Diffusion Engineers IPO listing is scheduled for tomorrow, Friday, October 4, 2024. The IPO allotment will be finalized on Tuesday, October 1, 2024. For those who have been allocated shares, the shares will be credited to their demat accounts today, October 3. Additionally, the refund process for those who did not receive shares will also be completed today, October 3. Here’s what you need to know about the Diffusion Engineers IPO listing tomorrow and the impact of GMP under pressure.

Diffusion Engineers IPO Listing Tomorrow

On the final day of subscription, Monday, September 30, Diffusion Engineers IPO received strong subscription of 114.34 times, according to BSE data. The qualified institutional buyer (QIB) segment was oversubscribed 95.74 times, while the non-institutional investor (NII) quota saw 207.56 times subscriptions. The retail individual investor (RII) quota was oversubscribed 85.32 times, and the employee quota received 94.88 times subscriptions. The company aims to raise INR 158 crore through a fresh equity sale, with shares priced between INR 159 and INR 168 each, and a minimum bid of 88 shares per lot, with a minimum application amount of INR 14,784.

In the Diffusion Engineers IPO, 15% of the shares are allocated for NIIs, 35% are designated for retail investors, and 50% are reserved for QIBs. Additionally, shares are reserved for employees, who are also being offered nearly 5% discount.

Read Also: Upcoming IPOs in October 2024 – Seven Mainboard Offers Expected

Diffusion Engineers IPO GMP

Investors are also considering the market opportunity and the unique premium of manufacturing and service sector company about to enter the market. Consequently, there is a significant grey market premium (GMP), offering a profit potential. Let’s examine what the GMP for Diffusion Engineers IPO has indicated in the last few days ahead of its listing.

Over the past nine days (24 Sep – 3 Oct), the average grey market premium (GMP) for Diffusion Engineers IPO was INR 63 per share, with today’s GMP being at INR 60 per share, according to IPOCentral’s GMP tracker. Accordingly, the anticipated Diffusion Engineers IPO listing price is pegged at INR 228 per share. This figure represents a potential profit of 35% from the IPO price of INR 168 per share, factoring in the upper limit of the IPO pricing range and the current premium observed in the grey market. However, it is noteworthy that the GMP corrected to INR 60 in just a few days from the high of INR 75 per share. Accordingly, Diffusion Engineers IPO listing may be a muted affair as the premiums may decline further.

The term “Grey market premium” signifies the willingness of investors to pay a price higher than the initial offering price. While trading in this parallel market is not recognized by stock exchanges, the grey market has worked reasonably well to anticipate listing prices. Most recently, shares of KRN Heat Exchanger and Bajaj Housing Finance had strong starts on their stock market debuts, as indicated by the grey market.

Read Also – Latest IPO Approvals: SEBI Okays 5 High-Profile IPOs including Swiggy, Hyundai, Vishal Mega Mart

Diffusion Engineers IPO Details

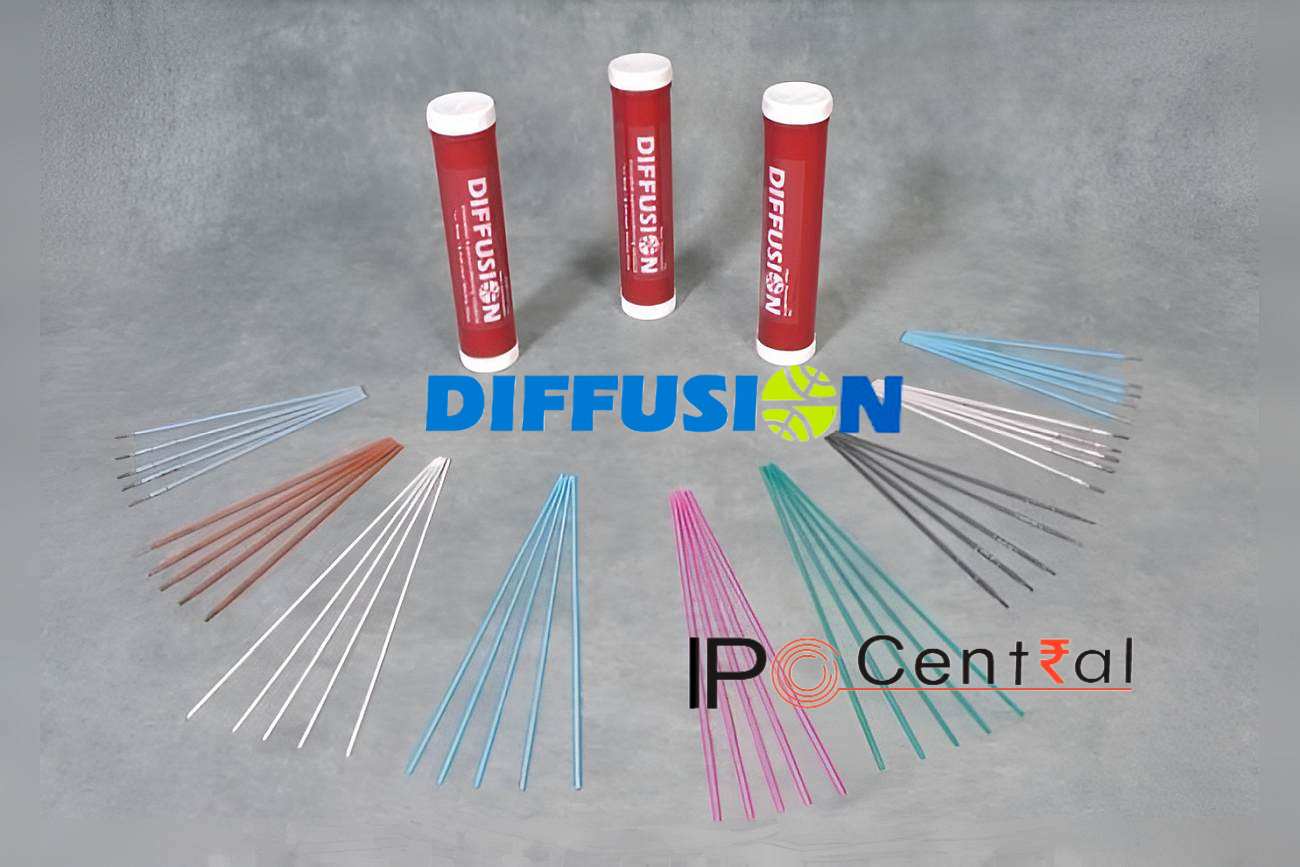

Incorporated in 1982, Diffusion Engineers is a prominent Indian company headquartered in Nagpur, Maharashtra. Initially focused on trading welding electrodes, the company has evolved into a leading manufacturer of welding consumables, wear plates, wear parts, and heavy engineering machinery. With over four decades of experience, Diffusion Engineers serves core industries such as cement, steel, power, mining, and oil & gas. The company specializes in providing repair and reconditioning services for heavy machinery, utilizing advanced technologies like super conditioning to enhance the durability and efficiency of industrial components.

Diffusion Engineers has shown strong financial performance compared to its industry peers, particularly in terms of growth rates and profitability metrics. Between FY 2021 and FY 2024, the company achieved a remarkable compound annual growth rate (CAGR) of 21% in operating income, which ranks as the third highest in its industry. Additionally, Diffusion Engineers reported a 38% CAGR in profit after tax (PAT) and a 33% CAGR in EBITDA during the same period, indicating effective cost management and robust profitability.

Read Also: Vikran Engineering IPO DRHP Filed: Star Investors, Strong Financials Among Highlights

Diffusion Engineers IPO Listing FAQs

What are Diffusion Engineers IPO dates?

Diffusion Engineers IPO subscription commenced on September 26, 2024, and concluded on September 30, 2024.

When is the Diffusion Engineers IPO listing expected?

Diffusion Engineers IPO listing date is Friday, October 4, 2024.

Can we buy an IPO on the listing date?

You can place a buy order at a desired price for the IPO shares on the listing day after 10 AM.