DMR Hydroengineering Rights Issue is scheduled on 14 Nov – 3 Dec 2024

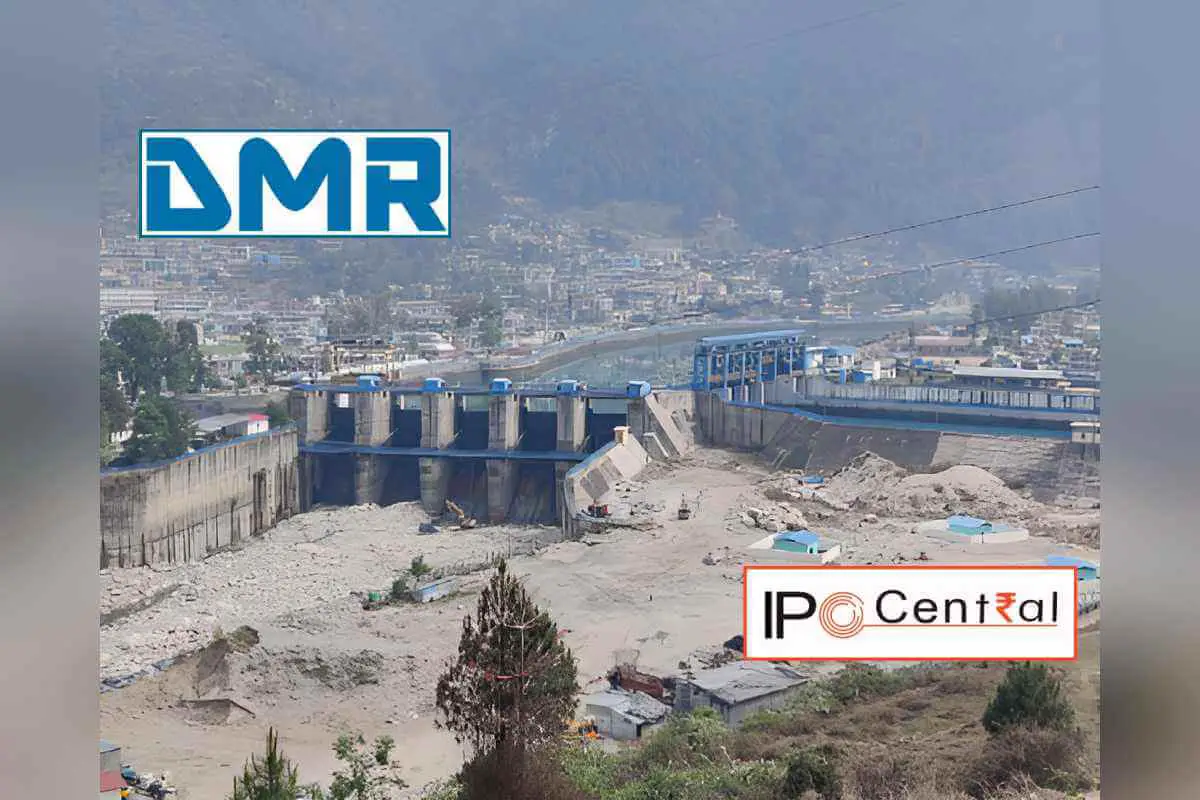

DMR Hydroengineering & Infrastructures specializes in providing engineering consultancy and due diligence services for hydropower projects, dams, pump-storage systems, roads, and railway tunnels. The company offers a comprehensive range of services across the entire project lifecycle, including design and engineering, due diligence and regulatory support, bid management, construction engineering, as well as quality and inspection.

The company offers a comprehensive suite of Hydro Engineering and Infrastructure services, including Strategic Advisory, Due Diligence Studies, Project Viability Analysis, Risk Assessment, Regulatory Approvals, and Monitoring and Evaluation. Their expertise extends to Geological, Hydrological, and Hydraulic Studies, along with Hydraulic and Geotechnical Design for both surface and underground structures. They provide services such as Structural Design, Dynamic and Numerical Analysis, Detailed Project Reports, Feasibility Reports, and Construction Planning. Additionally, the company manages Construction Management, Rate Analysis, and Cost Estimates, and oversees Quality Assurance through QA/QC plans, inspections, and contract management, ensuring successful project commissioning and completion.

The company operates in the Business-to-Business (B2B) sector, catering to both domestic and international markets. Within India, it has a robust presence across more than 15 states, executing numerous projects in regions such as J&K, Uttarakhand, Himachal Pradesh, Rajasthan, Arunachal Pradesh, Maharashtra, Odisha, Jharkhand, Madhya Pradesh, and Chhattisgarh. Internationally, the company is active in countries including Lao PDR, Bhutan, Nepal, Cambodia, and Nigeria. As of 13 September 2024, the company employs a total of 62 permanent staff members.

Promoters of the DMR Hydroengineering & Infrastructures – Mr. Subhash Chander Mittal and Mrs. Neelam Mittal

Table of Contents

DMR Hydroengineering Rights Issue Details

| DMR Hydroengineering Rights Issue Date | 14 Nov – 3 Dec 2024 |

| DMR Hydroengineering Rights Issue Price | INR 140 per share |

| Issue Size (in Shares) | 1,89,685 shares |

| Issue Size (in INR) | INR 2.66 crore |

| Issue Entitlement | 1 equity shares for every 20 equity shares held on record date |

| Terms of Payment | Fully payable at the time of application |

| DMR Hydroengineering Rights Issue Record Date | 22 October 2024 |

| Face Value | INR 10 per share |

| Listing On | BSE |

DMR Hydroengineering Rights Issue Calculation

| DMR Hydroengineering Rights Issue Price | INR 140 per share |

| Market Price on Rights Issue Approval | INR 159.4 per share |

| Dilution Factor (X) | 1.05 |

| Fair Value After Dilution at Prevailing Price | INR 158.48 per share |

DMR Hydroengineering & Infrastructures Financial Performance

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 3.53 | 4.38 | 7.02 |

| Expenses | 2.54 | 3.19 | 5.00 |

| OPM (%) | 28.05 | 27.17 | 28.77 |

| Net income | 0.69 | 0.77 | 1.54 |

| ROCE (%) | 20.89 | 18.08 | 27.05 |

DMR Hydroengineering Rights Offer Objectives

The net proceeds from the offer are proposed to be used for the following objective

- To augment the existing and incremental working capital requirement of the company

- General Corporate Purposes

DMR Hydroengineering Rights Offer Documents

- DMR Hydroengineering Rights Issue Application Form

- DMR Hydroengineering Letter of Offer

- Board Meeting Outcome

- Rights Issue in 2024

DMR Hydroengineering Rights Issue Dates

| Rights Issue Approval Date | 15 October 2024 |

| Rights Issue Record Date | 22 October 2024 |

| Credit of Rights Entitlement | 13 November 2024 |

| Rights Issue Opening Date | 14 November 2024 |

| Last Date for Market Renunciation | 25 November 2024 |

| Rights Issue Closing Date | 3 December 2024 |

| Finalization of Basis of Allotment | 11 December 2024 |

| Rights Allotment Date | 11 December 2024 |

| Credit Date | 16 December 2024 |

| Listing Date | 19 December 2024 |

DMR Hydroengineering Rights Offer Registrar

KFIN TECHNOLOGIES LIMITED

Selenium Tower – B, Plot 31 & 32, Gachibowli,

Financial District, Nanakramguda, Serilingampally,

Hyderabad – 500 032, Telangana

Telephone: +91-40-6716-2222/+91 1800 309 4001

Email: [email protected]

Website: www.kfintech.com

DMR Hydroengineering Issue Contact Details

DMR HYDROENGINEERING & INFRASTRUCTURES LIMITED

473 Sector-30, Faridabad,

Haryana, India, 121003

Phone: +91 1294360445

E-mail: [email protected], [email protected]

Website: www.dmrengineering.net

DMR Hydroengineering Rights Offer FAQs

What is the DMR Hydroengineering Rights Issue Price?

The issue price is INR 140 per share.

What is the DMR Hydroengineering Rights Issue entitlement ratio?

The eligible shareholders are offered 1 Equity Shares for every 20 Equity Shares held on the record date.

What is the DMR Hydroengineering Rights Issue Record Date?

The Record date is 22 October 2024.

How to Apply in the DMR Hydroengineering Rights Offer?

The best way to apply in the DMR Hydroengineering Rights Offer is through Internet banking ASBA. You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an application Form form and deposit the same to your broker.