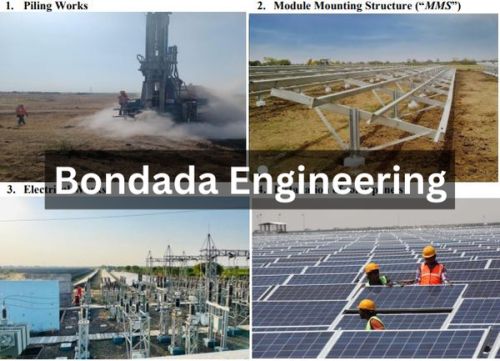

Bondada Engineering IPO description – Incorporated in 2012, Bondada Engineering is an ISO 9001:2015 certified integrated infrastructure company engaged in the business of providing engineering, procurement, and construction (“EPC”) services and operations and maintenance (“O&M”) services to its pan India customers operating in the telecom and solar energy industry. The company has over 550 employees.

Bondada Engineering provides passive telecom infrastructure services which include turnkey services for cell site construction, erection, operation, and maintenance of telecom towers with civil, electrical, and mechanical works; supply of poles and towers, laying and maintenance of optical fiber cables, supply of power equipment and other telecom infrastructure related services to major telecom companies and telecom tower operators in India. The company has installed over 11,600 telecom towers and poles out of which, it has installed over 7,700 telecom towers and poles in the last three fiscal.

The company also provides O&M services to telecom and tower operating companies such as cell site maintenance with preventive and corrective maintenance of passive infrastructure and equipment, backup power systems, manning services and supply of riggers, surveillance, and corrective maintenance of optical fiber cable routes and other maintenance related facilities.

Bondada’s manufacturing facility is located in Keesara Mandal, Medchal, Telangana, with an installation capacity of ~12 thousand MTPA for tower fabrication.

Promoters of Bondada Engineering – Raghavendra Rao Bondada, Neelima Bondada and Satyanarayana Baratam

Table of Contents

Bondada Engineering IPO Details

| IPO Dates | 18 – 22 August 2023 |

| IPO Price | INR 75 per share |

| Fresh issue | 56,96,000 shares (INR 42.72 crore) |

| Offer For Sale | NIL |

| Total IPO size | 56,96,000 shares (INR 42.72 crore) |

| Minimum bid (lot size) | 1,600 shares (INR 120,000) |

| Face Value | INR 10 per share |

| Retail Allocation | 35% |

| Listing On | BSE SME |

Bondada Engineering Financial Performance

| FY 2021 | FY 2022 | FY 2023 | |

| Revenue | 287.09 | 334.11 | 370.59 |

| Expenses | 276.69 | 319.57 | 347.18 |

| Net income | 9.21 | 10.14 | 18.25 |

Bondada Engineering Offer News

- Bondada Engineering RHP

- Bondada Engineering Draft Prospectus

- ASBA IPO Forms

- Live IPO Subscription Status

- IPO Allotment Status

Bondada Engineering Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 5.91 | 6.51 | 11.43 |

| PE ratio | – | – | 6.56 |

| RONW (%) | 19.27 | 17.51 | 22.77 |

| NAV | 30.65 | 37.16 | 49.27 |

| ROCE (%) | 28.71 | 29.72 | 35.63 |

| EBITDA (%) | 6.08 | 5.97 | 8.41 |

| Debt/Equity | 0.98 | 0.66 | 1.07 |

Bondada Engineering IPO GMP Today

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| 29 August 2023 | 40 | – | 48,000 |

| 28 August 2023 | 40 | – | 48,000 |

| 24 August 2023 | 38 | – | 42,000 |

| 23 August 2023 | 35 | – | 40,000 |

| 22 August 2023 | 25 | – | 24,000 |

| 21 August 2023 | 20 | – | 20,000 |

| 19 August 2023 | 20 | – | 20,000 |

| 18 August 2023 | 20 | – | 22,000 |

| 17 August 2023 | 15 | – | – |

| 16 August 2023 | 15 | – | – |

Bondada Engineering IPO Subscription – Live Updates

| Category | Non-retail | Retail | Total |

|---|---|---|---|

| Shares Offered | 2,704,000 | 2,704,000 | 5,408,000 |

| 22 Aug 2023 | 124.61 | 100.05 | 112.33 |

| 21 Aug 2023 | 13.77 | 29.32 | 21.54 |

| 18 Aug 2023 | 0.77 | 4.50 | 2.64 |

Bondada Engineering IPO Allotment Status

Bondada Engineering IPO allotment status is now available on the KFin Tech website. Click on this link to get allotment status.

Bondada Engineering IPO Dates & Listing Performance

| IPO Opening Date | 18 August 2023 |

| IPO Closing Date | 22 August 2023 |

| Finalization of Basis of Allotment | 25 August 2023 |

| Initiation of refunds | 28 August 2023 |

| Transfer of shares to demat accounts | 29 August 2023 |

| IPO Listing Date | 30 August 2023 |

| Opening Price on BSE SME | INR 142.5 per share (up 90%) |

| Closing Price on BSE SME | INR 149.62 per share (up 99.49%) |

Bondada Engineering Offer Lead Manager

VIVRO FINANCIAL SERVICES PRIVATE LIMITED

607/608 Marathon Icon, Opp. Peninsula Corporate Park,

off. Ganpatrao Kadam Marg, Veer Santaji Lane, Lower Parel, Mumbai – 400 013

Phone: +91 22 6666 8040

Email: [email protected]

Website: www.vivro.net

Bondada Engineering Offer Registrar

KFIN TECHNOLOGIES LIMITED

Selenium, Tower-B, Plot 31& 32,

Gachibowli Financial District Nanakramguda,

Hyderabad – 500032, Telangana, India

Phone: +91-40-6716-2222

Email: [email protected].

Website: www.kfintech.com

Bondada Engineering Contact Details

BONDADA ENGINEERING LIMITED

Plot No. 11 & 15, 3rd Floor Surya PPR Towers,

Ranga Reddy, Hyderabad 500062, Telangana, India

Phone: +91 72070 34662

Email: [email protected]

Website: www.bondada.net

Bondada Engineering IPO FAQs

What is Bondada Engineering IPO offer size?

Bondada Engineering offer size is INR 42.72 crores.

What is the Bondada Engineering offer price band?

Bondada Engineering public offer price is INR 75 per share.

What is the lot size of Bondada Engineering’s public offer?

Bondada Engineering offer lot size is 1,600 shares.

What is Bondada Engineering IPO GMP today?

Bondada Engineering IPO GMP today is INR 40 per share.

What is Bondada Engineering kostak rate today?

Bondada Engineering kostak rate today is INR NA per application.

What is Bondada Engineering Subject to Sauda rate today?

Bondada Engineering Subject to Sauda rate today is INR 48,000 per application.