Last Updated on May 8, 2025 by Krishna Bagra

Equitas IPO opens on 5 April and will close on 7 April in the biggest public offer of India this year. The upcoming IPO of the Chennai-based microfinance player has been priced in the range of INR109-110 per share. The IPO is being managed by Axis Capital, ICICI Securities, HSBC and Edelweiss Financial Services. At INR109 per share, the IPO will raise INR2,163.4 crore while the issue size increases to INR2,176.7 crore at the upper end of the price band.

The equity shares are proposed to be quoted on BSE and NSE and listing is expected on 21 April. Here are some broad details before we delve deeper in the IPO review and analysis.

Equitas Holdings IPO details

| IPO dates | 5-7 April 2016 |

| Price Band | INR109 – 110 per share |

| Issue Size | INR 2,163.4 – 2,176.7 crore |

| Minimum Bid | 135 shares |

| Retail allocation | 35% |

Equitas IPO structure

According to the red herring prospectus (RHP), out of the total figure, Equitas will get INR720 crore, through fresh issue of shares. This figure is up from the earlier marks an increase from the INR600 crore the company was earlier planning to raise. In addition, 13.24 crore shares will be sold by existing shareholders through the offer for sale (OFS) route. This is also an increase from the 13.08 crore shares the investors were planning to sell earlier.

Equitas has an impressive list of existing shareholders which includes International Finance Corporation (IFC), CDC Group, Sequoia, WestBridge and Aavishkaar. Clearly, this is an interesting company and deserves in-depth analysis and review.

Since a lot of these investors are based out of India, Equitas has exceptionally high foreign shareholding at 92.64%. The company plans to bring this figure down to 49% through the IPO.

Equitas has a well-spread-out shareholding pattern as no investor holds more than 15%. IFC is the biggest shareholder with 14.27% and founder PN Vasudevan holds 3.16% stake. Interestingly, almost all the big investors will be participating in the OFS. In fact, some of the investors such as Aavishkar, Aquarius, Lumen, MVH, Sequoia and WestBridge will completely sell their positions. Still, IFC and CDC Group will remain onboard as biggest investors and this shows that these investors see value in Equitas post listing.

Read Also: Equitas Holdings IPO opens on 5 April, IFC, Helion to part exit

Here is the list of the investors participating in the OFS and their shareholding. For the listing of the biggest shareholders and other details about Equitas IPO, please visit this page.

| Investor | Shareholding before IPO | OFS | Resulting shareholding |

| IFC | 38,523,657 | 16,463,772 | 22,059,885 |

| FMO | 14,884,016 | 11,926,668 | 2,957,348 |

| Aavishkar | 4,999,998 | 4,999,998 | 0 |

| Aquarius | 7,153,038 | 7,153,038 | 0 |

| Creation | 18,182,037 | 868,125 | 17,313,912 |

| Helion | 8,147,298 | 4,288,648 | 3,858,650 |

| IFIF | 26,229,885 | 25,938,594 | 291,291 |

| Lumen | 22,571,820 | 22,571,820 | 0 |

| MVH | 16,975,484 | 16,975,484 | 0 |

| Sarva | 9,789,045 | 6,635,770 | 3,153,275 |

| Sequoia | 12,840,861 | 12,840,861 | 0 |

| WestBridge | 1,583,106 | 1,583,106 | 0 |

| PN Vasudevan | 8,532,999 | 180,000 | 8,352,999 |

More than the prospects of cashing out, the OFS in Equitas IPO is mandated by regulations which require foreign shareholding in small finance banks to be less than 74%. Founder PN Vasudevan will also be participating in the OFS, although the sale will be limited to 180,000 shares which is designed to bring his stake to just under 2.5% in the final capital structure.

Use of proceeds from Equitas IPO

Out of the INR720 crore Equitas Holdings will receive, INR288 crore will be invested in flagship Equitas Micro Finance Limited (EMFL), while a similar amount will go in Equitas Finance Limited (EFL). Nearly INR40 crore have been earmarked for Equitas Housing Finance Limited (EHFL) and the rest INR104 crore for general corporate purposes.

Read Also: Upcoming IPOs in 2016: IPOs worth at least INR13,500 crores in pipeline

Equitas Holdings business background

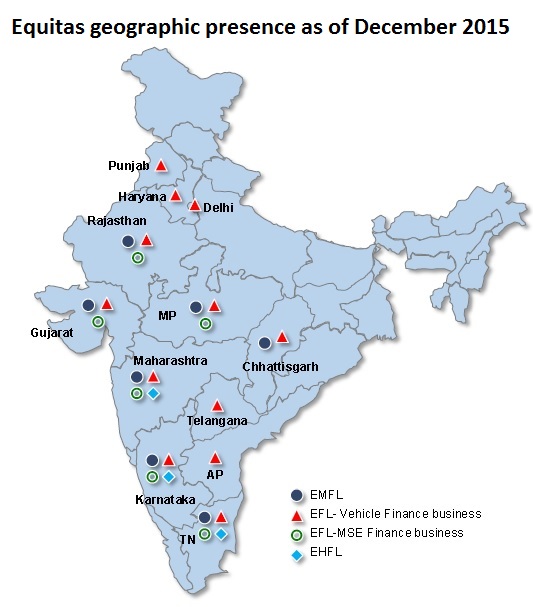

As mentioned above, Equitas is primarily a microfinance player, although it has diversified in vehicle finance, micro and small enterprise (MSE) finance, and housing finance verticals in recent years. The last two businesses are largely undertaken as cross-sales to its existing borrowers based on their previous back record.

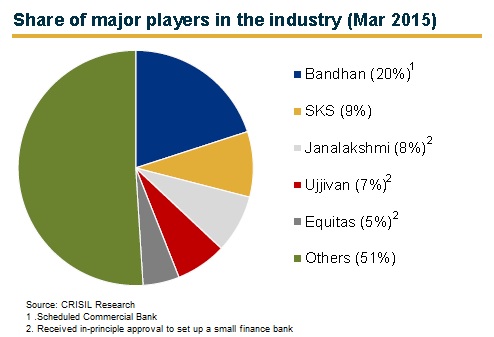

Nevertheless, microfinance business accounted for 52.49% of its total assets under management (AUM) as of June 2015 while vehicle finance business accounted for 28.26%. MSE finance and housing finance verticals accounted for 14.85% and 4.4% respectively. Equitas claims to be the fifth largest microfinance player in India on the basis of gross loan portfolio.

In terms of geographic presence, the company’s operations are spread across 11 states, one union territory and the NCT of Delhi. As of December 2015, Equitas had 539 branches across the country.

What makes Equitas IPO special?

We simply like the fact that this is India’s first IPO of small finance bank (SFB). Equitas was one of the 10 companies in September 2015 which received an in-principle approval from the RBI to set up SFBs. This was out of 72 applicants and is quite an achievement in itself.

Microfinance is a tricky subject and something which can be easily turned into a matter of political debate. Winning of the SFB license is also a step in the direction of reducing dependency to this politically sensitive issue.

There are other reasons as well, please read more to find out why we like Equitas IPO.

Financial performance

As seen in the below table, Equitas has been on top of the game with a consistent performance in revenue growth. The topline of microfinance major has trebled in the last three years and a large part of it has trickled in the form of profits. No financial engineering or excessive payouts to promoters here. We like this.

Margins are strong in double digits and it is important to highlight that they are not going down despite the growth in scale. Another thing we like.

| Equitas Holdings’ consolidated financial performance (in INR million) | |||||

| FY2011 | FY2012 | FY2013 | FY2014 | FY2015 | |

| Total revenue | 2,392.0 | 1,986.5 | 2,831.7 | 4,835.2 | 7,559.3 |

| Total expenses | 1,951.6 | 1,878.6 | 2,425.3 | 3,697.1 | 5,923.7 |

| Profit/(loss) after tax | 285.2 | -34.7 | 319.0 | 743.4 | 1,066.3 |

| Net margin (%) | 11.9 | -1.7 | 11.3 | 15.4 | 14.1 |

Ok, it sounds like a gravy train, is it really the case?

Well, simple answer is yes and no and long answer follows here.

Going forward, as Equitas turns into an SFB, it will be needed to increase funding to adhere to CRR (cash reserve ratio) and SLR (statutory liquidity ratio) requirements laid out by the RBI. Accordingly, negative carry forward on these parameters is likely to bring down net interest margins.

As it broadens its customer and retail deposit base, Equitas will be required to bring new products which may increase its operating expenses. Costs are also going to increase as it recruits more, trains more and upgrades systems and branch infrastructure.

As one can see, these are necessary evils in the system and will be there in the case of every other SFB candidate including Ujjivan which is also firming plans to bring its IPO.

Read Also: Ujjivan Financial Services plans IPO

Since these are systemic issues, the ultimate decision to invest in Equitas IPO rests upon the simple question if the offer is overpriced or not. Thankfully, this IPO does not hide behind the “no listed industry peers” garbage and thus, offers good visibility in terms of valuations. This comparison with listed players is especially helpful for retail investors which have been at the receiving end lately in IPOs.

Based on the consolidated earnings for the year ended March 2015, Equitas has diluted EPS of INR4.47. This values the company at 24.6 times its earnings at the upper end of the price band INR110 per share. This is less than the PE ratio of 26.8 times for SKS Microfinance which is closest to the business model of Equitas. SKS Microfinance trades at 6.6 times its book value while that of Equitas is 2.5 times. Another industry player, though not directly comparable, is Cholamandalam Investment and Finance Company which trades at a lower PE ratio of 21.7 but has a high price to book multiple of 4.1 times. Repco Home Finance – another listed peer – trades at a PE ratio of 25.3 and a PB ratio of 4.4. Clearly, Equitas offers decent discount despite strong fundamentals.

In our analysis, it is a case of a company leaving (or required to leave by regulation) money on the table. In either case, retail investors will do well to capitalize on this opportunity. Without doubt, Equitas is a major player in its field but its reasonable and attractive price range is a clear contrast to what we have seen in Bharat Wire Ropes, HealthCare Global, and Infibeam. In short, we fail to see Equitas IPO in any other light except positive for IPO investors.

Good analysis, I’m going to invest in this IPO. Can you suggest I should sell in grey market or hold after listing??

Thanks for your comment Dipesh. Equitas looks good for listing gains but can be held for long term appreciation as well.

A perfect and complete objective analysis. You deserve accolade and lot of appreciations.

Krishna Bagra, could you please dwell on the road that is to be traversed post listing, keeping in mind the various issues that are to be undertaken by the company, and be able to reach a suitable level to be able to pay back to the investors who will repose faith at this IPO stage. Or else we first observe them till their midway and then plunge into from secondary market at appropriate time and valuations? Please do comment/advise supported with facts and measurable analysis. Regards,

Manjit, thanks for your kind words. I’m glad the review was helpful and your appreciation is helpful. Specific price trends are difficult to predict but taking a call on the basis of fundamentals is a proven way and Equitas is good on those parameters.

Equity investing is inherently risky and investors need to go through fundamentals before making a decision. Now, Equitas is a transformation play from an NBFC to a bank and generally speaking, it is not uncommon to see some hiccups in an evolution.

I’ve already mentioned there may be pressure on margins because of capital requirements. It is up to you to decide if you want to hold this for long term. Personally speaking, I’m a big supporter of booking partial profits.

Keep writing 🙂

Should i invest in equitas financial ipo for listening gain?

Yes you should, that’s what everyone is saying. Right price and great business.

Tomorrow is the last day for this ipo, apply before 12 to avoid last minute rush.

Thanks for your wonderful comments, Ms Krishna.

One must learn the art of reading between the lines… and at the end of the day decisions/risks are mine, make losses/gains.

Keep delivering objectively, regards

good analysis. very helpful. i was wondering post-listing which broad sector will equitas be part of. for example, the banking sector is in the dumps (albeit rose a bit in the monsoon forecast equity bump). if equitas becomes a banking sector story, will it also rise with them? or should we think of it as Sriram Transport types? or a Bajaj finance types?

I am new to these things so please correct me if i sound amateur :).

Good work Krishna ji.