After witnessing a historic event earlier this year in the form of listing of BSE, the Indian markets are once again going for an epic moment as Central Depository Services Limited (CDSL) launches its IPO next week. The IPO, priced in the range of INR145 – 149 per share, will open for subscription on 19 June and will close on 21 June. Like BSE IPO, shares of CDSL will only be traded on NSE. In total, the IPO will mobilize nearly INR524 crore. CDSL IPO will be managed by Axis Capital, Edelweiss Financial Services, Haitong Securities India, IDBI Capital Market Services, Nomura Financial Advisory and Securities India, SBI Capital Markets, and YES Securities. Link Intime will be the registrar of the IPO.

Here is a look at basic details about the public offer before we dig deeper into CDSL IPO review.

CDSL IPO details | |

| Subscription Dates | 19 – 21 June 2017 |

| Price Band | INR145 – 149 per share |

| Fresh issue | Nil |

| Offer For Sale | 35,167,208 shares (INR523.99 crore) |

| Total IPO size | 35,167,208 shares (INR523.99 crore) |

| Minimum bid (lot size) | 100 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE |

CDSL IPO Review: No Fresh shares, All OFS

Like the offer from its parent BSE, CDSL will not be issuing any new shares. All the shares will be offered by existing shareholders through an Offer For Sales (OFS) and as a result, CDSL will not get any funds from the IPO. We generally like to see some IPO funds going towards the company but it is not a problem in case of CDSL as the well-established business isn’t immediately in need of funds. More on this later.

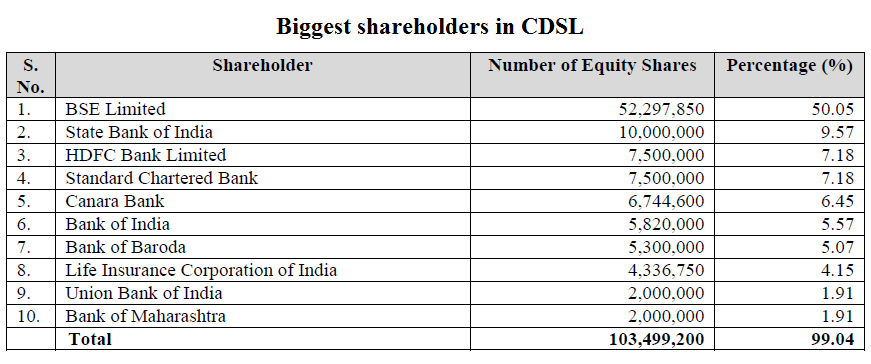

The depository – one of the two in India – has a long list of marquee investors. While BSE Limited is the promoter with a shareholding of slightly above 50%, there are other big names like State Bank of India (SBI), Standard Chartered Bank, HDFC Bank, Canara Bank, Bank of India, Bank of Baroda, Union Bank of India, and Calcutta Stock Exchange. Top 10 shareholders account for just above 99% shareholding. Regulatory requirements stipulate that a single entity cannot own more than 24% equity stake in a depository so BSE will be leading the charge in offloading its shares. SBI and Bank of Baroda will reduce their shareholding while Calcutta Stock Exchange will sell all the 1,000,000 shares it owns.

CDSL IPO Review: Depository gold mine

Established by BSE in 1997, CDSL is one of the only two securities depositories in the country, the other being NSE-promoted NSDL. As the name suggests, a depository holds securities such as equity shares, preference shares, mutual fund units, debt instruments, and government securities in electronic form and enable securities transactions. As stock trading is mandatorily in electronic format in India, CDSL has a ready market which it taps through depository participants (DPs). As of April 2017, CDSL had 589 registered DPs with over 17,000 service centres across the country. As a result, CDSL has over 12.4 million investor accounts and over 15 million KYC (Know Your Customer) records with a market share of approximately 67%.

Read Also: Tejas Networks IPO Review: Sycamore again?

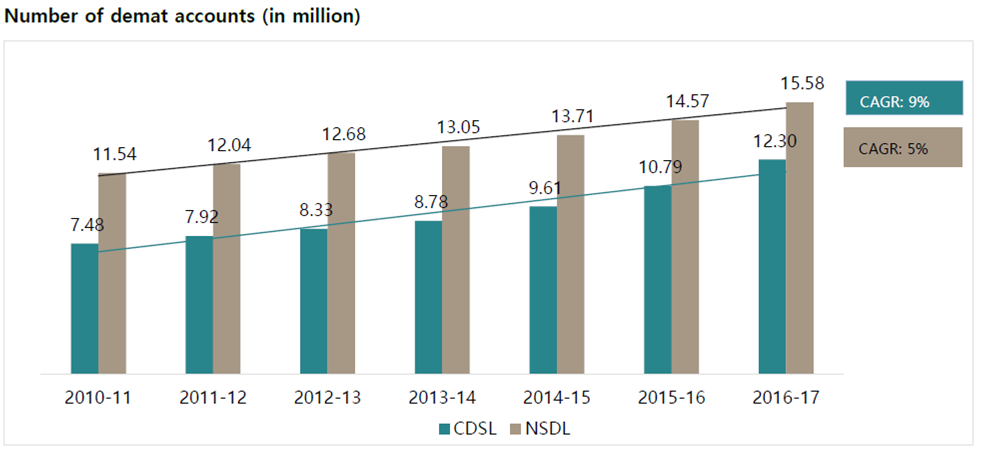

CDSL has parentage of BSE and that has greatly helped its case; however, it would be wrong to assume that CDSL is dependent on the stock exchange for business. As we mentioned in our review of BSE, the stock exchange has lost considerable market share to NSE in recent years. However, CDSL has gained market share from NSDL in these years as illustrated in the chart below. In Fiscal year 2017, CDSL held a 59% market share of incremental BO accounts.

CDSL IPO Review: Financial performance

CDSL has put up a great show in financial performance. As mentioned above, it is outsmarting its bigger rival NSDL in acquiring new customers and this is clearly reflected in CDSL’s top line which has grown from INR124 crore in FY2013 to INR186.8 crore in FY2017. This is not ‘out of world’ growth but a steady performance. However, the real deal is in the profits which have demonstrated faster growth. Thanks to high economies of scale, net earnings jumped from INR49.9 crore in FY2013 to INR85.4 crore in the year just ended. As the table shows, margins are volatile but have never went below 39.7% in the last five years. In the latest year, its profitability was at 45.7%. This is what the company has to say about its scalable business model.

“Our largely fixed operating costs result in high economies of scale. Our main costs are employee wages and post employee benefits and software development and maintenance costs.”

CDSL’s consolidated financial performance (in INR crore) | |||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | |

| Total revenue | 124.0 | 122.8 | 145.5 | 161.3 | 186.8 |

| Total expenses | 57.6 | 61.2 | 66.3 | 63.1 | 70.3 |

| Profit after tax | 49.9 | 49.3 | 57.7 | 90.9 | 85.4 |

| Net margin (%) | 40.2 | 40.1 | 39.7 | 56.4 | 45.7 |

CDSL IPO Review: Should you subscribe?

Securities depository isn’t the kind of business which can show astronomical expansion. And that’s perfectly fine. As long as reasonably solid businesses can grow at 10% rate every year with a smaller growth in expenses, they are doing something worth a serious consideration. CDSL has clearly demonstrated this with operations growing with proportionately less increase in costs. In such cases, no dilution (full OFS) is a great proposition.

We see many positives in CDSL IPO. Participation of retail investors in stock markets is quite less in India and it is not difficult to see that this will only increase from here. This ensures solid ongoing business for CDSL. With just two players in this market, CDSL has been more aggressive in tapping customers from tier-2 and tier-3 cities. The market framework limiting the number of depositories to two is also a big positive for CDSL. The backing of stock exchanges to the two players offers them a head-start over any new entrant.

Read Also: Eris Lifesciences IPO review: Dare to miss?

CDSL’s consolidated EPS stood at INR8.21 in the latest FY. In terms of valuations, the IPO’s price range of INR145 – 149 per share values the business at a PE ratio of 17.66 – 18.14. This is evidently not very high for a high entry barrier business which is virtually guaranteed to generate higher profits for many years to come. Since CDSL’s only competitor remains unlisted, there is no benchmark to compare these valuations. Nevertheless, there is ample the company is leaving on the table.

Another positive for prospective investors is the regular dividend CDSL pays. Although the dividend rate was a modest 30% for the latest year, it is important to highlight that it increased from 20% in 2014. For investors keen to keep CDSL as a portfolio stock, effective dividend yields will improve substantially from the current 2%.

Our overall impression after detailed CDSL IPO review is that investors have little to lose by applying to the offer. Even though investors have option to choose from Tejas Networks IPO, Eris Lifesciences IPO, and GTPL Hathway IPO at around the same time, CDSL IPO remains a no brainer. Strong premium in the grey market (check this page for more details) is further indication that this IPO will list at a substantial premium.