Private equity firm GEF Capital Partners has executed a partial exit from ESDS Software Solution, coinciding with the data centre and cloud services provider’s renewed efforts to launch an initial public offering (IPO) after a three-year hiatus. This strategic move reflects ESDS’s commitment to advancing its market presence and capitalizing on growth opportunities.

Details of Partial Exit from ESDS Software Solutions

GEF Capital, which initially invested in ESDS in 2018, sold a portion of its stake to local investors and family offices in a pre-IPO round valued between INR 300 to 400 crore (approximately USD 35-47 million), according to a report by VC Circle. This transaction is estimated to have valued the company at around INR 2,000 – 2,200 crore. Prior to this exit, GEF held over 41% of ESDS, having invested approximately INR 167 crore across multiple funding rounds. The latest deal is believed to have yielded a return of 5-6 times the original investment for GEF, demonstrating the firm’s successful monetization strategy as it prepares to raise its third fund, targeting up to USD 400 million.

ESDS Software Revives IPO Plans

ESDS has not raised any primary capital from this transaction; however, the report added that it is actively pursuing an IPO within the next four to six months, aiming to raise over INR 500 crore. The company has engaged DAM Capital Advisors to oversee the IPO process. This upcoming IPO marks the company’s second attempt at going public; its previous efforts in 2021 were halted due to unfavourable market conditions.

Company Overview & Financial Performance

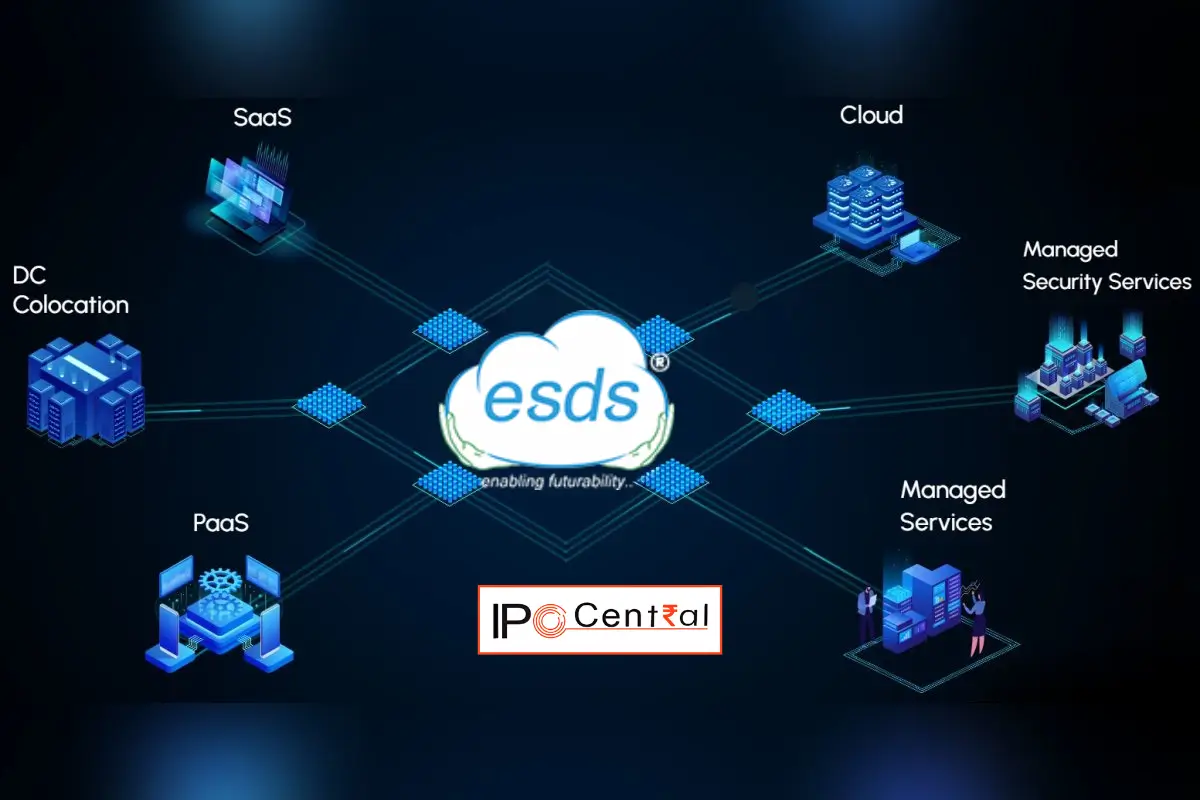

Founded in 2005 by Piyush Somani, ESDS specializes in IT services including hosting, network and server management, and security solutions for Indian clients. The company currently operates six data centres across India and plans to expand its infrastructure with two new facilities in Noida and Kolkata over the next two years.

For the fiscal year ending March 2024, the company reported consolidated net sales of INR 286.5 crore, up from INR 207.5 crore the previous year, alongside a profit of INR 13.6 crore—signifying a turnaround after two years of losses. This financial recovery positions the company favourably as it seeks to attract investors through its upcoming IPO.

Conclusion

The developments surrounding GEF’s partial exit and after ESDS Software revives IPO plan, highlight a significant moment for both entities as they navigate the evolving landscape of private equity and public offerings in India. For more information related to IPO GMP, SEBI IPO Approval, and Live Subscription stay tuned to IPO Central.