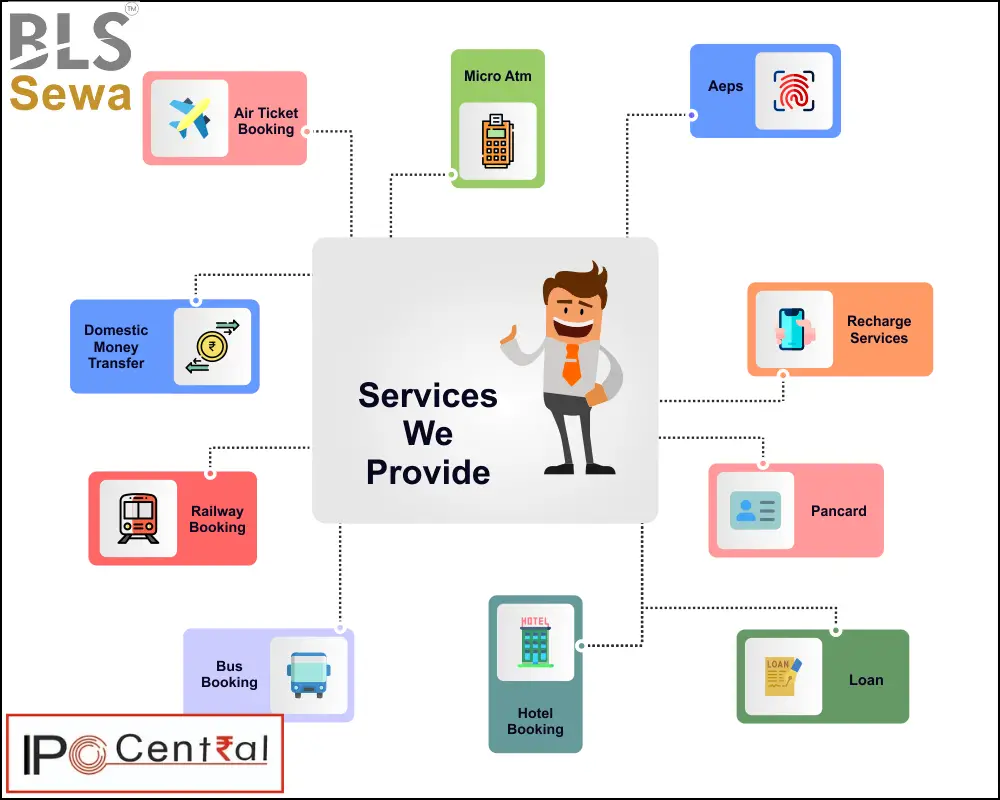

BLS E-Services IPO Description – BLS E-Services is a leading technology-enabled digital service provider, offering (i) Business Correspondents services to major banks in India, (ii) Assisted E-services, and (iii) E-Governance Services at grassroots levels in India. Through its robust network, the company provides access points for the delivery of essential public utility services, social welfare schemes, healthcare, financial, educational, agricultural, and banking services for governments (G2C) and businesses (B2B) alike. Additionally, it offers a host of B2C services to citizens in urban, semi-urban, rural, and remote areas.

BLS E-Services is a subsidiary of BLS International Services which specializes in delivering visa, passport, consular, and various citizen services to state and provincial governments in India and abroad.

As of 31 March 2023, BLS E-Services boasts a network of 92,427 BLS Touchpoints and 402 BLS Stores. As of 30 June 2023, BLS E-Services employs a total of 3,071 individuals, which includes 2,413 contract employees.

Promoters of BLS E-Services – BLS International Services Limited

Table of Contents

BLS E-Services IPO Details

| BLS E-Services IPO Dates | 30 Jan – 1 Feb 2024 |

| BLS E-Services Issue Price | INR 129 – 135 per share (Shareholder Discount – INR 7 per share) |

| Fresh issue | 23,030,000 shares (INR 297.09 – 310.9 crore) |

| Offer For Sale | NIL |

| Total IPO size | 23,030,000 shares (INR 297.09 – 310.9 crore) |

| Minimum bid (lot size) | 108 shares (INR 14,580) |

| Face Value | INR 10 per share |

| Retail Allocation | 10% |

| Listing On | BSE, NSE |

BLS E-Services Financial Performance

| FY 2021 | FY 2022 | FY 2023 | H1 FY 2024 | |

| Revenue | 64.49 | 96.70 | 243.06 | 156.18 |

| Expenses | 61.31 | 91.63 | 216.71 | 137.27 |

| Net income | 3.15 | 5.38 | 20.33 | 14.68 |

| Margin (%) | 4.88 | 5.56 | 8.36 | 9.40 |

BLS E-Services Offer News

BLS E-Services Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 0.52 | 0.89 | 3.02 |

| PE ratio | – | – | 42.72 – 44.70 |

| RONW (%) | 34.30 | 36.93 | 16.46 |

| NAV | 1.53 | 2.42 | 18.76 |

| ROCE (%) | 29.68 | 28.39 | 30.62 |

| EBITDA (%) | 8.39 | 8.76 | 14.73 |

| Debt/Equity | 1.14 | 1.01 | 0.05 |

BLS E-Services IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 5 February 2024 | 175 | – | – |

| 3 February 2024 | 175 | – | – |

| 2 February 2024 | 170 | – | – |

| 1 February 2024 | 170 | – | – |

| 31 January 2024 | 155 | – | – |

| 30 January 2024 | 150 | – | – |

| 29 January 2024 | 140 | – | – |

| 27 January 2024 | 120 | – | – |

| 26 January 2024 | 115 | – | – |

| 25 January 2024 | 95 | – | – |

| 24 January 2024 | 55 | – | – |

BLS E-Services IPO Objectives

The company proposes to utilize the Net Proceeds towards funding the following objects:

- Strengthening the technology infrastructure to develop new capabilities and consolidating its existing platforms – INR 97.59 crore

- Funding initiatives for organic growth by setting up BLS Stores – INR 74.78 crore

- Achieving inorganic growth through acquisitions – INR 28.71 crore

- General Corporate Purposes

BLS E-Services IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Shareholder | Total |

|---|---|---|---|---|---|

| Shares Offered | 6,218,154 | 3,109,050 | 2,072,700 | 2,303,000 | 13,702,904 |

| 1 Feb 2024 | 123.30 | 300.05 | 236.62 | 15.31 | 162.40 |

| 31 Jan 2024 | 2.68 | 94.09 | 125.46 | 7.38 | 42.78 |

| 30 Jan 2024 | 2.19 | 29.70 | 49.40 | 2.80 | 15.67 |

The anchor investor portion of 93,27,096 shares is not included in the above calculations.

BLS E-Services – Comparison With Listed Peers

| Company | Face Value | PE ratio | EPS | RONW (%) | NAV | Revenue (Cr.) |

| BLS E-Services | 10 | 44.70 | 3.02 | 16.46 | 18.76 | 246.29 |

| EMudhra | 5 | 500.60 | 8.01 | 15.75 | 53.02 | 248.76 |

BLS E-Services IPO Allotment Status

BLS E-Services IPO allotment status is now available on the KFin Tech website. Click on this link to get allotment status.

BLS E-Services IPO Dates & Listing Performance

| IPO Opening Date | 30 January 2024 |

| IPO Closing Date | 1 February 2024 |

| Finalization of Basis of Allotment | 2 February 2024 |

| Initiation of refunds | 5 February 2024 |

| Transfer of shares to demat accounts | 5 February 2024 |

| BLS E-Services IPO Listing Date | 6 February 2024 |

| Opening Price on NSE | INR 305 per share (up 125.93%) |

| Closing Price on NSE | INR 366 per share (up 171.11%) |

BLS E-Services IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi – Subscribe

Axis Capital –

Antique Stock Broking –

Arihant Capital – Neutral

Ashika Research –

Asit C Mehta –

BP Wealth – Subscribe

Capital Market – May Apply

Canara Bank Securities – Subscribe

Choice Broking – Subscribe

Dalal & Broacha –

Elite Wealth – Apply for long-term

GCL Broking –

Geojit –

GEPL Capital – Subscribe

Hem Securities – Subscribe

ICICIdirect –

Investmentz –

Jainam Broking –

DR Choksey –

LKP Research –

Marwadi Financial – Subscribe

Motilal Oswal –

Nirmal Bang –

Reliance Securities – Subscribe

Religare Broking –

Samco Securities – Subscribe

Unistone Capital – Not Rated

SMC Global – 2/5

Swastika Investmart – Subscribe for long-term

Ventura Securities – Subscribe

BLS E-Services Offer Lead Manager

UNISTONE CAPITAL PRIVATE LIMITED

A/305, Dynasty Business Park, Andheri Kurla Road,

Andheri East, Mumbai 400059, Maharashtra

Phone:+91 98200 57533

Email: [email protected]

Website: www.unistonecapital.com

BLS E-Services Offer Registrar

KFIN TECHNOLOGIES LIMITED

Selenium Tower – B, Plot 31 & 32, Gachibowli,

Financial District, Nanakramguda, Serilingampally,

Hyderabad – 500 032, Telangana

Tel: 91 40 6716 2222

E-mail: [email protected]

Website: www.kfintech.com

BLS E-Services Contact Details

BLS E-SERVICES LIMITED

Plot no. 865, Udyog Vihar Phase V,

Gurugram, Haryana – 122016, India

Phone: +91-11-45795002

Email: [email protected]

Website: www.blseservices.com

BLS E-Services IPOFAQs

How many shares in BLS E-Services Issue are reserved for HNIs and retail investors?

The investors’ portion for QIB – 75%, NII – 15%, and Retail – 10%.

How to apply in BLS E-Services Public Offer?

The best way to apply in BLS E-Services public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is BLS E-Services IPO GMP today?

BLS E-Services IPO GMP today is INR 175 per share.

What is the BLS E-Services kostak rate today?

BLS E-Services kostak rate today is INR NA per application.

What is BLS E-Services Subject to Sauda rate today?

BLS E-Services Subject to Sauda rate today is INR NA per application.