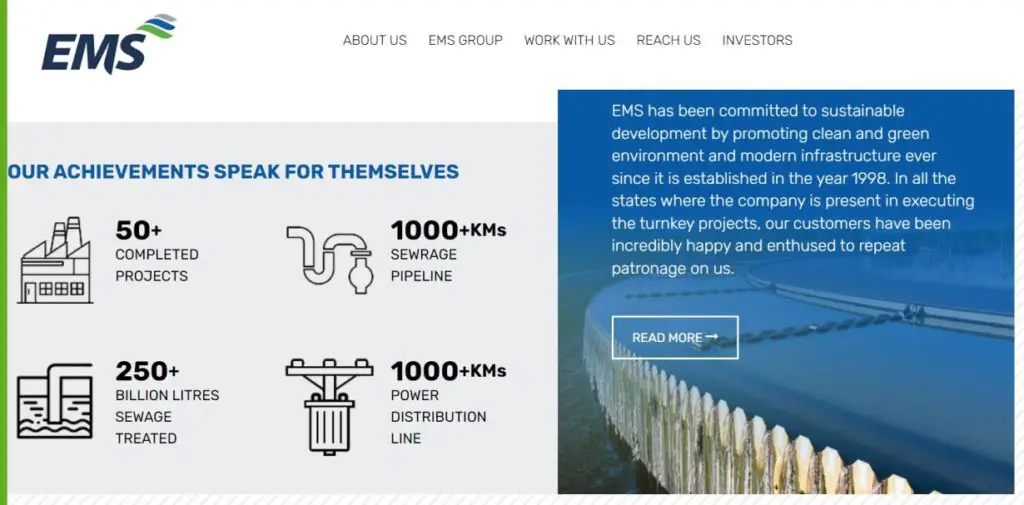

EMS Limited IPO Description – The company is in the business of Sewerage solutions, Water Supply System, Water and Waste Treatment Plants, Electrical Transmission and Distribution, Road and Allied works, operation and maintenance of Wastewater Scheme Projects (WWSPs) and Water Supply Scheme Projects (WSSPs) for government authorities/bodies.

EMS Limited bids for tenders issued by CPWD, State Governments and Urban Local Bodies (ULBs) for developing WWSPs and WSSPs on EPC or HAM models. It has an in-house team for designing, engineering and construction, making it self-reliant on all aspects of the business. The company has a team of 61 engineers who are supported by third-party consultants and industry experts to ensure compliance and quality standards laid down by the industry and government agencies & departments. It also has own team for civil construction works thereby reducing dependence on third parties.

As on March 24, 2023, it was operating and maintaining 13 projects including WWSPs, WSSPs, STPs & HAM aggregating of INR 1,38,909.00 lakhs & 5 O&M projects aggregating to INR 9,928.00 lakhs i.e. unbilled amount as of February 28, 2023 spread across five states.

Promoters of EMS Limited – Mr Ramveer Singh and Mr Ashish Tomar

EMS Limited IPO Details

| EMS Limited IPO Dates | 8 – 12 September 2023 |

| EMS Limited IPO Price | INR 200 – 211 per share |

| Fresh issue | INR 146.24 crore |

| Offer For Sale | 82,94,118 shares (INR 165.88 – 175.01 crore) |

| Total IPO size | INR 312.12 – 321.25 crore |

| Minimum bid (lot size) | 70 shares (INR 14,770) |

| Face Value | INR 10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

EMS Limited Financial Performance

| FY 2020 | FY 2021 | FY 2022 | FY 2023 | |

| Revenue | 325.64 | 330.70 | 359.85 | 538.16 |

| Expenses | 234.06 | 237.99 | 255.61 | 396.40 |

| Net income | 72.43 | 71.91 | 78.93 | 108.67 |

| Margin (%) | 22.24 | 21.74 | 21.93 | 20.19 |

EMS Limited Offer News

EMS Limited Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 61.24 | 62.27 | 23.15 |

| PE ratio | – | – | 8.64 – 9.11 |

| RONW (%) | 23.83 | 20.79 | 22.31 |

| NAV | – | 80.89 | 103.80 |

| ROCE (%) | 33.65 | 29.50 | 28.26 |

| EBITDA (%) | 29.91 | 31.27 | 27.69 |

| Debt/Equity | 0.01 | 0.01 | 0.09 |

EMS Limited IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 19 September 2023 | 100 | 350 | 5,000 |

| 18 September 2023 | 100 | 350 | 5,000 |

| 16 September 2023 | 100 | 350 | 5,000 |

| 15 September 2023 | 100 | 350 | 5,000 |

| 14 September 2023 | 100 | 350 | 5,000 |

| 13 September 2023 | 120 | 350 | 5,000 |

| 12 September 2023 | 120 | 350 | 5,000 |

| 11 September 2023 | 120 | 350 | 5,000 |

| 9 September 2023 | 125 | 350 | 5,000 |

| 8 September 2023 | 125 | 350 | 5,000 |

| 7 September 2023 | 120 | 350 | 4,600 |

| 6 September 2023 | 100 | 350 | 4,000 |

| 5 September 2023 | 90 | 300 | 3,000 |

| 4 September 2023 | 90 | 300 | 3,000 |

| 2 September 2023 | 90 | 300 | 3,000 |

| 1 September 2023 | 80 | – | – |

EMS Limited IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Total |

|---|---|---|---|---|

| Shares Offered | 29,84,371 | 23,40,918 | 54,62,142 | 1,07,87,431 |

| 12 Sep 2023 | 153.02 | 82.32 | 29.75 | 75.26 |

| 11 Sep 2023 | 0.67 | 29.73 | 16.62 | 15.05 |

| 8 Sep 2023 | 0.09 | 6.00 | 4.82 | 3.77 |

EMS Limited IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi –

Antique Stock Broking –

Arihant Capital –

Ashika Research –

Asit C Mehta –

BP Wealth –

Canara Bank Securities – Subscribe

Choice Broking – Subscribe

Dalal & Broacha –

Elite Wealth – Subscribe

Geojit –

GEPL Capital – Subscribe

Hem Securities – Subscribe

ICICI direct –

Jainam Broking –

KR Choksey –

LKP Research –

Marwadi Financial –

Motilal Oswal –

Nirmal Bang – Subscribe

Reliance Securities –

Religare Broking –

Samco Securities – Not Rated

SMC Global –

Swastika Investmart –

Ventura Securities – Subscribe

EMS Limited Offer Registrar

KFIN TECHNOLOGIES LIMITED

Selenium Tower – B, Plot 31 & 32, Gachibowli,

Financial District, Nanakramguda, Serilingampally,

Hyderabad – 500 032, Telangana

Tel: +91 40 6716 2222

E-mail: [email protected]

Website: www.kfintech.com

EMS Limited Contact Details

EMS LIMITED

701, DLF Tower A, Jasola

New Delhi-110025, India

Phone: +91 8826696627

E-mail: [email protected]

Website: www.ems.co.in

EMS Limited IPO Allotment Status

EMS Limited IPO allotment is now available on the KFin Tech website. Click on this link to get allotment status.

Meanwhile, bank debits and lien removal has started. Please check effective balance in bank to know allotment status.

EMS Limited IPO Dates & Listing Performance

| EMS Limited IPO Opening Date | 8 September 2023 |

| EMS Limited IPO Closing Date | 12 September 2023 |

| Finalization of Basis of Allotment | 18 September 2023 |

| Initiation of refunds | 19 September 2023 |

| Transfer of shares to demat accounts | 20 September 2023 |

| EMS Limited IPO Listing Date | 21 September 2023 |

| Opening Price on NSE | INR 282 per share (up 33.65%) |

| Closing Price on NSE | INR 279.90 per share (up 32.7%) |

EMS Limited IPO FAQs

How many shares in EMS Limited IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 50%, NII – 15%, and Retail – 35%.

How to apply in EMS Limited Public Offer?

The best way to apply in EMS Limited public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is EMS Limited IPO GMP today?

EMS Limited IPO GMP today is INR 100 per share.

What is EMS Limited kostak rate today?

EMS Limited kostak rate today is INR 350 per application.

What is EMS Limited Subject to Sauda rate today?

EMS Limited Subject to Sauda rate today is INR 5,000 per application.

This is a certainly an interesting IPO. With more and more population shifting towards urban centers, sewage service is will be required more and more. Many more companies will mushroom in this sector.