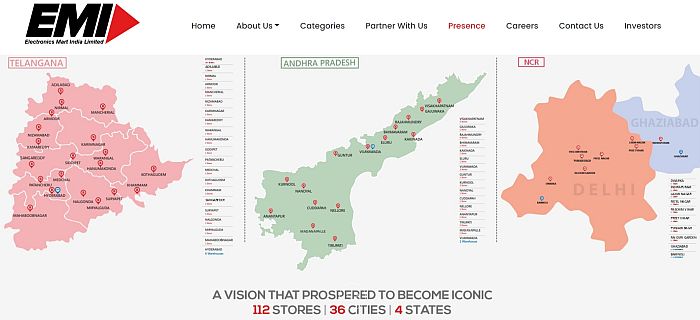

Electronics Mart IPO description – The company is India’s 4th largest consumer durable and electronics retailer with dominance in the states of Telangana and Andhra Pradesh. It has been one of the fastest growing consumer durable & electronics retailers in India with a revenue CAGR of 25.60% from Financial Year 2015 to Financial Year 2020. It has consistently demonstrated profitability with a robust operating performance and managed to post higher revenues even during Covid-19 pandemic.

As on 15 August 2021, the company had 99 stores across 31 cities / urban agglomerates with a retail business area of 0.99 million sq. ft. The company offers a diversified range of products with focus on large appliances (air conditioners, televisions, washing machines and refrigerators), mobiles and small appliances, IT and others. Its offerings include more than 6,000 SKUs across product categories from more than 70 consumer durable and electronic brands.

Promoters of Electronics Mart – Pavan Kumar Bajaj and Karan Bajaj

Electronics Mart IPO Details

| Electronics Mart IPO Dates | 4 – 7 October 2022 |

| Electronics Mart IPO Price | INR 56 – 59 per share |

| Fresh issue | INR 500 crore |

| Offer For Sale | Nil |

| Total IPO size | INR 500 crore |

| Minimum bid (lot size) | 254 shares (INR 14,986) |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Electronics Mart Financial Performance

| FY 2019 | FY 2020 | FY 2021 | FY 2022 | Q1 FY 2023 | |

| Revenue | 2,823.6 | 3,172.5 | 3,201.9 | 4,349.3 | 1,408.4 |

| Expenses | 2,702.5 | 3,059.0 | 3,127.8 | 4,213.3 | 1,355.1 |

| Net income | 77.2 | 81.1 | 58.8 | 104.6 | 41.5 |

| Margin (%) | 2.73 | 2.56 | 1.84 | 2.40 | 2.95 |

Electronics Mart Offer News

Electronics Mart Valuations & Margins

| FY 2019 | FY 2020 | FY 2021 | FY 2022 | |

| EPS | 2.57 | 2.72 | 1.95 | 3.46 |

| PE ratio | – | – | – | 16.18 – 17.05 |

| RONW (%) | 22.64 | 18.84 | 11.92 | 17.42 |

| NAV | – | – | 16.40 | 19.88 |

| ROCE (%) | 25.94 | 20.28 | 14.35 | 18.87 |

| EBITDA (%) | 7.65 | 7.18 | 6.37 | 6.71 |

| Debt/Equity | – | 1.20 | 1.11 | 1.00 |

Electronics Mart IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 15 Oct 2022 | 30 | – | – |

| 14 Oct 2022 | 25 | 400 | 4,500 |

| 13 Oct 2022 | 25 | 400 | 4,500 |

| 12 Oct 2022 | 30 | 400 | 4,500 |

| 11 Oct 2022 | 28 | 400 | 4,500 |

| 10 Oct 2022 | 30 | 400 | 4,300 |

| 8 Oct 2022 | 30 | 400 | 4,300 |

| 7 Oct 2022 | 35 | 450 | 4,800 |

| 6 Oct 2022 | 35 | 450 | 5,000 |

| 4 Oct 2022 | 35 | 450 | 5,000 |

| 3 Oct 2022 | 30 | 400 | 4,500 |

| 1 Oct 2022 | 30 | 400 | 4,500 |

| 30 Sep 2022 | 30 | 400 | 4,500 |

| 29 Sep 2022 | 20 | 400 | 4,000 |

Electronics Mart IPO Subscription – Live Updates

| QIB | NII | Retail | Total | |

| Shares Offered | 1,78,57,142 | 1,33,92,858 | 3,12,50,000 | 62,500,000 |

| 4 Oct 2022 | 1.68 | 1.04 | 1.98 | 1.69 |

| 6 Oct 2022 | 4.01 | 11.74 | 7.81 | 7.57 |

| 7 Oct 2022 | 169.54 | 63.59 | 19.72 | 71.93 |

Electronics Mart IPO Reviews – Subscribe or Avoid?

Angel One – Subscribe

Anand Rathi –

Antique Stock Broking –

Arihant Capital –

Ashika Research –

Asit C Mehta –

BP Wealth – Subscribe for long term

Canara Bank Securities – Subscribe

Choice Broking –

Dalal & Broacha – Subscribe

Elite Wealth – Subscribe

Geojit –

GEPL Capital – Subscribe for listing gains

Hem Securities – Subscribe

ICICIdirect – Subscribe

Jainam Broking – Subscribe

KR Choksey – Subscribe

LKP Research –

Marwadi Financial – Subscribe

Motilal Oswal –

Nirmal Bang – Subscribe

Reliance Securities – Subscribe

Religare Broking –

Samco Securities – Subscribe for listing gains

SMC Global – 2/5

Swastika Investmart –

Ventura Securities – Subscribe

Electronics Mart Offer Registrar

KFIN TECHNOLOGIES LIMITED

Selenium Tower B, Plot No – 31 & 32,

Financial District, Nanakramguda,

Serilingampally, Hyderabad Rangareddi,

500 032, Telangana, India

Phone: +91 40 6716 2222

Email: [email protected]

Website: www.kfintech.com

Electronics Mart Contact Details

ELECTRONICS MART INDIA LIMITED

6-3-666/A1 to 7, 3rd and 4th Floors,

Opposite NIMS Hospital,

Punjagutta Main Road,

Hyderabad – 500 082, Telangana

Phone: +91 040 2323 0244

Email: [email protected]

Website: www.electronicsmartindia.com

Electronics Mart IPO Allotment Status

Electronics Mart IPO allotment is now available on KFin Technologies’ website. Click on this link to get allotment status.

Electronics Mart IPO Dates & Listing Performance

| Electronics Mart IPO Opening Date | 4 October 2022 |

| Electronics Mart IPO Closing Date | 7 October 2022 |

| Finalisation of Basis of Allotment | 12 October 2022 |

| Initiation of refunds | 13 October 2022 |

| Transfer of shares to demat accounts | 14 October 2022 |

| Electronics Mart IPO Listing Date | 17 October 2022 |

| Opening Price on NSE | INR 90 per share (up 52.54%) |

| Closing Price on NSE | INR 83.7 per share (up 41.86%) |

Electronics Mart IPO FAQs

How many shares in Electronics Mart IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 50%, NII – 15%, and Retail – 35%.

How to apply in Electronics Mart Public Offer?

The best way to apply in Electronics Mart public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is Electronics Mart IPO GMP today?

Electronics Mart IPO GMP today is INR 30 per share.

What is Electronics Mart kostak rate today?

Electronics Mart kostak rate today is NA per application.

What is Electronics Mart Subject to Sauda rate today?

Electronics Mart Subject to Sauda rate today is NA per application.