Last Updated on September 8, 2016 by Krishna Bagra

Come next week and two IPOs will open for investors in India. While the INR894.4 crore IPO of L&T Technology Services is getting all the attention, Jalandhar-based GNA Axles will also try to get investors onboard. The company is planning to raise INR130 crore through the upcoming IPO which will open on 14 September and will close on 16 September. The company plans to sell a total of 6,300,000 shares through the IPO in the price band of INR205 – 207 per share. The offer will include 200,000 shares reserved for eligible employees. Here is a low down on GNA Axles IPO.

History and business – GNA Axles was established in 1993 and is primarily into making rear axle shafts for agricultural and commercial vehicles. The company also makes spindles for these vehicles. Rear axle shaft – the primary product of GNA Axles – contributed 84% to its total sales in FY2016 while spindles contributed nearly 9% of revenues. Other shaft products made nearly 6% of its revenues.

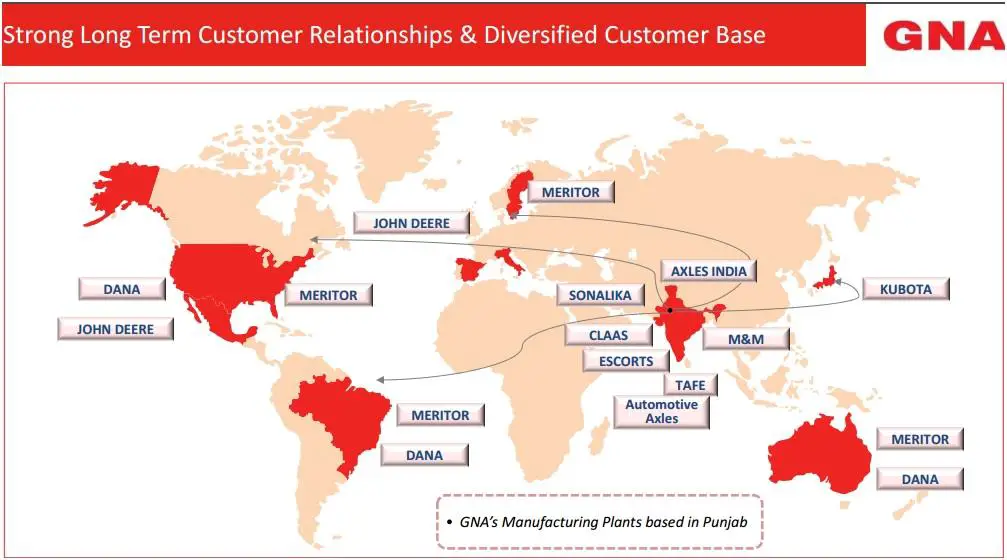

Local setup but international operations – GNA Axles has two manufacturing units and both are located in Kapurthala and Hoshiarpur, both in Punjab. The facilities together produce the entire line-up for the company for its global operations. More than half (54%) of its revenues in FY2016 came from export operations and this figure has grown from just 35% in FY2012.

Clients – GNA Axles has several national and overseas companies as its clients. Among OEMs are Mahindra & Mahindra (M&M), Tractors and Farm Equipment (TAFE) and John Deere. Apart from OEMs, GNA Axles also supplies its products to as tier-1 vendors such as Transaxle Manufacturing of America, Kubota Corporation Meritor HVS AB, Dana Limited and Automotive Axles Limited.

High dependence on certain clients – Given the nature of its target market, GNA Axles has a high dependence on its biggest customers. Top 10 domestic customers contributed 89.29% of its domestic sales in FY2016 while the share of top 5 overseas customers stood at 80.19% in export sales.

High dependence on certain clients – Given the nature of its target market, GNA Axles has a high dependence on its biggest customers. Top 10 domestic customers contributed 89.29% of its domestic sales in FY2016 while the share of top 5 overseas customers stood at 80.19% in export sales.

Read Also: L&T Technology Services IPO Review: Technology isn’t just IT

Use of funds – Since there is no offer for sale (OFS) involved in the IPO, all the proceeds from the public offer will go to the company. GNA Axles plans to use IPO funds for acquiring plant and machinery, meet working capital requirements and general corporate purpose. In the red herring prospectus (RHP), the company said it plans to use INR80.07 crore (INR800.7 million) for purchasing plant and machinery while INR35 crore (INR350 million) will be used to fund working capital requirements.

Profitable growth – According to the RHP, the company’s revenues and profits have been growing consistently in the last three years. In FY2016, GNA Axles’ revenues jumped 18.2% to INR508.9 crore (INR5.08 billion) while profits surged 20% to INR25.9 crore (INR259.5 million). This translates into the net profit margin of 5.1% in FY2016, marking the highest level in the last five years.

Valuation – GNA Axles’ earnings per share (EPS) for FY2016 stood at INR17.12 which values the company at a PE ratio of 12.09. This compares with a PE ratio of 13.79 for peer Talbros Engineering.

To know more about the IPO and to participate in a lively discussion, refer to this page on GNA Axles IPO. Keep coming back to IPO Central as we plan to publish our review of GNA Axles IPO in the coming days.