Goa Shipyard Share Price Description – Goa Shipyard (GSL) is a prominent Indian shipbuilder with a rich history and a strong presence in the defense sector. GSL has been at the heart of India’s shipbuilding industry since 1957. That experience shows in the high-quality vessels it designs and constructs for the Indian Navy and the Indian Coast Guard—and for clients around the world. As an unlisted company, GSL is often of interest to investors looking for opportunities in the defense and shipbuilding sectors.

At its core, GSL is a shipbuilder. And that means building the kinds of ships that meet the exacting needs of its clients. Offshore patrol vessels, fast patrol vessels, and mine countermeasure vessels are just a few examples. With a skilled workforce and cutting-edge facilities, GSL delivers on that promise. Ship repair and modernization projects are another area where the company excels.

Products & Services of Goa Shipyard

- Design and Construction of Ships – That’s where most of GSL’s revenue comes from—around 91%. The company builds a wide range of vessels, from Advanced Frigates to Pollution Control Vessels. Those vessels serve the Indian Navy, the Indian Coast Guard and international clients. GSL is known for delivering complex, technology-intensive ships that meet the toughest defense and commercial requirements.

- Ship Repair – While ship repairs make up a smaller portion of GSL’s revenue, they’re just as vital for maintaining relationships with the Indian Navy, Coast Guard and commercial clients. Last fiscal year, GSL completed refits of five vessels. That kind of comprehensive maintenance service is what keeps those relationships strong.

- General Engineering Services (GES) – GSL’s engineering division offers specialized solutions for shipbuilding and naval applications. In the last fiscal year, the company delivered a Damage Control Simulator to the Indian Navy ahead of schedule. It supplied specialized boats to the Indian Army. And it’s investing in research and development, focusing on making Indian shipbuilding more self-sufficient and technologically advanced. Autonomous Surface Vessels are just one area where GSL is pushing the boundaries.

- Modernization and Infrastructure – Modernization and infrastructure are key to GSL’s success. The yard has been extensively modernized to incorporate the latest technologies in shipbuilding. That included the commissioning of Phases 1 and 2 of the Modernization Project in 2011. That gave GSL the capacity to dock vessels up to 120 meters in length and 6,000 tons. With that upgrade, GSL became India’s first defense shipyard equipped with a modern ship lift facility for launching and docking ships.

Read Also: Big Basket Unlisted Share Price

Strategic Initiatives and Growth Prospects

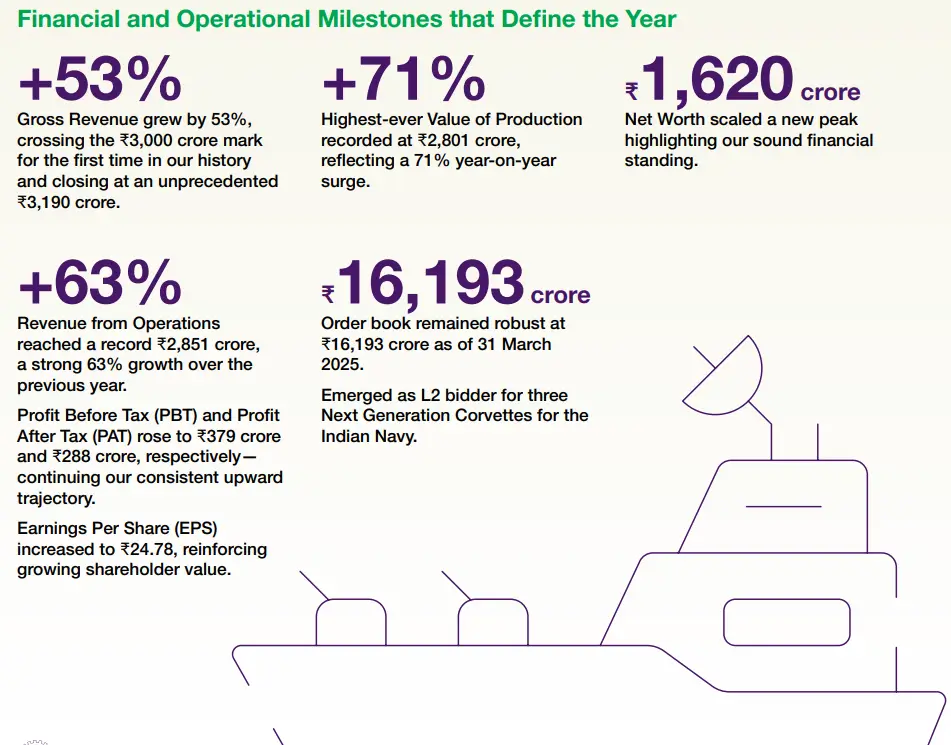

GSL’s order book stands at approximately INR 16,020 crore, with a strong outlook to exceed INR 34,000 crore following the anticipated finalization of the Next-Generation Corvettes (NGC) contract. The company is actively moving forward with the project for 7 Next-Generation Offshore Patrol Vessels (NGOPVs) for the Indian Navy. This project, being executed in collaboration with Garden Reach Shipbuilders & Engineers (GRSE), remains on track with the delivery of the ships scheduled to begin in September 2026.

GSL is further expanding its global footprint by executing high-value international projects, such as the construction of a Floating Dry Dock for the Sri Lanka Navy and a next-generation trailing Suction Hopper Dredger for the Luxembourg-based Jan De Nul Group. These projects signify GSL’s successful expansion into specialized international markets and its growing reputation as a lead design yard for complex maritime platforms.

Key Highlights FY 2024 – 25

- GSL achieved a historic milestone by launching the second Advanced Frigate, ‘Tavasya’ (P11356), and successfully completing the launch cycle for the series of eight Fast Patrol Vessels (FPVs) for the Indian Coast Guard.

- The company maintains a massive order book valued at over INR 16,000 crore, with advanced negotiations underway for the Next-Generation Corvettes (NGC) project, which is expected to push the total order value beyond INR 34,000 crore.

- In FY 2024-25, GSL recorded its highest-ever gross revenue of INR 3,190 crore, marking a significant 53% increase from the previous financial year’s record.

- The Value of Production (VoP) surged by 71% to reach INR 2,801 crore, while the company reported a Profit After Tax (PAT) of INR 288 crore, reflecting strong operational performance and financial health.

- GSL strengthened its international and specialized portfolio by progressing on the construction of a Next-generation Trailing Suction Hopper Dredger for the Jan De Nul Group (Luxembourg) and delivering a dedicated LPG Cylinder Carrier for the Lakshadweep Administration.

- The shipyard successfully launched the second Pollution Control Vessel (PCV) for the Indian Coast Guard, a complex platform designed entirely in-house, showcasing GSL’s growing indigenous design capabilities.

- Under the ‘Aatmanirbhar Bharat’ initiative, the company transitioned into a “Design House,” with the majority of current projects, including FPVs and PCVs, being based on GSL’s own internal designs and technical specifications.

Goa Shipyard Share Price – Clients

- Indian Army

- Indian Navy

- Indian Coast Guard

- Oil & Natural Gas Corporation

- Mormugao Port Trust

- Madras Port Trust

- Tutikorin Port Trust

- Government of Goa

- Government of Maldives

- Government of Mozambique

- Government of Yemen

- Exploratory Fisheries Project, Mumbai

- Central Institute of Fisheries, Mumbai

- Royal Navy of Oman

- Central Marine Fisheries Research Institute

- Ministry of Home Affairs, Govt. of India

- Government of Iran

- Government of Srilanka

- Government of Mauritius

- Government of Myanmar

Read Also: Zepto Unlisted Share Price

Goa Shipyard Board of Directors

- Mr. Brajesh Kumar Upadhyay, Chairman & Managing Director

- Mr. Amit Satija, Govt.Nominee Director

- Mr. Sunil Shivaling Bagi, Director (Finance) & CFO

- Rear Admiral Nelson A. J. D’Souza, IN (Retd.), Director (Operations)

- Shri. Deepak Manohar Patwardhan, Independent Director

- Shri. Hasmukh Hindocha, Independent Director

Goa Shipyard Limited Share Price Details

| Name | Goa Shipyard Unlisted Shares Details |

| Face Value | INR 5 per share |

| ISIN Code | INE178Z01013 |

| Lot Size | 100 share |

| Demat Status | NSDL, CDSL |

| Goa Shipyard Share Price | INR 3,040 per share |

| Market Cap | INR 35,386 crores |

| Total number of shares | 11,64,03,748 shares |

| Website | www.goashipyard.in |

Goa Shipyard Unlisted Share Price Details – Shareholding Pattern

Details of shareholders’ holding of the equity share capital in the company as of 31 March 2025:

| Shareholder Name | % to Holding | No. of shares |

| President of India | 51.09 | 5,94,66,780 |

| Mazagon Dock Shipbuilders | 47.21 | 5,49,57,600 |

| General Public and Others | 1.70 | 19,79,368 |

Read Also: Studds Unlisted Share Price

Goa Shipyard Unlisted Share Price – Financial Performance

| Particulars | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 740.35 | 869.43 | 1,752.56 | 2,850.60 |

| Revenue Growth (%) | (13.96) | 17.43 | 101.58 | 62.65 |

| Expenses | 725.68 | 840.79 | 1,726.20 | 2,811.46 |

| Net Income | 101.09 | 154.54 | 271.32 | 288.44 |

| Margin (%) | 13.65 | 17.77 | 15.48 | 10.12 |

| EBITDA (%) | 26.38 | 30.75 | 25.10 | 14.42 |

| ROCE (%) | 12.00 | 16.27 | 25.27 | 24.80 |

| RONW (%) | 9.00 | 12.91 | 20.22 | 18.87 |

| EPS | 8.68 | 13.28 | 23.31 | 24.78 |

Goa Shipyard Limited Share Price – Peer Comparison

| Company | 3-yr Sales CAGR (%) | PE Ratio | Net Margin (%) | ROCE (%) | MCap (INR Cr.) |

| Goa Shipyard | 56.74 | 122.68 | 10.12 | 24.80 | 35,386 |

| Mazagon Dock Shipbuilders | 25.9 | 39.8 | 21.1 | 43.2 | 92,850 |

| Garden Reach Shipbuilders | 42.5 | 41.5 | 10.4 | 37.3 | 25,600 |

| Cochin Shipyard | 12.4 | 51.7 | 18.6 | 20.4 | 39,157 |

Goa Shipyard Annual Reports

Goa Shipyard Annual Report FY 2024 – 2025

Goa Shipyard Annual Report FY 2023 – 2024

Goa Shipyard Annual Report FY 2022 – 2023

Goa Shipyard Annual Report FY 2021 – 2022

Goa Shipyard Unlisted Share Price FAQs

What comprises the Goa Shipyard business portfolio?

Goa Shipyard’s business portfolio includes shipbuilding, ship repair, and general engineering services. GSL serves the defense and commercial sectors.

What is Goa Shipyard unlisted share price?

Goa Shipyard share price today is INR 3,040 per share. Shares are purchased in lots of 100 shares.

Who determines Goa Shipyard unlisted share price?

Goa Shipyard share price is determined by various factors including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

When is the Goa Shipyard IPO planned?

GSL does not currently plan to go public. It is a public-sector undertaking that builds defense ships in Vasco da Gama, Goa.