Cafe Coffee Day’s parent Coffee Day Enterprises Limited (CDEL) has received market regulator SEBI’s permission to launch its IPO. The regulator issued its final observations on 14 August 2015. Observation by SEBI amounts to approval to bring the IPO. CDEL applied for IPO on 26 June 2015 through Kotak Mahindra Capital Company Limited. The maiden public issue will be managed by Kotak Mahindra Capital, Axis Capital, Citigroup, Morgan Stanley, Edelweiss Financial Services, YES Bank. Taking just 49 days (including weekends), this marks the fastest IPO approval by SEBI this year. This also takes the total number of IPO approvals so far this year to 25.

As we reported earlier, CDEL plans to raise INR1,150 crore from the IPO which will only involve issue of fresh shares. As such, there will not be any offer for sale (OFS), although the high-profile company counts Infosys co-founder Nandan Nilekani, investor Rakesh Jhunjhunwala’s Rare Enterprises and stock broker Ramesh Damani among prominent investors.

Use of funds

Out of the INR1,150 crore, CDEL plans to use INR632.8 crore towards repayment of loans while INR87.7 crore will be used for expansion of its retail network. Included in its expansion plans are 216 new outlets and 105 Coffee Day Xpress kiosks by FY 2016/17. Another INR97.3 crore will be invested in manufacturing and assembling of vending machines. The company has also earmarked INR60.6 crore for refurbishment of existing outlets and vending machines while setting-up of a new coffee roasting plant near its existing facility in Chikkamagaluru will involve INR41.9 crore. Following the investment, CDEL’s roasting capacity will double to 14,000 metric ton (MT) per annum.

Read Also: Cafe Coffee Day IPO: What you need to know

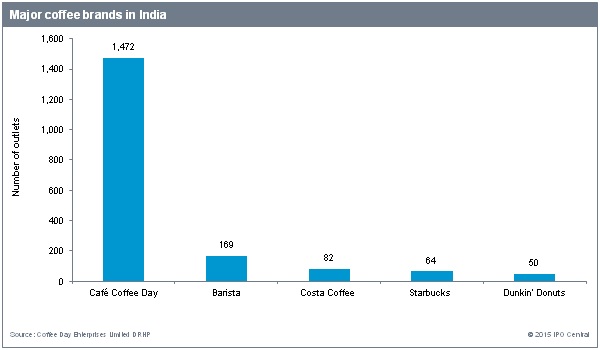

With over 1,472 outlets across 209 cities, CafeCoffee Day is the largest chain of coffee outlet in India. In fact, it beats the competition, including Starbucks, in the game by a wide margin (see the graph on the left). Apart from the popular coffee chain, CDEL’s holdings include Coffee Day Hotels and Resorts Pvt Ltd, Global Technology Ventures Ltd and Tanglin Developments Ltd. Apart from the names mentioned above, the company counts prominent private equity firms such as KKR and Bennett Coleman & Company Limited among its investors.

We intend to analyze the prospects of Coffee Day Enterprises Limited’s IPO once pricing details are out. Feel free to follow us on Twitter and Facebook or subscribe to our weekly newsletter to remain updated about this much awaited IPO.