retailers. Its distribution network spans multiple states, including Maharashtra, Kerala, Gujarat, Chhattisgarh, Tamil Nadu, Assam, Haryana, and Trivandrum Tripura.

Table of Contents

Billwin Industries Rights Issue Details

| Billwin Industries Rights Issue Date | 13 May – 10 Jun 2024 |

| Billwin Industries Rights Issue Price | INR 34 per share |

| Issue Size (in Shares) | 2,130,724 shares |

| Issue Size (in INR) | INR 7.24 crore |

| Issue Entitlement | 1 equity shares for every 1 equity shares held on record date |

| Terms of Payment | Fully payable at the time of application |

| Billwin Industries Rights Issue Record Date | 29 April 2024 |

| Face Value | INR 10 per share |

| Listing On | BSE |

Billwin Industries Rights Issue Calculation

| Billwin Industries Rights Issue Price | INR 34 per share |

| Market Price on Rights Issue Approval | INR 87.5 per share |

| Dilution Factor (X) | 2 |

| Fair Value After Dilution at Prevailing Price | INR 60.75 per share |

Billwin Industries Financial Performance

| FY 2021 | FY 2022 | FY 2023 | |

| Revenue | 2.85 | 4.39 | 4.82 |

| Expenses | 2.76 | 4.09 | 3.81 |

| Operating Margin (%) | 14.74 | 14.81 | 29.05 |

| Net Income | 0.06 | 0.22 | 0.74 |

| ROCE (%) | 5.13 | 6.99 | 14.32 |

All Standalone data

Billwin Industries Rights Offer Objectives

The net proceeds from the offer are proposed to be used for

- Funding the working capital requirement of the company – INR 5.57 crore

- General corporate purposes – INR 1.45 crore

Billwin Industries Rights Offer Documents

- Billwin Industries Rights Issue Application Form

- Billwin Industries Letter of Offer

- Board Meeting Outcome

- Rights Issue in 2024

Billwin Industries Rights Issue Dates

| Rights Issue Approval Date | 22 April 2024 |

| Rights Issue Record Date | 29 April 2024 |

| Credit of Rights Entitlement | Coming soon |

| Rights Issue Opening Date | 13 May 2024 |

| Last Date for Market Renunciation | 15 May 2024 |

| Rights Issue Closing Date | 10 June 2024 |

| Finalization of Basis of Allotment | 23 May 2024 |

| Rights Allotment Date | 23 May 2024 |

| Credit Date | 23 May 2024 |

| Listing Date | 27 May 2024 |

Billwin Industries Rights Offer Registrar

BIGSHARE SERVICES PRIVATE LIMITED

S6-2, 6th Floor, Pinnacle Business Park,

Next to Ahura Centre, Mahakali

Caves Road, Andheri East, Mumbai – 400 093

Phone: +91 22 6263 8200122

Email: [email protected]

Website: www.bigshareonline.com

Billwin Industries Contact Details

BILLWIN INDUSTRIES LIMITED

79, Vishal Industrial Estate, Village Road,

Nahur (VV), Mumbai – 400078

Phone: 022 -25668112

Email: [email protected]

Website: www.billwinindustries.com

Billwin Industries Rights Offer FAQs

What is the Billwin Industries Rights Issue Price?

The issue price is INR 34 per share.

What is the Billwin Industries Rights Issue entitlement ratio?

The eligible shareholders are offered 1 Equity Shares for every 1 Equity Shares held on the record date.

What is the Billwin Industries Rights Issue Record Date?

The Record date is 29 April 2024.

How to Apply in Billwin Industries Rights Offer?

The best way to apply in Billwin Industries Rights Offer is through Internet banking ASBA. You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an application Form form and deposit the same to your broker.