Last Updated on September 11, 2016 by Krishna Bagra

GNA Axles IPO is one of the two public issues opening next week for subscription in a volatile market environment, the other being L&T Technology Services which we have already written about here. While the two IPOs compete for attention at the same time, there is enough liquidity and risk appetite to soak in both the IPOs. Besides, GNA Axles IPO is a totally different ball game from L&T Technology Services. We have already noted that L&T Tech IPO is for high risk takers and in GNA Axles IPO review, we try to find out if investors need to be as cautious while subscribing.

GNA Axles’ public offer opens on 14 September for subscription and investors will have time till 16 September to bid for shares. The issue is priced at INR205 – 207 per share and a total of 6,300,000 shares will be issued in the IPO, including 200,000 shares for eligible employees. In total, GNA Axles IPO will raise INR130 crore (INR1.3 billion).

GNA Axles IPO details

| IPO dates | 14 – 16 September 2016 |

| Price Band | INR205 – 207 per share |

| Fresh Issue Size | INR130 crore |

| Total IPO size | INR130 crore |

| Minimum bid (lot size) | 70 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | BSE, NSE |

Use of IPO funds

Since there is no offer for sale (OFS) involved in the IPO, all the proceeds from the public offer will go to the company. GNA Axles plans to use IPO funds for acquiring plant and machinery, meet working capital requirements and general corporate purpose. According to its red herring prospectus (RHP), the company plans to use INR80.07 crore (INR800.7 million) for purchasing plant and machinery while INR35 crore (INR350 million) will be used to fund working capital requirements.

GNA Axles – Seehra, Singh and Kaur

Established in 1993, GNA Axles is a major player in rear axle shafts for agricultural and commercial vehicles. GNA has two manufacturing units in Kapurthala and Hoshiarpur with production for on-highway and off-highway vehicular segments including HCV, MCV, LCV tractors and machinery. Manufacturing and sales of rear axle shafts is the primary business of GNA Axles and it contributed 84% to the company’s total sales in FY2016 while spindles contributed nearly 9% of revenues. The company is family-owned and has no external investors. Accordingly, the list of biggest shareholders is dominated by Singh, Sehra, and Kaur surnames.

Having external investors on board is a great indicator of the confidence these investors have in the business and also works as a validation tool for IPO investors. However, absence of external investors is also not a deal breaker as we noticed in Alkem Laboratories IPO.

Biggest shareholder’s in GNA Axles | ||

| Name of shareholder | Equity Shares | Percentage (%) |

| Jasvinder Singh Seehra | 2,630,400 | 17.34 |

| Ranbir Singh | 2,630,400 | 17.34 |

| Gurdeep Singh | 2,630,400 | 17.34 |

| Maninder Singh | 2,630,400 | 17.34 |

| Rachhpall Singh | 1,790,400 | 11.81 |

| Gursaran Singh | 1,365,400 | 9.00 |

| Mohinder Kaur | 531,500 | 3.50 |

| Harjinder Kaur | 531,500 | 3.50 |

| Kulwin Sehra | 212,500 | 1.40 |

| Keerat Singh Sehra | 212,500 | 1.40 |

| Total | 15,165,400 | 100.00 |

GNA Axles IPO Review- Major customers

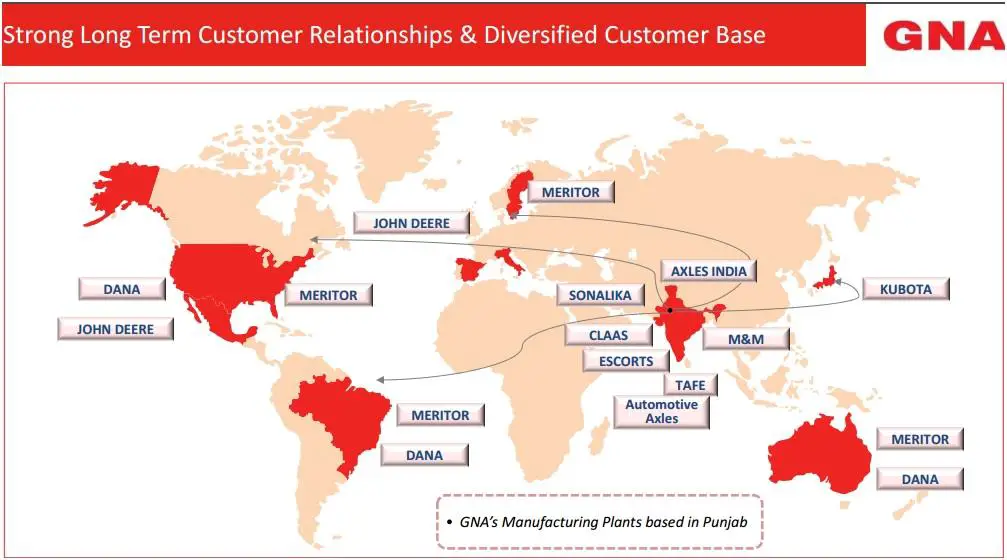

Through its two manufacturing plants in Punjab, the company caters to a wide array of customers. This list includes original equipment manufacturers (OEMs) such as John Deere, Mahindra & Mahindra (M&M), Tractors and Farm Equipment Limited (TAFE) as well as tier-1 suppliers to OEMs such as Transaxle Manufacturing of America, Kubota Corporation, Automotive Axles Limited, Meritor HVS AB and Dana Limited. The following image demonstrates that GNA Axles exports equipment to several overseas locations including USA, UK, China, Japan, Germany, France, Australia, Sweden, Italy, Turkey and Spain.

In fact, more than half (54%) of its revenues in FY2016 came from export operations and this figure has grown from just 35% in FY2012. The company hopes to cash on existing overseas customer relationships and cross sell products while also get help from the Indian government’s export friendly policies like duty drawback schemes and export promotion capital goods.

In fact, more than half (54%) of its revenues in FY2016 came from export operations and this figure has grown from just 35% in FY2012. The company hopes to cash on existing overseas customer relationships and cross sell products while also get help from the Indian government’s export friendly policies like duty drawback schemes and export promotion capital goods.

Overreliance on few clients

Despite the strong list of customers and well-established relationships with them, GNA Axles has high dependency on a few clients. Ten of its biggest domestic customers contributed 89.29% of domestic sales in FY2016 and this figure was largely unchanged from 89.06% in FY2015.

Read Also: ICICI Prudential Life IPO price band at INR300-334, issue to open on 19 Sep

On the exports front (which is a bigger business), the company’s dependence is even higher. The share of top 5 overseas customers stood at 80.19% in export sales in FY2016, although this figure was down from 91.32% in FY2015.

In both cases, the figures are very high, although it has more to do with the nature of the industry where the number of OEMs it can supply are limited.

GNA Axles IPO Review – Financial performance

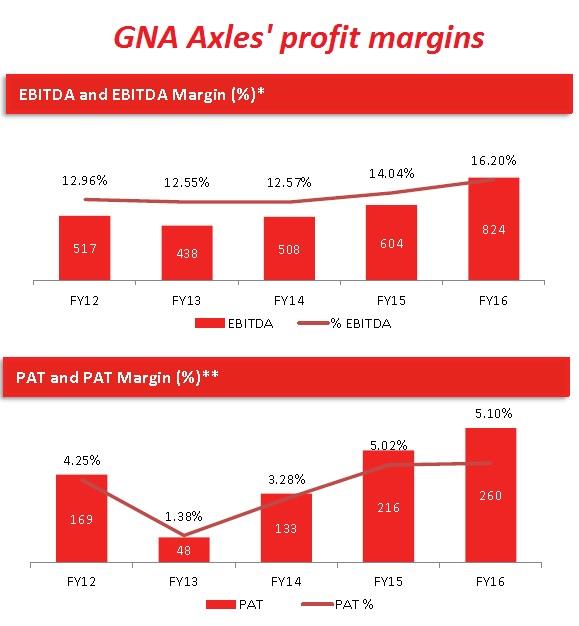

GNA Axles has been making steady growth in its core business and has posted higher top line and bottom line in the recent years. Except a dip in FY2013, which was on account of an industry-wide slowdown, the company has posted improvement in major financial metrics. In FY2016, GNA Axles’ revenues jumped 18.2% to INR508.9 crore (INR5.08 billion) while profits surged 20% to INR25.9 crore (INR259.5 million). This translates into the net profit margin of 5.1% in FY2016, marking the highest level in the last five years. EBITDA margins have also moved up for the company in these years.

GNA Axles’ financial performance (in INR crore) | |||||

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | |

| Total revenue | 398.7 | 349.0 | 404.2 | 430.6 | 508.9 |

| Total expenses | 370.8 | 331.4 | 385.8 | 409.9 | 469.6 |

| EBITDA margin (%) | 13.0 | 12.6 | 12.6 | 14.0 | 16.2 |

| Profit after tax | 16.9 | 4.8 | 13.2 | 21.6 | 25.9 |

| Net profit margin (%) | 4.2 | 1.4 | 3.3 | 5.0 | 5.1 |

The company says the proximity of its manufacturing facilities near to its large customers like International Tractors Ltd, M&M (Swaraj division), Escorts & New Holland helped in lower transportation and logistics costs. In addition, receding debt levels also helped in boosting margins. As on 31 March 2016, the company’s debt equity ratio stood at 0.95 – its lowest level in three years.

The company says the proximity of its manufacturing facilities near to its large customers like International Tractors Ltd, M&M (Swaraj division), Escorts & New Holland helped in lower transportation and logistics costs. In addition, receding debt levels also helped in boosting margins. As on 31 March 2016, the company’s debt equity ratio stood at 0.95 – its lowest level in three years.

GNA Axles IPO Review – Should you subscribe?

So we come back to the original question if it makes sense for investors to subscribe to the IPO. Looking at the company’s business fundamentals, GNA Axles comes across as a decent company. Despite being a family owned company, we didn’t find GNA Axles paying excessive remuneration to its promoters. In total, the aggregate value of the remuneration paid to the six executive directors in FY2016 is INR2.34 crore (INR23.40 million). This is a fresh breeze considering the fact that high payouts are not uncommon in the industry and especially in family controlled comapnies. We still have the memories fresh in our minds of the amazing figures Precision Camshafts paid to its promoters Yatin Shah and Suhasini Shah (more on this INR22 crore package to promoters can be read here).

In terms of valuations, GNA Axles’ FY2016 earnings per share (EPS) of INR17.12 value the business at a PE ratio of 12.09. This compares with a PE ratio of 13.79 for peer Talbros Engineering. An important thing to highlight here is the superior quality of earnings and margins for GNA Axles. In comparison of the 2.3% profit margin of Talbros Engineering in FY2016, GNA Axles’ profitability was 5.1%. Similarly, return on net worth (RONW) figures for the company was nearly double at 18.7% in the latest FY.

Read Also: L&T Tech IPO Review: Technology isn’t just IT

By no stretch, GNA Axles is an exotic business and investors need to see it in that light. Although auto and ancillary stocks are doing extremely well in the market currently, GNA Axles caters to industries which are heavily dependent on macroeconomic performance and government spending on infrastructure. Since its growth prospects are limited, GNA Axles is unlikely to get the valuations offered to component suppliers in passenger vehicle segment such as Sona Koyo Steering System (PE ratio of 32) or Hi-Tech Gears (PE ratio of 27).

On the other hand, GNA Axles IPO is priced just about right and in fact, valuation offers some comfort. Automotive Axles, operating in the same line and one of the customers of GNA Axles, currently trades at a PE ratio of 31. Overall, GNA Axles is a solid growth story; however, the risk that the market may not offer it full valuations is a real one. We saw this recently in the case of L&T Infotech IPO where a decent business is bogged down by dim industry outlook. Stock markets over the last week have demonstrated signs of faltering at these levels and it is well known that markets always overreact when they are not driven by fundamentals. In this backdrop, our view in the GNA Axles IPO review indicates that an investment decision is largely a call on the wider market than the company’s fundamentals which are very much in place.