Are you looking for a tasty investment opportunity? Gopal Snacks, a leading player in India’s fast-moving consumer goods (FMCG) industry, is all set to launch its Initial Public Offering (IPO). Let’s delve into the Gopal Snacks IPO analysis and explore if subscribing to Gopal Snacks’ IPO might be a wise choice for investors.

Table of Contents

Gopal Snacks IPO Analysis: The Story Behind Gopal Snacks’ Success

In 1990, armed with a modest INR 4,500 and a fervent dream, Bipinbhai Vithalbhai Hadvani embarked on a journey to establish his own venture at the young age of 21. Initially partnering with his cousin, they launched a local snack brand with just INR 8,500, which quickly gained traction. However, differing business philosophies led to a parting of ways.

Undeterred, by 1994, with a mere INR 2.5 lakh in hand, Bipinbhai, along with his wife Daxa, laid the foundation of what would become Gopal Snacks. Starting as a partnership firm and later incorporating as a company in 2009, Gopal Snacks emerged as a fast-moving consumer goods (FMCG) powerhouse in India.

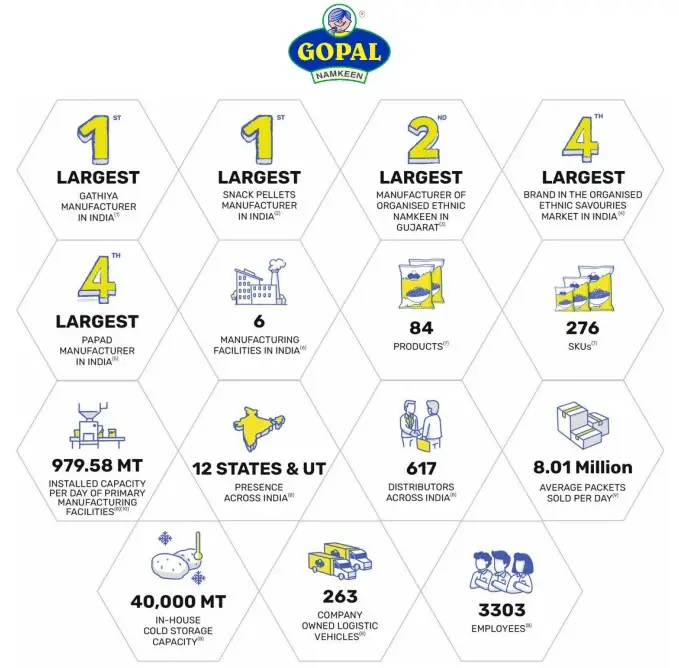

Today, Gopal Snacks caters to the diverse tastes of consumers across ten states and two union territories in India. Gopal Snacks operates six manufacturing facilities strategically located in Nagpur and Rajkot among other key locations.

Gopal Snacks IPO Review: Operating in a High-Growth Sector

The Indian packaged food industry has experienced significant growth, reaching a valuation of INR 4,62,200 crore in 2023 and projected to hit INR 6,76,700 crore by 2027. The savory snacks segment, including western and ethnic varieties, plays a pivotal role, with a projected 11% CAGR through 2027.

Key drivers of growth include rising disposable incomes, changing consumer preferences post-COVID-19, and India’s robust economic expansion. Gopal Snacks operates in a competitive landscape alongside giants like PepsiCo and Haldiram’s but maintains a strong market position through brand equity, innovation, and customer focus.

Gopal Snacks IPO Analysis: Company’s Business

Gopal Snacks has established itself as a frontrunner in the fast-moving consumer goods (FMCG) industry, offering a delectable array of savory products under its esteemed brand name, ‘Gopal’. The company’s diverse product portfolio encompasses a wide range of offerings, catering to the discerning tastes of consumers across India.

Gopal Snacks has an extensive product lineup, which includes:

Ethnic Snacks: From traditional namkeen to authentic gathiya, Gopal Snacks offers a tantalizing selection of ethnic delicacies that resonate with the rich culinary heritage of India.

Western Snacks: Delight your taste buds with an assortment of western snacks, including crispy wafers, flavorful extruded snacks, and irresistible snack pellets that offer a perfect blend of taste and crunch.

Additional Offerings: In addition to its savory delights, Gopal Snacks also offers a variety of complementary products such as papad, spices, gram flour (besan), noodles, rusk, and soan papdi, providing consumers with a comprehensive culinary experience.

Gopal Snacks holds a prominent position in the market, particularly in gathiya and snack pellets, and ranks among the top leaders in the ethnic namkeen and snacks category. The company’s extensive distribution network comprises three depots and 617 distributors, supported by a dedicated sales and marketing team of 741 professionals.

Gopal Snacks IPO Analysis: Purpose of IPO

The IPO comprises 100% Offer for Sale (OFS), with the company not receiving any proceeds from the issuance.

The OFS is primarily intended for the founder to divest his stake in the company to the public, aiming to raise funds to settle the loan acquired for purchasing his brother’s shares. Additionally, the IPO provides Gopal Snacks with access to the capital markets, enabling the company to tap into new avenues of funding for future growth initiatives.

Gopal Snacks IPO Review: Financial Performance

Over the years, the company has demonstrated commendable performance across key financial metrics, underscoring its resilience and market acumen.

From 2021 to 2023, Gopal Snacks witnessed a steady increase in total revenue, climbing from INR 1,129.8 crore to INR 1,398.5 crore at a commendable CAGR of 11.15%.

Similarly, Gopal Snacks’ profitability metrics exhibit remarkable improvement over the same period. The Profit After Tax (PAT) surged from INR 21 crore to INR 112 crore, reflecting an impressive CAGR of 130.65%. Moreover, the PAT margin experienced a substantial uptick, rising from 1.87% to 8.06% during the period under review. Gopal Snacks’ EPS also witnessed substantial growth, escalating from INR 1.70 to INR 9.02 between 2021 and 2023.

| FY 2021 | FY 2022 | FY 2023 | |

| Revenue | 1,128.86 | 1,352.16 | 1,394.65 |

| Net income | 21.12 | 41.54 | 112.37 |

| Margin (%) | 1.87 | 3.07 | 8.06 |

Company Strengths

Gopal Snacks stands tall on a foundation of strengths that delineate its prowess and resilience in the competitive FMCG landscape.

Efficient Operations and Robust Supply Chain Management

Gopal Snacks maintains a well-oiled operational machinery, supported by six strategically located manufacturing facilities and a fleet of 250 trucks for efficient transportation. They purchase chassis and internally customize the body according to their specific requirements. This integrated supply chain network results in lowest transportation cost as a percentage of revenue in the snacks sector.

Strategic Management and Visionary Leadership

Gopal Snacks is managed by a seasoned management team, led by Chairman and Managing Director Bipinbhai Vithalbhai Hadvani. This team has decades of industry experience and has successfully overcome several challenges in these years. The management team drives strategic initiatives, fosters innovation, and navigates the company towards sustainable growth and profitability.

Integrated Infrastructure and Sustainable Practices

Gopal Snacks boasts a robust infrastructure, including a cold storage within its primary manufacturing facility at Modasa, Gujarat, with a capacity of 40,000 MT and commissioned wind turbine generators with a capacity to generate 2 MW of electricity annually. Additionally, they have in-house facilities for R&D, an automobile workshop, machinery manufacturing, and engineering and fabrication. This robust setup enables them to support their operations and drive innovation effectively.

Strong Supplier Relationships and In-House Production Capacity

Gopal Snacks nurtures long-standing relationships with its suppliers, ensuring reliable access to raw materials and logistical flexibility. Moreover, the company’s significant in-house production capacity enhances operational efficiency and enables stringent quality control measures across its manufacturing processes.

Gopal Snacks IPO Analysis: Risks

For all the attractive market growth figures, the packaged food business is extremely competitive and can be brutal at times. In navigating the vibrant yet volatile FMCG landscape, Gopal Snacks faces significant risks that could impact its operations and financial performance.

The company’s heavy reliance on specific products like namkeen and gathiya, coupled with its concentrated market base in Gujarat, underscores the need for strategic resilience.

Intense competition, evolving consumer preferences, and escalating costs further heighten operational challenges. Moreover, Gopal Snacks must navigate the complexities of modern distribution channels, balancing opportunities with the need for effective partnerships and market reach.

Gopal Snacks IPO Analysis: Valuation

The company is doing well financially. If we compare it to similar companies like Bikaji Foods and Prataap Snacks, we can learn some valuable things about its value.

| KPIs (2023) | BIKAJI FOODS | PRATAAP SNACKS | GOPAL SNACKS |

| Revenue | 1,966 | 1,652 | 1,394 |

| PAT | 126 | 20 | 112 |

| PAT MARGIN % | 6.44 | 1.23 | 8.06 |

With a return on equity (ROE) of 38.63%, it surpasses the industry average, while its fixed assets turnover ratio of 6.27 outshines industry standards. The company’s debt to equity ratio stands at a healthy 0.37, signaling a balanced financing structure. Despite its price-to-earnings (PE) ratio of 44.45, slightly above the industry median and higher from the pre-IPO round, appears reasonable given the significant increase in profit margins. Overall, the company’s financial performance and market position support its fair valuation.

The company has demonstrated notable financial growth, reflecting the commendable efforts of its founders. They initiated the business with limited funds, and now it stands as a valuable enterprise. The founder’s relentless pursuit of success in challenging categories is admirable. Furthermore, they are actively bolstering the company’s infrastructure by investing in in-house capabilities such as cold storage, trucks, and renewable energy plants. Additionally, expanding the product portfolio underscores the founder’s consistent efforts and foresight. The offer also commands a premium in IPO grey market which is indicative of the market’s verdict in the favor of the offer.