| C2C Advanced Systems IPO GMP, Review | C2C Advanced Systems IPO Subscription Status | C2C Advanced Systems IPO Allotment |

C2C Advanced Systems IPO listing is scheduled for Tuesday, December 3, 2024. The IPO allotment will be finalized on Friday, November 29, 2024. For those who have been allocated shares, the shares will be credited to their demat accounts on Monday, December 2. Additionally, the refund process for those who did not receive shares will also be completed on Monday, December 2. Here’s what you need to know about the C2C Advanced Systems IPO listing tomorrow and the impact of GMP under pressure.

C2C Advanced Systems IPO Listing

C2C Advanced Systems’ IPO, which closed on November 26, 2024, experienced a remarkable subscription rate of 125.43 times overall, indicating strong investor interest. This figure reflects the number of shares that investors applied for compared to the number available. Specifically, the non-institutional investor (NII) segment was particularly robust, being oversubscribed by 233.48 times, which suggests that high-net-worth individuals and other non-institutional investors showed significant confidence in the company’s prospects. The qualified institutional buyers (QIB) segment saw a subscription of 31.61 times, while retail investors (RII) also demonstrated strong participation with an oversubscription of 132.73 times.

The company aims to raise INR 99.07 crore through this IPO, with shares priced between INR 214 and INR 226 each. Investors are required to bid for a minimum of 600 shares per lot, resulting in a minimum application amount of INR 1,35,600. This pricing structure and the minimum bid requirement indicate that C2C Advanced Systems is targeting serious investors who are willing to commit substantial amounts of capital to participate in this offering. In the C2C Advanced Systems IPO, 15% of the shares are allocated for NIIs, 35% are designated for retail investors, and 50% are reserved for QIBs.

Read Also: Enviro Infra IPO Allotment: Bids Surpass INR 40,000 Crore, Check Your Status

C2C Advanced Syatems Listing Postponed

The initial listing date on the NSE SME platform was set for November 29, 2024; however, this has been postponed due to a directive from the Securities and Exchange Board of India (SEBI). SEBI has mandated the appointment of independent auditors to review the company’s financials before proceeding with the listing. The new listing date is now expected to be on or before December 3, 2024.

C2C Advanced Systems IPO GMP

Investors are also considering the market opportunity and the unique premium of defense electronics sector company about to enter the market. Consequently, there is a significant grey market premium (GMP), offering a profit potential. Let’s examine what the GMP for C2C Advanced Systems IPO has indicated in the last few days ahead of its listing.

Over the past eight days leading up to November 26, 2024, the average grey market premium (GMP) for the C2C Advanced Systems IPO was reported at INR 228 per share. However, on the final day of subscription, the GMP experienced a significant decline, with today’s GMP being noted as no trade, indicating that there were no transactions taking place in the grey market for these shares at that time, according to IPOCentral’s GMP tracker.

C2C Advanced Systems’ IPO has experienced a significant drop in its grey market premium (GMP), which fell to INR 100 as of November 26, 2024. This decline follows regulatory action from the Securities and Exchange Board of India (SEBI), which directed the company to appoint independent auditors and obtain a third-party review of its financial accounts. The GMP previously stood at INR 245 on November 25, indicating a potential listing gain of around 45% from the upper end of the IPO price band.

The term “Grey market premium” signifies the willingness of investors to pay a price higher than the initial offering price. While trading in this parallel market is not recognized by stock exchanges, the grey market has worked reasonably well to anticipate listing prices.

Read Also: Suraksha Diagnostic IPO Analysis – Evaluating Investment Opportunities

C2C Advanced Systems IPO Details

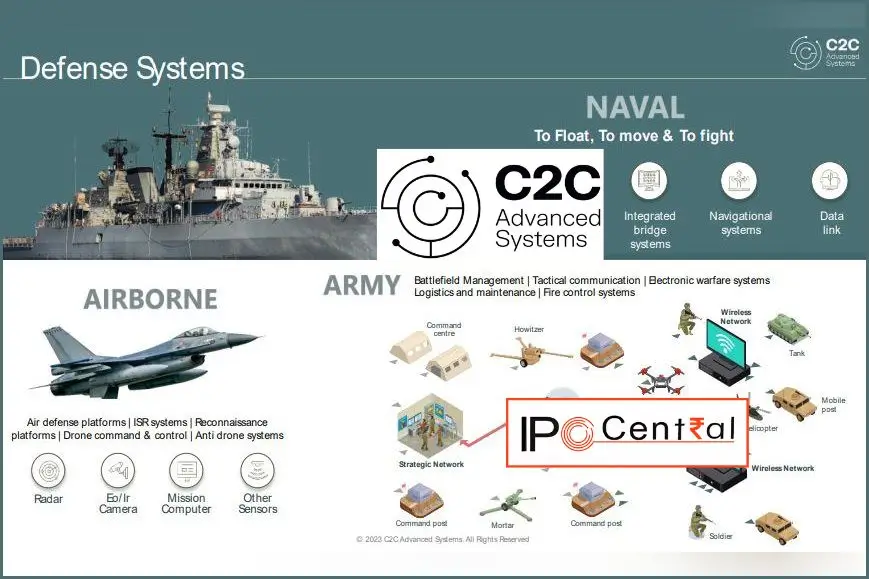

Founded in 2018, C2C Advanced Systems specializes in indigenous defense electronics products and solutions tailored for air and sea defense platforms. The company focuses on areas such as C4I systems and AI/ML-based analytics, aligning with India’s defense modernization efforts under initiatives like Atmanirbhar Bharat and Make in India.

C2C Advanced Systems has demonstrated remarkable financial performance in comparison to its industry peers, particularly in the defense electronics sector. For the fiscal year 2024, the company reported a revenue of INR 41.29 crore, marking a staggering 412% increase from INR 8.06 crore in the previous fiscal year. Its net profit surged by over 327%, reaching INR 12.27 crore compared to INR 2.87 crore in fiscal 2023, showcasing strong operational efficiency and market demand for its products.

Read Also – IPOs with 500% Returns: Explore Best Performing IPOs

C2C Advanced Systems IPO Listing FAQs

What are C2C Advanced Systems IPO dates?

C2C Advanced Systems IPO subscription commenced on November 22, 2024, and concluded on November 26, 2024.

When is the C2C Advanced Systems IPO listing expected?

C2C Advanced Systems IPO listing date is Tuesday, December 3, 2024.

Can we buy an IPO on the listing date?

You can place a buy order at a desired price for the IPO shares on the listing day after 10 AM.