Last Updated on January 6, 2025 by Krishna Bagra

Price band for Endurance IPO has been fixed at INR467-472 per share. In its red herring prospectus (RHP), the company said its IPO opens on 5 October and will close on 7 October. Investors can apply for minimum 30 shares and in multiples thereafter. A total of 24,613,024 shares will be sold in the IPO. In total, the share sale by existing shareholders will mobilize INR1,161.7 crore (INR11.6 billion). As there are no new shares being offered, the company will not get any proceeds from the IPO. Endurance Technologies IPO will be managed by Axis Capital and Citi Group Markets India while Link Intime India is the registrar to the public offer.

Price band for Endurance IPO has been fixed at INR467-472 per share. In its red herring prospectus (RHP), the company said its IPO opens on 5 October and will close on 7 October. Investors can apply for minimum 30 shares and in multiples thereafter. A total of 24,613,024 shares will be sold in the IPO. In total, the share sale by existing shareholders will mobilize INR1,161.7 crore (INR11.6 billion). As there are no new shares being offered, the company will not get any proceeds from the IPO. Endurance Technologies IPO will be managed by Axis Capital and Citi Group Markets India while Link Intime India is the registrar to the public offer.

The most prominent name among the selling shareholders in Endurance IPO is the UK-based PE firm Actis Advisors which plans to sell all of its 19,295,968 shares. In addition, company promoter Anurang Jain will also offload 5,317,056 shares.

Read Also: Actis plans partial exit through Endurance Technologies IPO

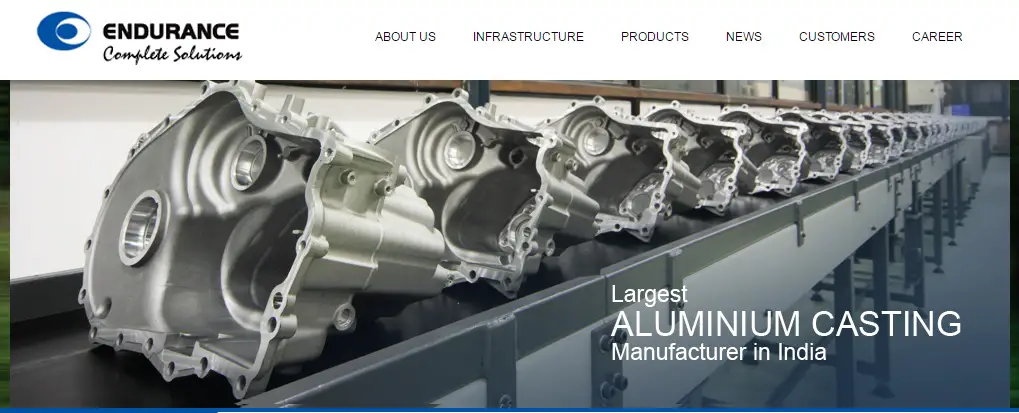

Aurangabad-based Endurance Technologies manufactures and supplies a wide range of aluminium die castings, suspensions, transmissions and brakes components for two-wheelers, three-wheelers, passenger vehicles, light commercial vehicles and heavy commercial vehicles. According to the Aluminium Casters’ Association of India, Endurance is the number one aluminium die-casting company in India in terms of actual output and installed capacity in FY2016.

Stable financial performance

Promoted by industry veteran Anurang Jain, Endurance Technologies has expanded in Europe in recent years. Endurance Technologies primarily supplies to car manufacturers in the region and the business continues to grow. In FY2016, Europe accounted for 29.9% of the company’s revenue and the figure increased to 33.2% in the first quarter of FY2017. Endurance Technologies’ financial performance is quite impressive as its top line and bottomline have grown in each of the last four years, except in FY2013. In the same timeframe, its profit margins have also improved from 4.7% in FY2012 to 5.5% in FY2016.

Endurance Technologies’ consolidated financial performance (in INR crore) | |||||

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | |

| Total revenue | 3,831.7 | 3,822.4 | 4,211.9 | 4,916.9 | 5,240.5 |

| Total expenses | 3,599.1 | 3,610.0 | 3,959.8 | 4,589.9 | 4,860.8 |

| Profit after tax | 182.3 | 169.2 | 204.4 | 252.4 | 289.8 |

As always, we will publish our analysis of Endurance IPO in the coming days. Meanwhile, you can visit our discussion page on Endurance Technologies IPO to see how the offer is received by our members of investor community.